– From Rothschild To Koch Industries: Meet The People Who “Fix” The Price Of Gold (ZeroHedge, May 14, 2014):

Earlier today many were stunned when the historic, 117-year old, London Silver Fix announced that in three months it would no longer exist. However, silver is only one half of the world’s two best known precious metals. Which is why we decided to take a long, hard look at that other fix: gold.

The reason for this particular inquiry is because in the aftermath of the rapid and dramatic departure of the world’s largest bank by outstanding notional derivatives, and Europe’s biggest bank by any metric, Deutsche Bank, from the precious metal fix, something felt out of place: almost as if the participants of the “fixing” process which for so many years took place in the office of none other than Rothschild on St. Swithin’s Lane in London, were suddenly scrambling to disappear without a trace.

In conducting our research we hope to not only memorialize just who are these particular individuals who “fix” gold using nothing but publicly available information of course – because after all it is not as if they have anything to hide or fear – but to connect some of the very peculiar dots behind the scenes of what to some, is the original, and most manipulated market in history – that of gold.

* * *

First, as has been reported previously, when Deutsche departs, this will leave only four gold fix members, namely, Barclays, HSBC, Société Générale (SocGen) and Scotiabank, and since only two silver fixing entities remained, HSBC and Scotiabank, the traditional silver price discovery mechanism was shuttered. The Fixings are conducted twice daily at 10:30 am and 3 pm London time and are used widely by all participants in the precious metals industry for benchmarking prices and valuations and also as trading price reference points.

The gold and silver fixings are organised through UK limited liability companies of which the member investment bank traders are directors. Before the resignation of Deutsche Bank, there were five directors and five alternate directors of “The London Gold Market Fixing Limited” and three directors and three alternate directors of “The London Silver Market Fixing Limited.”

Earlier this year on 16th January, German financial regulator BaFin stated that possible manipulation of currency and precious metals markets could be more serious than the manipulation that has already been proven in the Libor rigging scandal. On the very next day, January 17th, Deutsche Bank announced that it was withdrawing from both the gold and silver fixings in what it called “a scaling back of its commodities business.”

Needless to say, in aftermath of the termination of the silver fix, and now that there are significant regulatory and litigation spotlights on the Fixings, and one major member exiting, some are wondering: will the demise of the Silver Fixing undermine the rationale for retaining the Gold Fixing? And what will replace it.

* * *

We don’t have the answer. What we do know is that using public records such as the British Companies House database and other public databases, one can find not only all the available information on the London Gold Market Fixing Limited company before it too disappears into thin air, but to get a sense of the kind of people it employs.

Below is the full list of 10 most recent directors and backups of the Gold Fixing:

