– How Jamie Dimon Became A Billionaire (ZeroHedge, June 3, 2015):

Two years ago, bank analyst Mike Mayo asked JPM chief Jamie Dimon a simple question: why should affluent customers not pick UBS over JPM due to a mismatch in capital ratios, to which Dimon’s response was even simpler: “that’s why I’m richer than you.” To which we then added: “No logic, no rationale: all about the bottom line, which to Jamie at least is all that matters.”

The bottom line was indeed all, because as Bloomberg calculated overnight, over the past several years, Jamie Dimon quietly became not just “richer than you”, but “much” richer: his net worth is now well over $1 billion!

With JPMorgan shares near a record high, Dimon’s net worth is about $1.1 billion, according to the Bloomberg Billionaires Index. Dimon’s fortune derives from a $485 million stake in New York-based JPMorgan, where he’s been chief executive officer since the end of 2005, and an investment portfolio seeded by proceeds from Citigroup stock sales.

Dimon owns 6.1 million shares of JPMorgan valued at about $404 million based on Tuesday’s closing price of $66.02. He also has 3.2 million exercisable options worth more than $80 million, according to company filings. The Bloomberg net-worth calculation excludes unexercisable options, some restricted shares and $4.1 million in contributions he has made to the James and Judith K. Dimon Foundation. It also assumes taxes are paid at the highest rate.

Real estate holdings include a Westchester home and Park Avenue apartments valued at $32 million. The estimate is based on the 2006 purchase price of the 30-acre property in Bedford Corners, New York, and the current market value of his primary Park Avenue residence.

Dimon’s wealth — he was awarded $20 million in compensation for 2014 — and his criticism of regulators and adversaries has made him a lightning rod for those decrying income inequality and the existence of too-big-to-fail banks. Even a Dimon family holiday greeting card featuring the father of three swinging a tennis racket in a well-appointed apartment was lambasted in Time magazine as “tone deaf.”

* * *

“The odds are much, much lower for a bank CEO becoming a billionaire than a guy going to a hedge fund or private equity,” said Roy Smith, a professor at New York University Stern School of Business and a former Goldman Sachs Group Inc. partner who started on Wall Street in 1966. “The real lucre in this business has always been on the transactional side. The CEOs of Wall Street have to deal with litigation, regulation and the relatively short tenures you have at the top of the pile.”

However, the odds soared when JPM, like every other bank, got a multi-billion bailout courtesy of US taxpayers after it had taken on so much risk the entire system imploded. One wonders what Jamie’s net worth would have been had Americans not collectively “decided” it is time to make Jamie the richest bank CEO currently to have a job.

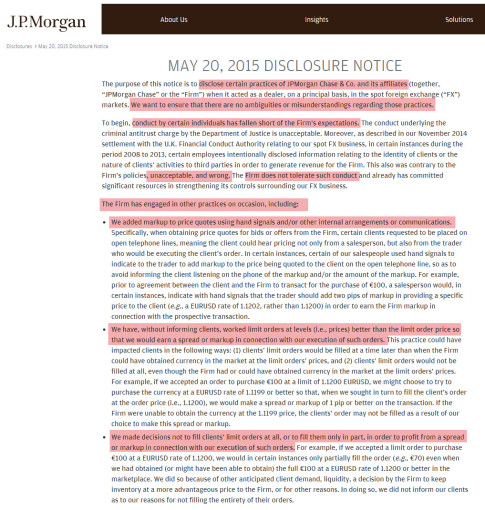

The odds get even higher when instead of anyone doing any prison time for criminally rigging the FX market, JPM can get away with a shareholder funded fine, and just putting up the following disclaimer on its website.

