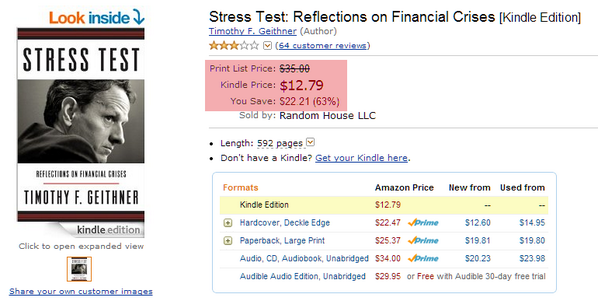

– “Stress Test” Reviewed: Tim Geithner Is “A Grifter, A Petty Con Artist” (Liberty Blitzkrieg, June 5, 2014):

Geithner is at heart a grifter, a petty con artist with the right manners and breeding to lie at the top echelons of American finance at a moment when the government and financial services industry needed someone to be the face of their multi-trillion dollar three card monte. He’s going to make his money, now that he’s done living his life of fantastic power after his upbringing of remarkable mysterious privilege. After reading this book and documenting lie after lie after lie, I’m convinced that there’s more here than just a self-serving corrupt official. There’s an entire culture, of figures at Treasury, the Federal Reserve, in the entire Democratic Party elite structure, and in the world of journalism, a culture in which Geithner is seen as some sort of role model.

– From Matt Stoller’s fantastic article published yesterday, The Con-Artist Wing of the Democratic Party

Timothy Geithner is likely to go down in American history as one of the most dangerous, destructive cronies to have ever wielded government power. The man is so completely and totally full of shit it’s almost impossible not to notice.

The last thing I’d ever want to do in my free time is read a lengthy book filled with Geithner lies and propaganda, so I owe a large debt of gratitude to former Congressional staffer Matt Stoller for doing it for me. Stoller simply tears Geither apart limb from limb, detailing obvious lies about the financial crisis, and even more interestingly, Geithner’s bizarre bio, replete with mysterious and inexplicable promotions into positions of power.

So without further ado, here are some excerpts from this excellent article.

From Vice:

The most consequential event of this young century has been the financial crisis. This is a catchall term that means three different things: an economic housing boom and bust, a financial meltdown, and a political response in which bailouts were showered upon the very institutions that were responsible for the chaos.

More than anyone else, it was then US Treasury Secretary Tim Geithner who shaped this response, and who bears praise, blame, and responsibility for the outcome. And finally, with the release of his book, Stress Test: Reflections on Financial Crises, Geithner is getting to tell his side of the bailout story.

I’ll address both of these, since they are intertwined. For as I read the book, and compared the book with what was written at the time and what was written afterwards, I noticed something odd, and perhaps too bold to say in polite company. As much as I really wanted to hear what Geithner had to say, I quickly realized that I wasn’t getting his actual side of the story. The book is full of narratives, facts, and statements that are, well, untrue, or at the very least, highly misleading. Despite its length, there are also serious omissions that suggest an intention to mislead, as well as misrepresentations of his critics’ arguments. As I went further into Geithner’s narrative, even back into his college days, I got the sense that I was seeing only a brilliantly scrubbed surface, that there were nooks and crannies hidden away. It struck me that I was reading the memoirs of an incredibly savvy and well-bred grifter, the kind that the American WASP establishment of financiers, foundation officials, and spies produces in such rich abundance. I realize this is a bold claim, because it’s an indictment not just of Geithner but also of those who worked for him at Treasury and at the Federal Reserve, as well as indictment of the Clinton-era finance team of Robert Rubin, Larry Summers, Alan Greenspan, Michael Barr, Jason Furman, and other accomplices. That’s why this review is somewhat long, as it’s an attempt to back up such a broad and sweeping claim. I will also connect it to what Geithner is doing now: working in the same kind of financial business that made Mitt Romney a near billionaire.

There are a few glaring problems with how Geithner portrays this debate. First of all, his main foil during the crisis was a fellow technocrat, former International Monetary Fund (IMF) official Simon Johnson, who actually had significant crisis-management experience parachuting into panicked countries and imposing structural reform on their bankers. Johnson became increasingly irate as he saw Geithner diverge from what Geithner himself at the US Treasury and the IMF forced on other countries: conditions. Geithner was hard on oligarchs when they were foreign, but when it was US bankers, well, then the wall of money argument triumphed. In fact, in a paper released in 2013, it was revealed that financial firms with a personal relationship with Geithner himself saw an abnormal 15% bump in share prices when Geithner’s name was floated for Treasury Secretary, and a corresponding though smaller, abnormal decline when his nomination was on the rocks due to his being caught not paying taxes by Senate investigators.