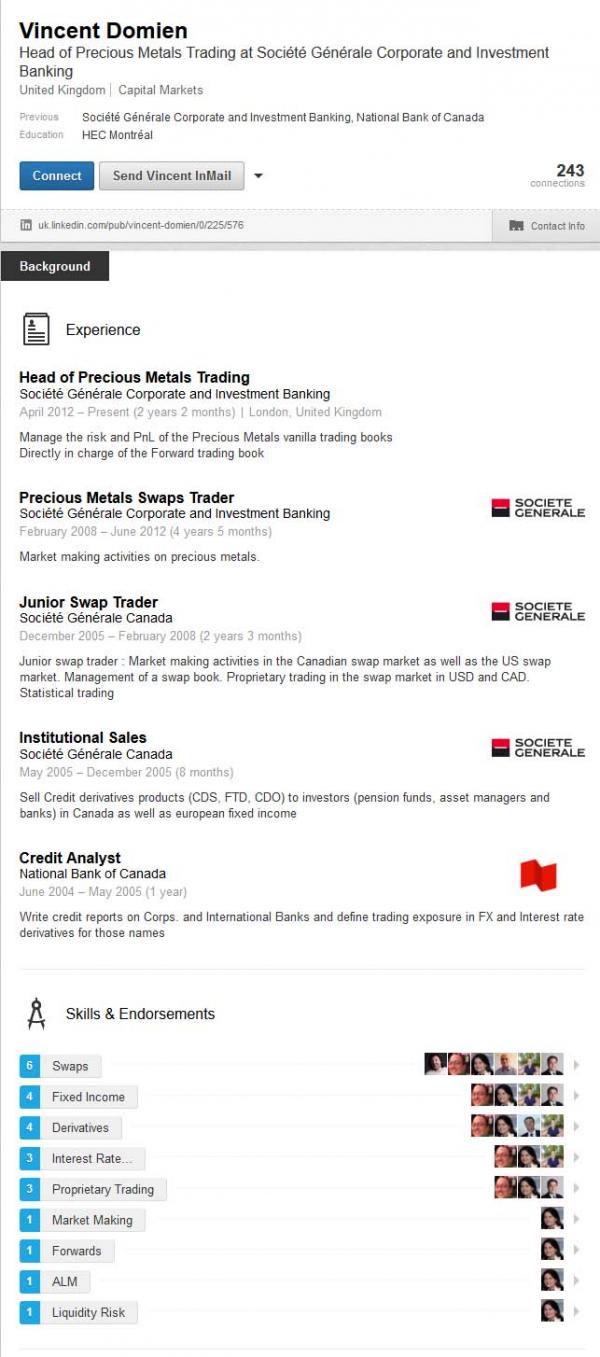

So let’s start with everyone favorite French bank: SocGen, where we meet young master Vincent Domien, born June 13, 1980, and director since January 25, 2010. His Goldfixing phone contact info is +44 207 762 5374, and he can be reached at: [email protected]. His LinkedIn profile has extensive details on what it takes to become a gold fixer.

Sadly, the other director from SocGen, Xavier Lannegrace, born 1964 and director since December 19, 2013, has no LinkedIn profile, so we had to go to other primary sources. As it turns out Mr. Lannegrace keeps a low profile but does have occasional media appearances, such as this one in Risk.net from 2011

Instead of increasing margin calls to protect against credit risk as many banks did at this time, SG CIB began providing some unmargined lines to mining firms, even taking over margined positions that miners had with other lenders and making them unmargined.

“To avoid a cash constraint we can provide some unmargined lines – transforming risk on the price into risk of performance. But in that case what we really need to see is the miner performing, producing the material, and delivering the material,” explains Xavier Lannegrace, managing director of base metals, precious metals and agriculture at SG CIB in Paris.

And also from Risk, from the year before:

“The Meteor system has been able to handle a massive increase in both flow and new transactions, which leaves us in a very strong position on the operational side. We looked at all our operational risk reporting, counterparty risk exposures and risk limits, and Meteor told us we are solid. So we can keep on developing a stronger commodities desk, moving into agricultural commodities and developing new indexes because we know commodities are going to be the hot spot with investors in 2010,” says Xavier Lannegrace, global head of commodities marketing and sales in Paris.

* * *

“You can go to bed at night having left an order with Société Générale knowing that order is going to be watched and looked after, so there is no problem when you come into the office the next morning. The service is first class.”

And from yet another year prior:

As well as the sharp drop in metals prices last year, the collapse of Lehman on September 15 sent reverberations around the metals markets. The investment bank was not a big player in the metals markets, but the collapse of the broker-dealer caused counterparty credit risk to become the number one issue for market credit risk, we have seen investors and corporates diversify their hedges amongst several banks. Those who normally traded with one, two, or three banks are now trading with five or six different banking counterparties,” says Xavier Lannegrace, global head of commodities marketing at Société Générale Corporate and Investment Banking (SG CIB) in Paris.