But nothing could push the odds higher, than JPM officially manipulating, rigging, and fraudulently generating tens of billions in profits over the years, thesettlements and fines on which represent the highest IRR conceivable. Case in point courtesy of dividend.com:

Misleading CDO Investments

Quick Stats

- JP Morgan fined $153.6 million

- Settled on 6/21/2011

- Case Details

The SEC settled with JP Morgan after it was discovered that the company misled investors on the complexity of a number of CDOs that were being offered. Specifically, the firm failed to notify investors that it had taken short positions in more than half of the assets bundled in said CDOs. The company did not admit to any wrongdoing or deny the allegations, but it agreed to pay $18.6 million in disgorgement, $2 million in prejudgment interest, and $133 million as a penalty. It was also required that the company change how it reviews and approves certain mortgage securities.

Anticompetitive Conduct in Municipal Bonds

Quick Stats

- JP Morgan fined $228 million

- Settled on 7/7/2011

- Case Details

JP Morgan settled an anticompetitive case with the U.S. Department of Justice (DOJ) in which it was forced to admit wrongdoing and knowledge of its illegal actions. “By entering into illegal agreements to rig bids on certain investment contracts, JPMorgan and its former executives deprived municipalities of the competitive process to which they were entitled” said Assistant Attorney General Christine Varney of the case. The charges stemmed from actions the company took from 2001 to 2006.

Foreclosure Abuses and “Robo-Signing”

Quick Stats

- JP Morgan fined $5.29 billion

- Settled on 2/9/2012

- Case Details

This gargantuan settlement came as the DOJ fined the five largest mortgage servicers in the nation. The entire suit was for $25 billion and was centered around “robo-signing” affidavits in foreclosure proceedings, “deceptive practices in the offering of loan modifications; failures to offer non-foreclosure alternatives before foreclosing on borrowers with federally insured mortgages; and filing improper documentation in federal bankruptcy court.” All banks involved, including JP Morgan, have until 2/9/2015 to comply with the settlement [see also The Unofficial Dividend.com Guide to Being an Investor].

More Mortgage Misrepresentation

Quick Stats

- JP Morgan fined $269.9 million

- Settled on 11/16/2012

- Case Details

Settled with the SEC, this case focused on JP Morgan misstating the delinquency status of mortgage loans that were collateral for residential mortgage-backed securities in which JP Morgan was the underwriter. It was found that investors lost $37 million on undisclosed delinquent loans. “Misrepresentations in connection with the creation and sale of mortgage securities contributed greatly to the tremendous losses suffered by investors once the U.S. housing market collapsed” said Robert Khuzami, Director of SEC’s Division of Enforcement.

Improper Foreclosures Pt. 2

Quick Stats

- JP Morgan fined $1.8 billion

- Settled in 01/2013

- Case Details

Continuing from the 2/9/2012 fine, JP Morgan tacked on another $1.8 billion to its already massive fine of $5.29 billion, totaling just over $7 billion. Combined, it is the company’s largest fine ever up to that point. That record would not stand for long, as the latter half of 2013 had other plans for the financial blue chip.

Electricity Trading Scandal

Quick Stats

- JP Morgan fined $410 million

- Settled on 7/30/2013

- Case Details

This fine was brought on by the Federal Energy Regulatory Commission (FERC) as it was discovered that JP Morgan was manipulating energy markets in California and the Midwest. In total, $125 million of unjust profits were returned and $285 million came as a civil penalty to be sent back to the U.S. Treasury.

Illegal Credit Card Practices

Quick Stats

- JP Morgan fined $389 million

- Settled on 9/19/2013

- Case Details

This fine was the result of JP Morgan deceiving customers into signing up for costly, unnecessary services when opening a new credit card. Broken down, $309 million of that figure was dedicated to repaying consumers, there was a $60 million civil penalty, and a separate $20 million penalty from the Consumer Financial Protection Bureau.

