– Physical Gold Demand Soared As Gold Price Tumbled In 2013 (ZeroHedge, Jan 3, 2014):

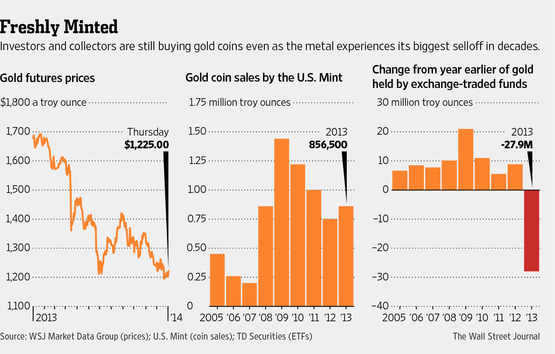

Sales of gold coins are booming even as the precious metal’s price is falling (and it’s not just central banks). Despite gold futures 28% drop in 2013 (its worst since 1981), the WSJ reports that demand for gold coins shot up 63% to 241.6 metric tons in the first three quarters of 2013.

Because these investors intend to hold onto their gold for years or decades, many see the recent drop as an opportunity to buy more at a cheaper price, notes on strategist, “they’re not under any pressure to get a yield or a return in a year.”

Still, the importance of gold coins has been eclipsed in recent years by the rapid growth of exchange-traded funds, some analysts say, “hedge funds tend to overpower the impact of physical gold purchases… relatively little money gets them an awful lot of market power.” Unlike hedge funds, who may leave when prices fall, it is clear that coin buyers are in for the long haul.

Sales of gold coins are booming even as the metal’s price is falling, a testament to gold’s continued appeal for small investors and collectors despite its first bear market in more than a decade.

The heightened appetite for physical gold is a rare bright spot in a market that saw hedge funds and other large investors head for the exits last year. Gold futures prices tumbled 28% in 2013, their worst performance since 1981.

But at mints and coin shops around the world, gold continued flying off the shelves.

…

Sales of Gold Maple Leaf coins by the Royal Canadian Mint surged 82.5% to 876,000 ounces in the first three quarters of 2013 from the same period of 2012. The Perth Mint, Australia’s national coin and bar producer, saw sales rise 41% to 754,635 ounces last year, while the U.S. Mint sold 14% more American Eagle gold coins than it did in 2012, along with a record amount of silver coins.

…

Because these investors intend to hold onto their gold for years or decades, many see the recent drop as an opportunity to buy more at a cheaper price, he added. “They’re not under any pressure to get a yield or a return in a year,” Mr. Melek said.

…

Some think the continued strength of physical gold buying will prevent prices from falling much further, as it becomes clear that a core group of investors is sticking with the market,

…

“It’s obvious to me that at some point our dollar will see a downturn in its value,” said Mr. McClintock, who runs a contract post office. “Gold is just a good comfort, it’s a commodity that anybody in the world knows and you don’t need to be an expert to understand.”

…

Still, the importance of gold coins has been eclipsed in recent years by the rapid growth of exchange-traded funds, some analysts say.

…

“Folks like hedge funds tend to overpower the impact of physical gold purchases,” Mr. Melek said. “Relatively little money gets them an awful lot of market power.”

Unlike hedge funds, who may leave when prices fall, many coin buyers are in for the long haul.

…

“Most people who buy physical gold aren’t doing it for the same reason you’d purchase a stock,” said Mike Getlin, vice president with Merit Financial, a bullion and coin dealership in Santa Monica, Calif. “They tend to have a much longer investment horizon. They tend to hold onto them forever and pride of ownership is a huge factor in that.”