* * *

Moving to the bank that redefined the term “money laundering”, HSBC we meet David Rose, contact phone +44 207 992 8041 and contact email: [email protected], who has the following rather sparse LinkedIn profile:

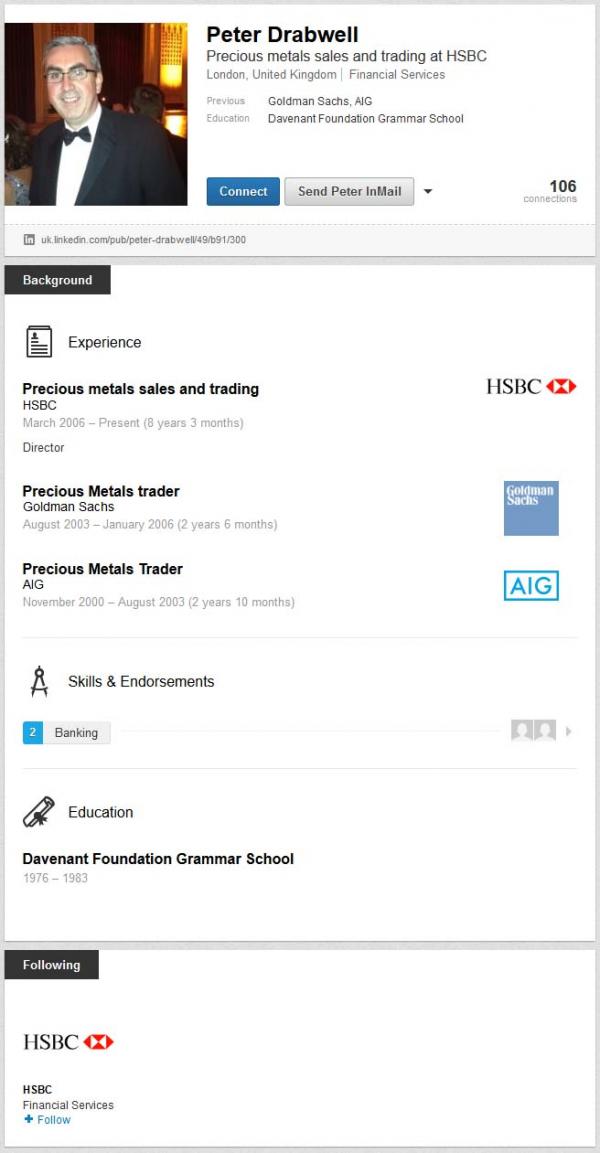

And his alternate director, Peter Drabwell, self-described on LinkedIn as “a precious metals sales and trader“

* * *

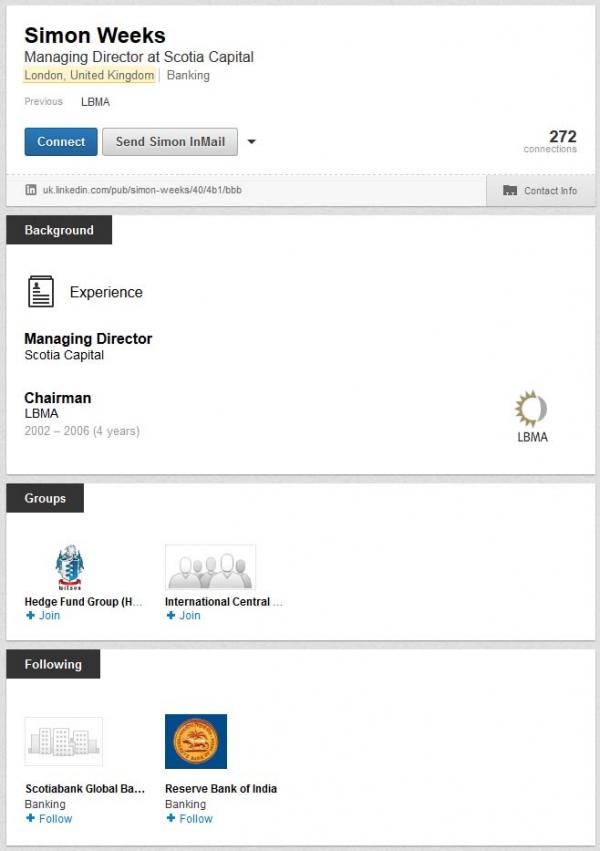

We then proceed to the current Chairman of the Gold Fixing group, Simon Weeks, born 1962, who hails from Canada’s Scotiabank, aka ScotiaMocatta. He is one of the veteran directors, appointed in February 1995. Those who so wish can reach Simon at +44 207 826 5930 and his contact email is [email protected]. Alas, there is not much in his LinkedIn profile:

