– The “Growth Problem” Explained For Idiots And Federal Reserve Dummies (ZeroHedge, Oct 10, 2014):

Over the past six years we have tried, in a countless number of ways, to explain to the “wise” economists, IMFers, World Bankers, Federal Reservers, talking heads and everyone else who would rather not listen, that which is glaringly obvious: the US (and global) economic growth will never recover and rebound and in fact will decline with every passing year for one simple reason – the US (and global) debt bubble is bigger than ever.

In fact, at 300% total debt/GDP it is bigger than the 275% hit during the Great Depression (we doubt we need to remind readers what global event ended that particular time in US history).

So, in hopes there is still some intelligent life left among the decision makers, and in hopes of liquidating the record debt overhang before it is too late and the US has to engage in another deadly, global war, here it is again:

1. Long wave economic cycles eventually all fail due to debt

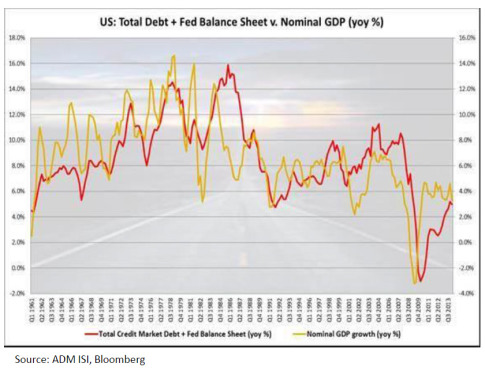

2. Nominal GDP growth tracks credit growth