The London Whale

Quick Stats

- JP Morgan fined $920 million

- Settled on 9/19/2013

- Case Details

One of the most infamous cases over the last few years is the “London Whale,” which refers to two former JP Morgan traders who committed fraud to cover up massive losses (approximately $6 billion) in a trading portfolio. “JPMorgan failed to keep watch over its traders as they overvalued a very complex portfolio to hide massive losses” said George S. Canellos, Co-Director of the SEC’s Division of Enforcement. The SEC slapped JP Morgan with the fine and also forced the firm to admit to wrongdoing [see also High Dividend Portfolios].

The Fannie and Freddie Fines

Quick Stats

- JP Morgan fined $5.1 billion

- Settled on 10/25/2013

- Case Details

The Federal Housing Finance Agency (FHFA) acted as a conservator for Fannie Mae and Freddie Mac in this settlement. The fine included a $4 billion charge to address infractions of both state and federal laws while another $1.1 billion went to Fannie and Freddie themselves – $670 million to the former and $480 million to the latter. Yet another case that was based on mortgage-related securities at its core, which is something of a theme for the company.

Institutional Mortgage Securities

Quick Stats

- JP Morgan fined $4.5 billion

- Settled on 11/15/2013

- Case Details

No surprises here, yet another case where JP Morgan was accused of shelling out less-than-stable mortgages. This time, however, the focus was on 21 institutional investors as opposed to a mass of retail investors. The $4.5 billion settlement covers the losses incurred from instruments that were sold between 2005 and 2008. Shortly before this case settled, the company disclosed for the first time that it had $23 billion set aside for legal expenses and penalties.

The Big One: Misleading “Toxic Mortgages”

Quick Stats

- JP Morgan fined $13 billion

- Settled on 11/19/2013

- Case Details

In the largest fine (of any single company) in corporate history, JP Morgan settled for $13 billion in November of 2013. The charges stemmed from misleading investors on what regulators dubbed “toxic mortgages.” The settlement also dictated that the company had to admit wrongdoing in that it knowingly misled investors on the quality of these securities. This has been one of the few times in recent memory that the company has actually offered a “mea culpa.” Of the $13 billion, $9 billion will be used to settle federal and state civil claims while $4 billion will be used as relief to aid consumers harmed by the unlawful practice.

Libor Rigging Scandal

Quick Stats

- JP Morgan fined $108 million

- Settled on 12/4/2013

- Case Details

The alleged manipulation of the London Interbank Offered Rate (Libor) was one of the biggest European cases in recent memory. When the dust finally settled, it was found that a number of banks, including Citigroup (C ) and JP Morgan were involved. JP Morgan settled for $108 million as the investigation could not find any evidence that management had knowledge of the actions of the two traders who committed the act [see also The Ten Commandments of Dividend Investing].

Madoff Retribution

Quick Stats

- JP Morgan fined $1.7 billion

- Settled on 1/6/2014

- Case Details

The Bernie Madoff ponzi scheme is one of the most infamous in the history of the investing world. After faking portfolio gains and eventually losing billions for his clients, Madoff was sentenced to 150 years in prison (after pleading guilty) and had to forfeit $17.179 billion. His scheduled release from Federal prison is on 11/14/2139. The high profile case cost JP Morgan $1.7 billion along with an onslaught of negative press.

Currency Manipulation

Quick Stats

- JP Morgan fined $1.34 Billion

- Settled on 11/21/2014

- Case Details

JP Morgan joined the likes of UBS, Citigroup, and Royal Bank of Scotland in being fined for currency manipulation and collusion-like efforts on the part of the financial institutions. Investigations revealed instant messages between traders of the institutions showing plans to buy and sell currencies after market close in order to manipulate foreign exchanges in their favor. JP Morgan was fined $996 million by U.S. and U.K. regulators along with an additional $350 million dollar fine from the Office of the Comptroller of the Currency (OCC).

And so on…

And so on…

And so on…

* * *

To summarize: enjoy your billion in paper wealth Jamie, just make sure you have the upcoming bailout of both JPM and your personal net worth all wrapped up, or else not all the offshore bank accounts and gold vaults in the world will protect your “legally” accumulated wealth.