* * *

And the alternate from ScotiaMocatta: Steven Lowe

Steve is the Managing Director of Scotiabank, London with overall responsibility for sales, trading and distribution of Scotiabank’s European precious metals business. Additionally he is the Global Head of ScotiaMocatta’s base metals business, CEO of Scotia Capital Europe Ltd and a board member of Scotiabank Europe Plc. Prior to his arrival in London in 1998, Steve worked in Toronto covering a portfolio of North American mining companies, particularly credit products including debt, project finance and metal derivative transactions. Steve has an MBA from the Ivey School of Business and a Bachelor of Commerce degree from Queen’s University.

He has been a member of the LBMA Management Committee for numerous years and has acted as Vice Chair of the committee for two years. He also sits on the LBMA PAC committee.

* * *

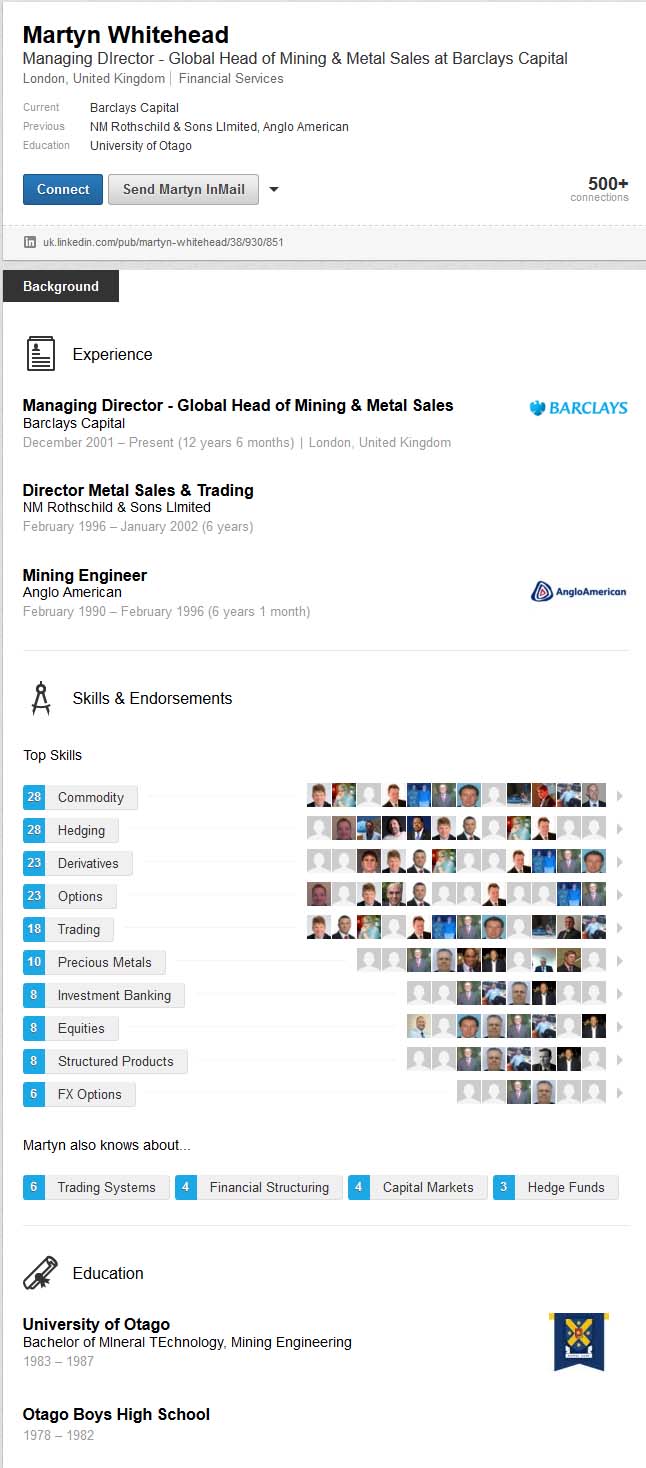

Next we get to most British notorious bank, Barclays, we find director Mr. Martyn Whitehead, contact phone: +44 20 7773 8106, contact email: [email protected], whose LinkedIn profile describes him as “Global Head of Mining & Metal Sales at Barclays Capital”, and who previously worked for 6 years at Rothschild.

* * *

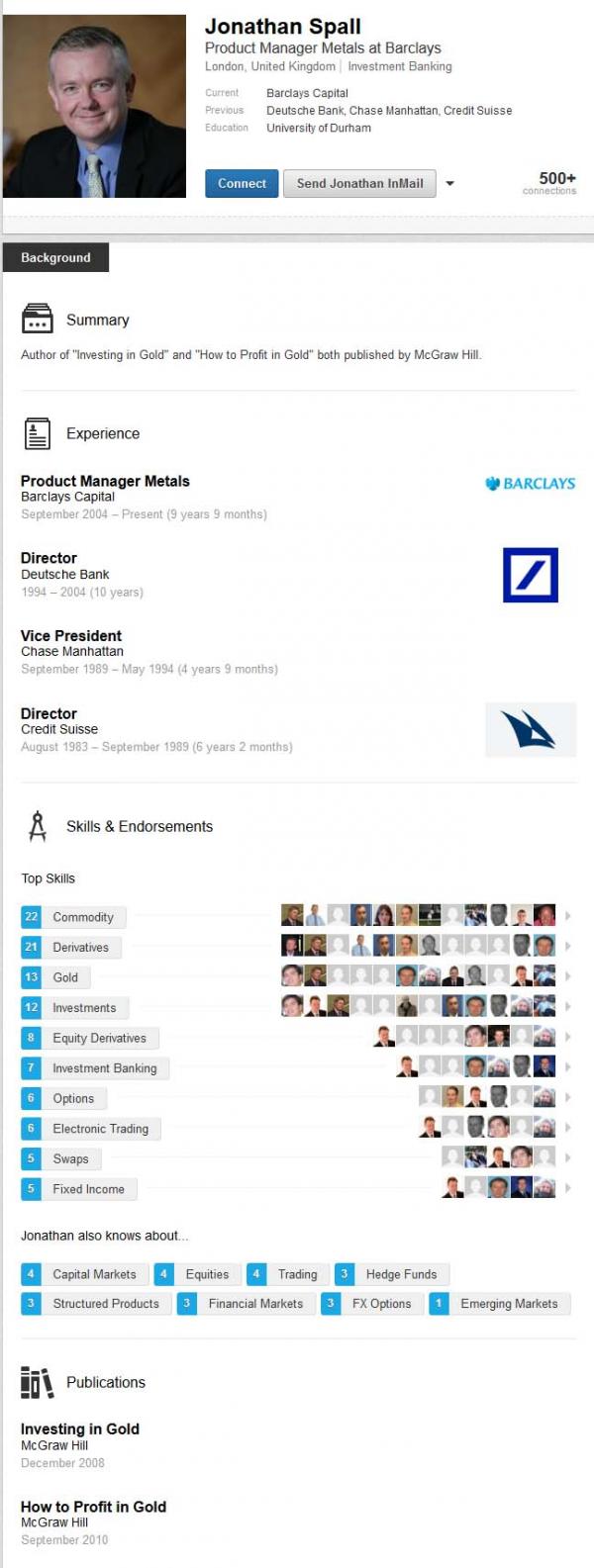

Also from Barclays, there is Jonathan Spall, who also has quite an extensive LinkedIn profile.

