“Greek banks are preparing contingency plans for a possible “bail-in” of depositors amid fears. The plans, which call for a “haircut” of at least 30 per cent on deposits above €8,000, sketch out an increasingly likely scenario for at least one bank, the sources said.”

– Greek Banks Considering 30% Haircut On Deposits Over €8,000: FT (ZeroHedge, July 3, 2015):

Last week in “For Greeks, The Nightmare Is Just Beginning: Here Come The Depositor Haircuts,” we warned that a Cyprus-style bail-in of Greek depositors may be imminent given the acute cash crunch that has brought the Greek banking sector to its knees and forced the Greek government to implement capital controls in a futile attempt to stem the flow.

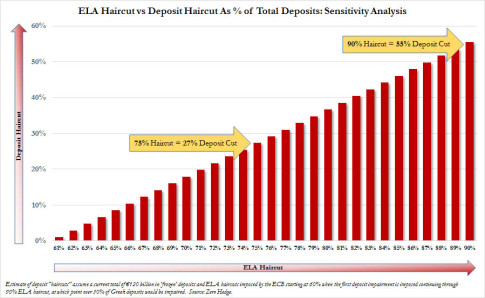

The depositor “haircut” would be a function of the staggered ELA haircut that the ECB could impose to escalate the rhetoric between the two sides, and could take place with as little as a 10% increase in the ELA collateral haircut from its current 50% level.

Unfortunately for Greeks, the ECB has frozen the ELA cap, meaning that as of last Sunday, Greek banks were no longer able to meet deposit outflows by tapping emergency liquidity from the Bank of Greece.

Now, with ATM liquidity expected to run out by Monday and with the country’s future in the Eurozone still undecided, it appears as though Alexis Tsipras’ promise that “deposits are safe” may be proven wrong.

According to FT, Greek banks are considering a depositor bail-in that could see deposits above €8,000 haircut by “at least” 30%.

Via FT:

Greek banks are preparing contingency plans for a possible “bail-in” of depositors amid fears

The plans, which call for a “haircut” of at least 30 per cent on deposits above €8,000, sketch out an increasingly likely scenario for at least one bank, the sources said.

A Greek bail-in could resemble the rescue plan agreed by Cyprus in 2013, when customers’ funds were seized to shore up the banks, with a haircut imposed on uninsured deposits over €100,000.

It would be implemented as part of a recapitalisation of Greek banks that would be agreed with the country’s creditors — the European Commission, International Monetary Fund and European Central Bank.

“It [the haircut] would take place in the context of an overall restructuring of the bank sector once Greece is back in a bailout programme,” said one person following the issue. “This is not something that is going to happen immediately.”

Greek deposits are guaranteed up to €100,000, in line with EU banking directives, but the country’s deposit insurance fund amounts to only €3bn, which would not be enough to cover demand in case of a bank collapse.

With few deposits over €100,000 left in the banks after six months of capital flight, “it makes sense for the banks to consider imposing a haircut on small depositors as part of a recapitalisation.?.?. It could even be flagged as a one-off tax,” said one analyst.

Earlier, via Bloomberg:

Liquidity for Greek bank ATMs after Monday will depend on the ECB decision, National Bank of Greece Chair Louka Katseli tells reporters in Athens.

Meanwhile, Yanis Varoufakis swears this is nothing but a “malicious rumor”:

FT report of a Gk Bank Bail In is a malicious rumour that the Head of the Greek Banks Association denied this morning http://t.co/3xtnQvpS7R

— Yanis Varoufakis (@yanisvaroufakis) July 3, 2015

And moments ago Bloomberg reported that according to an emailed statement by the Greek finance ministry, the “FT report on deposits bail in is outright lie, provocative, and targets undermining July 5 referendum” and as a resultt the “finance ministry demands Financial Tines to retract report.“

Any way it goes, it will be ugly. Greedy guts don’t like those who challenge or refuse their will……..

From UK Guardian, the media (newspapers) are trying to sell both points of view…….There are solidarity movements for the Greek PM all over Europe, as this article clearly shows. Also, the greedy guts are now offering debt relief, things that were not on the table during the last days before Greece told the greedy guts to get lost and defaulted.

Greece really has them over a barrel, and now, it is too late, the level of debt for the banks and the Euro nations have been exposed, and no sane investor will stay with them. This will hurt Europe and the US markets…….If our markets were half way honest, they would have reflected the truth before this……

http://www.theguardian.com/business/blog/live/2015/jul/04/greek-debt-crisis-countdown-to-polling-day-live

OT

This article related how communities around the world, including Fukushima, find the people to deal with nuclear disasters. Terrifying.

http://enenews.com/bbc-police-grabbed-people-movie-theatre-made-reactor-deal-burning-fuel-rods-tv-men-picked-streets-forced-battle-nuclear-meltdown-video?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+ENENews+%28Energy+News%29

From UK Guardian…… sick being blamed for the high cost of medical care instead of the fact no restraints are put on costs medical or pharmaceutical greedy guts can charge.

My doctor wants to give me a drug developed for cancer patients. Insurance is resisting payment; costs over $1000.00 a MONTH. It’s based on an old drug, yet, they get away with it. The fact they can charge whatever they want is another corporate serving aspect of Obama care.

Its becoming another financial epidemic the people cannot afford.

http://www.theguardian.com/us-news/2015/jul/04/deanna-fei-aol-distressed-baby-healthcare-privacy