– Here’s The Problem With This Market Crash… (Business Insider, Aug. 4, 2011):

Well, it’s deja vu all over again.

For anyone who followed the market crashes of 2000-2002 and 2007-2009–especially the crash of 2007-2009–the 512-point drop in the Dow feels awfully familiar.

And as those market crashes reminded us, the downdrafts can last a lot longer and be a lot more severe than most people initially think.

(They can also reverse themselves quickly and unexpectedly, and maybe that’s what will happen this time. We can always pray.)

But there are also several very important differences between this market crash and the ones a few years ago:

- The Fed has fired most of its bullets (interest rates are already at zero)

- Our budget deficit is already out of control, and Congress has had it with “stimulus”

- The public has had it with bailouts

That means the government’s ability to do anything about this market crash is severely limited.

Yes, we’ll almost certainly have a “QE3.” And maybe that will prop things up a bit. But it won’t fix the fundamental problems clogging the economy, just as QE1 and QE2 didn’t permanently fix anything. (The only thing that will fix our economy is debt-reduction, discipline, and time.)

To get a good sense of how hamstrung the government is, you need only look as far back as last week, when Congress was so paralyzed that it almost put the country into default rather than raise the debt ceiling.

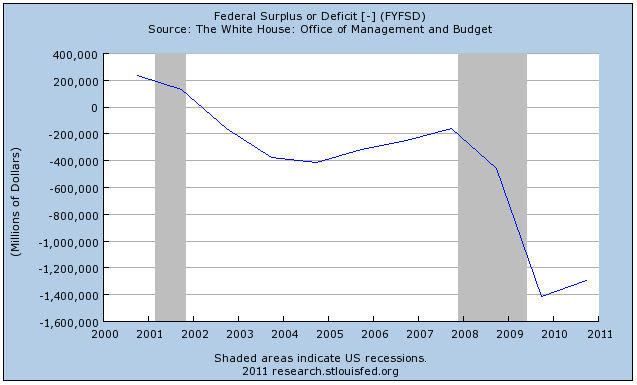

And you also need only note that, when the 2000 crash began, the US federal budget was running a surplus, and when the 2007 crash began, the deficit was only $200 billion. Now, the deficit’s about $1.4 trillion:

Image: St. Louis FedMeanwhile, to get a good sense of how different the Fed’s position is now than it was at the start of the last two market crashes, all you have to do is look at the chart below.

In 2000, when the market tanked, the Fed Funds rate was 6.5%. The Fed immediately began cutting rates and eventually took them all the way down to 1%. (Where it left them for far too long, thus helping to inflate the housing bubble.)

In 2007, when the market began to crack, the Fed Funds rate was 5.25%. The Fed immediately began cutting rates and eventually took them all the way down to 0.25%. Where they have been as long as anyone can remember. And where they still are today, just as the market is beginning to crash again.

Image: Federal Reserve Economic DataIn short, it IS different this time. And not in a good way.

Good article, thanks. In my opinion, the crash happened in 2000-2001. That is when Enron accounting was exposed, and the fraud about Worldcom, Global Crossing, the airlines was only part of it. Hundreds of thousands of workers from those companies lost their jobs and all of their pensions. Rather than deal with the underlying fraud, the government told Americans to be patriotic and “Go shopping.” The accompanying lower interests rates, plus the abandonment of all due diligence rules in finance brewed the housing bubble. All the mortgages and accompanying debt were being repackaged as bonds, the corrupt rating agencies cut up the mortgages so they could package them as AAA. The crash of 2007-08 happened because nothing had been done to clean up any of the fraud.

Once the CDOs and other financial packages they sold around the world were exposed as fraudulent, Moody’s taught Enron accounting to all the nations in the Euro. Entire nations went bankrupt, millions lost employment and the market started sinking like a stone. Obama’s first gift to corporate powers was to push GM and Chrysler into bankruptcy. They were able to dump their pensions for their retired workers, cut benefits and lay off hundreds of thousands of workers. When they emerged, a few thousand of the workers were hired back at half their former wages, from $28. to $14.00. Many lost their homes.

Again, nothing was done to stop the fraud, all the crooks walk free without fear of prosecution or punishment.

Once the rest of the world saw we would do nothing to prevent another crash from happening again, investors started leaving our markets at record rates. The loss of investors and fresh sources of cash, the money changers finally sold the NYSE to Germany for all stock NO CASH, the story was ignored by MSM. We are losing market every day.

Housing continues to decline as millions of jobs continue to disappear. Why hire American workers or engineers when they can be employed in China for pennies on the dollar. A supply chain engineer usually earned an average of $80K. In China, the same person earns $3-5K a YEAR.

When listening to our politicians and president, the word “competitive” is often used. The USA must become competitive in a global economy. Translation: They want to destroy Europe’s and USA standard of living by cutting jobs, and opportunities, forcing austerity on all of us, making our workers so desperate for work, they will work as cheaply as the Chinese. Part of the movement is to destroy the unions, lower educational standards and turn Europe and America into slave nations. They are doing it now in Spain, Portugal, Italy, Ireland, Belgium, the UK and now the USA. They already have slaves in China, India, etc.

The entire world economy is imploding, and we have fools running our nation over a cliff.

Thanks,

Marilyn Gjerdrum