Alas, Mr. Spall won’t be at Barclays, or the fix, for long. As Bloomberg reported in January 2014

Barclays Plc cut commodities jobs in London and New York as part of reductions in fixed income, currencies and commodities, according to two people familiar with the matter. Bharath Manium, a managing director in commodities structuring, Paul Jackman, a managing director in the commodities index business, Jonathan Spall, product manager for metals in London, and Sudakshina Unnikrishnan, an analyst in London, are leaving, according to the people who asked not to be identified because the move hasn’t been made public.

In fact as was reported by London Gold Market Fixing Ltd, Mr. Spall is no longer with the company since April 9, 2014.

* * *

Which leaves us with the two most interesting and curious individuals: the “fixers” from Deutsche Bank, which as was reported previously, is no longer a member of the gold fix company courtesy of BaFin’s accelerated procedure to reign in the German bank.

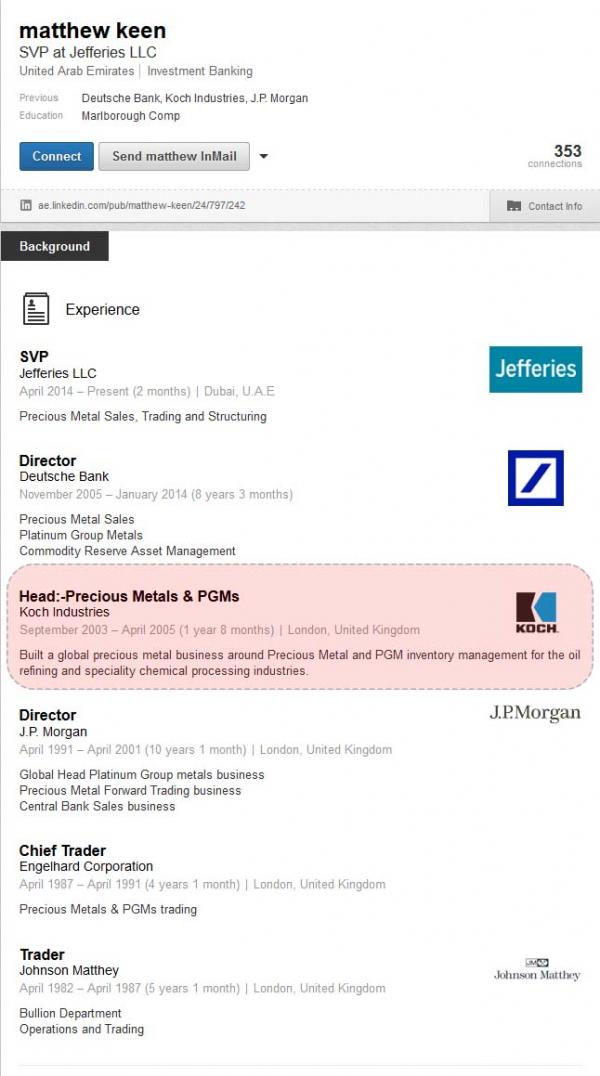

What follows next is an intricate timeline journey into the gold fixing rabbit hole, where we find some very suspicious and unreported issues about Deutsche Bank’s departure from the Gold and Silver Fixings, namely Matthew Keen’s sudden resignation and departure in January after BaFin’s statements, followed by the resignation of Kevin Rodgers. Why did Keen resign? Secondly, Deutsche quietly stopped contributing to GOFO as early as February or March.

1. On Friday January 17th, Deutsche announces that its quitting the gold and silver fixings. On Monday 20th January, Matthew Keen, Deutsche’s head of precious metals, resigns from the London gold and silver fixings companies and is replaced by Kevin Rodgers, Deutsche’s global head of FX. Matt Keen then departs fully from Deutsche Bank in January, and starts a new job for Jefferies in April.

Deutsche Bank then announces on 28th April that Kevin Rodgers is resigning from Deutsche Bank, the day before it announces that it can’t sell its two seats on the gold and silver panels and that it is resigning. The resignation of Matthew Keen has not been reported anywhere it seems.

