– And The Biggest Winner From The Oil Price Plunge Is… (ZeroHedge, Nov 15, 2014):

“The Chinese, among others, seem to be responding to the lower oil price with additional demand,” notes one tanker executive as Bloomberg reports the number of supertankers sailing toward China’s ports matched a record on Oct. 17 and is still close to that level now. The plunge in price has enabled China to add 35 million barrels to its inventories in the past three months as the nation fills its strategic petroleum reserves, OPEC said yesterday. Furthermore, though the oil slide is hurting nations from Venezuela to Iran – that depend on energy for revenues – ship owners serving the industry’s benchmark Middle East-to-Asia trade routes are reaping the best returns from charters in years as the slump drives down the industry’s single biggest expense. As one analyst notes, “we’ve seen the Chinese buying a lot from the Middle East and that’s really let rates cook.” So it appears the Chinese, in the face of the worst growth and economy in years, are rational enough to buy more at lower prices (as opposed to the buy-more-because-stocks-are-at-all-time-highs Western investors).

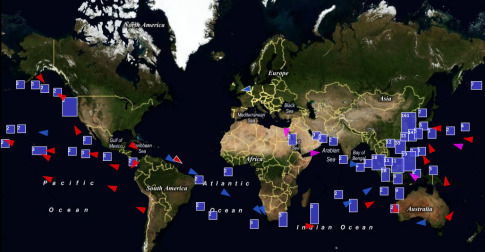

A near-record 113 tankers are destined for China…

At a time when China’s economy is growing at the slowest pace in decades, its oil imports are rallying. The world’s second biggest economy purchased 25.5 million metric tons a month in the January-to-September period, heading for a record year. Falling prices may add to those figures as winter approaches.

“The main traders, they are typically more active in the tanker market when prices have dropped,” said Moerkedal of RS Platou Markets. “When you look at chartering in the last couple of weeks China has definitely been one of the most active buyers of oil.”

…

While the oil slide is hurting nations from Venezuela to Iran that depend on energy for revenues, companies including airlines and cement makers are benefiting as their fuel costs decline. Ship owners serving the industry’s benchmark Middle East-to-Asia trade routes are reaping the best returns from charters in years as the slump drives down the industry’s single biggest expense.

The biggest tankers earned an average of about $28,000 last month shipping Middle East oil to Asia, Baltic Exchange data show. The last time they made more during October was in 2008. Rates averaged almost $20,000 since the start of January, heading for the best year since 2010.

…

“We’ve seen the Chinese buying a lot from the Middle East and that’s really let rates cook,” Erik Stavseth, an analyst at Arctic Securities ASA in Oslo whose recommendations on shippers returned 15 percent in the past year, said by phone Nov. 11. “With oil prices low going into winter, that’s likely to continue.”

The number of supertankers sailing toward China’s ports matched a record on Oct. 17 and is still close to that level now. The country added 35 million barrels to its inventories in the past three months as the nation fills its strategic petroleum reserves, OPEC said yesterday.

* * *

So like Russia and gold, China sees low-priced oil as an opportunity to build inventories.* * *

The biggest concern, of course, is that this burst of activity is interpreted by the all-knowing-ones as some sustainable pick up in aggregate demand that “means” growth is back baby… and thus begins another mini cycle of mal-investment.