– JPMorgan Puzzled By Record Gold Backwardation (ZeroHedge, Aug 18, 2013):

Curious where all the demand for (immediate) physical gold (delivery) is coming from (as detailed here first in April)? As it turns out, so is JPMorgan.From this week’s Flows & Liquidity

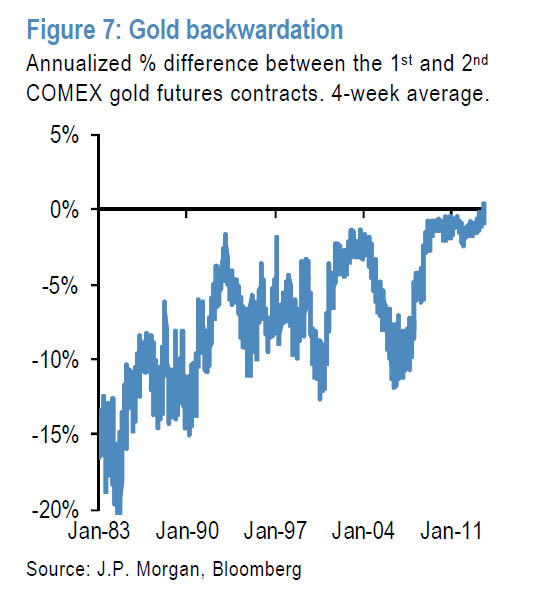

SEC filings showed that the largest hedge fund holders of the gold ETFs liquidated most of their positions in Q2, although the single largest holder commented that they had simply switched their exposure from ETFs to the OTC derivative market as the current downward sloping forward curve makes it cheaper to be long gold through futures than via the ETF. Figure 7 shows the annualized % difference between the 1st and 2nd COMEX gold futures contracts going back over the past 30 years on a weekly basis. As the figure shows, a backwardated (downward sloping) gold forward curve is very unusual. This is an indicator of how strong physical demand is, i.e. spot is bid up relative to forward prices due to strong demand for immediate delivery of gold.

Ostensibly, this means that until the Bundesbank and/or PBOC finally issue a relevant 8-K, the “confusion” will continue.

Does anyone think they will come clean? Like everything else, gold has been leveraged out 1000:1 or more. Gold certificates are far easier to show than the real stuff………The banks have no national affiliation, their only interest is money……and they have lost all credibility in the world markets. The “haircuts” given to Cyprus, Spain and US depositors (MF Global) are only early indications of what is coming.

When people can no longer trust banks, banks cannot survive. When they topple, and they will, they will be “nationalized” and all their stealing will be put on the backs of the nations and their populations.

I see rotten things ahead, and that chart doesn’t calm me down.

One other thing this reminds me of…….the crash of 1929 happened when people started getting margin calls from their brokers, and ran to their banks to get the cash to cover their overdrafts and save their portfolios. Soon, it became apparent the banks did not have their money on deposit, and they collapsed.

When people start asking for the real money, the game is up. FDR’s FED chairman, M. Eckles put it best when asked in 1952 what caused the crash of 1929. I was so impressed by his reply, I memorized it.

“As in a poker game, as the chips get concentrated into fewer and fewer hands, the other fellows can only stay in the game by borrowing. When their credit ran out, the game stopped.”

Get ready, folks. The time is neigh.