2. Sometime in March at the latest, Deutsche Bank quits being an LBMA forward market maker, and stops contributing to GOFO rates and forward curve data. This also appears to not have been reported previously.

The following timeline illustrates some important information that has not been discussed:

November 27th 2013: German regulator BaFin announces that it is reviewing how banks participate in the gold and silver price setting

December 12th 2013: The Financial Times states that BaFin has already been interviewing Deutsche Bank on this for several months and has demanded various documens from Deutsche.

FINANCIAL TIMES: “BaFin has grilled Deutsche Bank staff during several on-site inspections in the past few months”

Wednesday January 15th 2014: Reuters reveals that Deutsche has suspended New York based FX traders and that Fed and

OCC visited Citigroup offices in Canary Wharf, London

REUTERS: “Deutsche, Citi feel the heat of widening FX investigation”

Thursday January 16th 2014: BaFin’s president Elke König says in a speech in Frankfurt that currency and precious metals price manipulation is “worse than Libor”.

BLOOMBERG: “Metals, Currency Rigging Is Worse Than Libor, Bafin Says”

Friday 17th January 2014: Deutsche Bank announces that it is withdrawing from the gold and silver price fixings

Monday 20th January 2014: Matthew Keen, Director (precious metals) at Deutsche Bank resigns as a director of the gold and silver fixing companies and Kevin Rodgers, Global Head of Foreign Exchange at Deutsche Bank is appointed as Deutsche Director in both of these companies (why an FX trader is appointed to trade commodities is not quite clear).

On the same day, Matthew Keen also resigns as the Deutsche director representative of London Precious Metals Clearing Limited (LPMCL) and is replaced by Raj Kumar, Deutsche’sEuropean COO, Commodities.

Curiously, Matt Keen did not operate out of either London or Frankfurt, but instead relocated from London to Dubai with Deutsche in 2012. Is that the farthest one could get away from US and European regulators one wonders?

Sometime in February or March – Deutsche stops contributing to GOFO

LBMA rolled out a new web site in ealr April. This was mentioned in the LBMA’s Alchemist, Issue 73, published March 31st. The wayback machine has an imprint from the new site on April 9th. In the GOFO contributor list, Deutsche is not listed

Deutsche disappeared from GOFO before 9th April – new web site

Deutsche was still listed as a GOFO contributor on the old LBMA web site, latest imprint is February

Sometime in February or March – Deutsche ceases to be a market maker for forwards

Deutsche not a forward market maker now

Old market makers list – February 14th

April 25th 2014: Reuters reports that sources say Deutsche canot sell gold and silver seats due to US lawsuits

REUTERS: “U.S. lawsuits hobble Deutsche Bank’s bid to sell gold fix seat”

Just what was Deutsche worried buyers would find during the due diligence?

April 28th 2014: Deutsche Bank announces that Kevin Rodgers, Global Head of FX is quitting the bank in June

WALL STREET JOURNAL: “Deutsche Bank Head of Forex to Retire – Kevin Rodgers to Leave Industry in June; Departure Not Linked to Global Investigation”

Burying the evidence, and firing the bodies?

April 29th 2014: Deutsche resigns seats on gold and silver fixes, can’t sell them, gives 2 weeks notice, last day 13th May

REUTERS: “Deutsche Bank resigns gold, silver fix seat with no buyer”

Saturday May 10th 2014: FT’s John Dizard comments that “Precious metals market people tell me that even in advance of Deutsche’s formal departure from both the gold and silver fix, the bank had reduced its participation in putting up bids or offers at the silver fix very substantially.”

FINANCIAL TIMES: “No silver lining for gold-fix regulation“

May 13th 2014 – Deutsche’s last day on gold and silver panels

… However….

As Reuters reported earlier today:

A source familiar with the situation told Reuters that Deutsche Bank had postponed its resignation, responding to a specific request from Britain’s Financial Conduct Authority (FCA).

“The other banks may have indicated to the regulator that they were looking to withdraw as well and so to make this an orderly affair Deutsche was asked to postpone the date of resignation,” the source said.

In other words, just as the Silver Fix is no more, so the Gold Fix will almost certainly be nothing but a memory in a few short months now that the spotlight is shining on its members. But why the sudden scramble to depart and not just by Deutsche but by all other members? (… that was rhetorical)

Other questions also remain unanswered.

Looking at Mr. Keen’s LinkedIn profile we find that before Deutsche, Keen worked as Head of Precious Metals at none other than the infamous Koch Industries. Here he “Built a global precious metal business around Precious Metal and PGM inventory management for the oil refining and speciality chemical processing industries.”

Wait, so the Deutsche trader who is most suspect of rigging the Fix, and who quit first (and hence, best), learned his craft at Koch Industries? It almost makes one wonder just what kind of gold and silver trading the Koch brothers engage in.

* * *

But perhaps the most curious and surprising finding here is what Bloomberg reported back in November, when it wrote one of the first articles exposing the “Fix” to the mainstream (if not so much the “tinfoil blog” vertical which was well aware of all of this years ago). To wit:

London Gold Market Fixing Ltd., a company controlled by the five banks that administers the benchmark, has no permanent employees. A call from Bloomberg News was referred to Douglas Beadle, 68, a former Rothschild banker, who acts as a consultant to the company from his home in Caterham, a small commuter town 45 minutes south of London by train. Beadle declined to comment on the benchmark-setting process.

“No permanent employees”: extremely convenient when one has to pick up and simply disappear without a trace…

They can fix the price all they want.

I am far more concerned about the price for clean air, safe food and water to consume.

Thanks to Fukushima, we fact our own extinction.

Last time I ate, I didn’t need any gold……just safe food and water. I live in CA. We are surrounded by radioactive poisons in WA, NM, San Diego and Fukushima. All our fish are dead……thousands of species are finished. Right here where I live, the abalones are dead…….along with sardines, salmon…..all the good white fish I used to love……..anyone think Gold is more important?

I sure don’t. I loved going to Fisherman’s Wharf and eating fresh Crab or Swordfish……..now, they are poisoned with radiation…..

Our Ocean is dead……..I don’t give a rat’s ass what gold costs.

You think I care about the price of gold?

Does anyone have any respect for our government any longer? This is beyond anything I have ever seen. We really have an essential step here……we have to rid ourselves of the crooks who are destroying out government. I cannot emphasize how important this has become. We have become an oasis for thieves, and even worse, have their reputation…..

Many Americans are not crooks and thieves, we need to cleanse ourselves of these people………it is time to clean house, and do it thoroughly. We have a Manchurian Candidate in the White House……..and corporate crooks on every level; they all need to go.

I pray it can be done lawfully. If we go on much longer as we have, it will be a nasty clean up job.

What a mess.

To Squodgy: Your hope the UK currency will be reinstated as a world reserve currency would require a lot of house cleaning, soon. Not as much as the US, but you have quite a few crooks in power there, too.

I don’t care as long as the money is held in credible hands……..and I don’t see it being the US.

Thanks for picking up on that T, it was fascinating.

Now I wish I had bought the stuff ten years ago when I was flush, instead of putting my money into ‘investments’ which bomb as a result of corrupt puppets.

Still, that’s life.

Marilyn, I saw the abelone issue, have been trying to monitor the Alaskan Salmon runs, but keep coming up blank.

Fraser River Chinook runs are definitely hit badly, and Hanford leaks will probably finish it off, and there is one report Alaskan Sockeye numbers are hit but I wonder if the non-info on Alaska is Gov instigated.

Reports of bleeding herring claim it is a disease….is it or are they just avoiding joining the dots?

To Squodgy: They will reveal as little as possible. The story is just beginning; the Japs have destroyed the food chain. They don’t know what to do because there is nothing they can do…

A dead sea is something they cannot fix. 80% of all oxygen comes from the ocean…….and they cannot do a thing to stop it………..