The third problem is housing. Economists Amir Sufi and Atif Mian lead the charge in arguing that the Geithner strategy failed to restart the economy because it focused on leverage at the large banks rather than leverage among households, i.e., foreclosures. The shape of the Geithner policy architecture is two-tiered: The financiers recovered; everyone else did not. And the economy, even today, sputters along at just above stall speed because of this.

But the book is more than just a set of arguments; it’s also an autobiography of a man. And while I was reading it, I kept getting the feeling I wasn’t learning the full story. I noticed oddities, a kind of set of shimmering ephemera which suggest that there was something the author was holding just out of view of the reader.

Geithner talks about his childhood growing up abroad, with high-powered family members who had advised presidents, and a father who was a senior executive at the Ford Foundation in Southeast Asia in the 1960s and 70s. At that time, the Ford Foundation was a pivotal instrument of US foreign policy, an important vehicle for anti-Communist efforts and heavily integrated into the financial and foreign policy establishment (the head of the foundation even set up an internal committee to organize incoming requests from the CIA). Yet Geithner portrays himself as a largely apolitical and directionless kid, a sort of ordinary person in unusual circumstances, with loving parents. It was an odd way to describe growing up cocooned in the foreign-policy elite. Geithner is far too smart to not have been able to observe what was going on around him, yet he is silent in the book on how he saw power up close at a young age.

Ok, this is really important and something I touched on in my piece: Tim Geithner Admits “Too Big To Fail” Hasn’t Gone Anywhere (and that’s the way he likes it). As I note in that post, I find it beyond coincidental that Tim Geithner’s father and Barack Obama’s mother both worked at the Ford Foundation in Indonesia at the same time.

At Dartmouth, Geithner portrayed himself an “unexceptional and uninspired student,” finding economics dreary and political consulting boring. He didn’t even remember voting in 1980. Yet over Christmas break during his freshman year of college, he notes, he did a short stint as a war photojournalist along the Thai-Cambodian border for the Associated Press. It’s a short piece in the book, meant to describe one Christmas break. But I had to reread it several times, to make sure it was actually in there. I kept thinking, What the hell? Who does that? It’s not that it’s not true; it sounds like it is. But there’s more to this story than “Oh, I was a freshman in college and didn’t like studying, and then I did a stint as a war photographer over Christmas break and decided I didn’t want to be a photographer.” There’s something he’s not saying. He was not just a boring apolitical kid who didn’t notice very much about the world. Such people do not become photojournalists for a week over Christmas in war zones when they are 18.

And then there’s the mystery of how he managed to climb up the career ladder so quickly. He never really explains how this happens. He wasn’t a good student. He notes, as a grad student, that he mostly played pool. “During my orals, when one professor asked which economics journals I read, I replied that I had never read any. Seriously? Yes, seriously. But not long after we returned from our honeymoon in France, Henry Kissinger’s international consulting firm hired me as an Asia analyst; my dean at SAIS had recommended me to Brent Scowcroft, one of Kissinger’s partners.”

I’m sorry, but what? How does this just happen? And it goes on. One day, when Geithner was a junior Treasury civil servant, Treasury Secretary Lloyd Bentsen just called him out of the blue to ask his advice on a matter about which he knew nothing. Why? He doesn’t say—he’s just puzzled. Later on, he advances in Treasury without any real credentials in a department where a law degree or economics PhD is essential. Even Alan Greenspan eventually expressed surprise; he had just assumed Geithner had a doctorate. Power just always seemed to flow to Geithner, and he never says why. He knows why, of course—he’s an exceptional political climber. He just doesn’t say who was grooming him, why he ended up where he ended up, and what he paid to get there. It’s clear he had ideas about how the world should work, but he pretends otherwise.

As the book moved into the guts of his career, the Mexican crisis in the early 1990s, I began to come into contact with events that could actually be fact-checked. In 1994, just after NAFTA was signed, Mexico experienced a massive currency collapse. The roots of the crisis were excessive lending by American banks to Mexico, so the US Treasury–funded bailout helped ensure that Mexico could pay its debts and that US banks had their money returned. Geithner participated in the rescue designed by then Treasury Secretary Bob Rubin. The bailout was deeply unpopular at the time, and Congress refused to fund it. But Rubin found the financing for the wall of money in an old account called the Exchange Stabilization Fund, and the American banks who had lent to Mexico were ultimately paid back. Geithner presents this as a triumph of wisdom over the stupidity and cravenness of a short-sighted Congress and impatient public. Yet as Dean Baker notes, “Mexico had the worst per capita growth of any major country in Latin America in the two decades following” the bailout. It was bad for Mexico, but great for Citigroup.

He also reorganized the New York Fed Board to include prominent financiers, “including Lehman Brothers CEO Dick Fuld; JPMorgan Chase CEO Jamie Dimon; former Goldman Sachs Chairman Steve Friedman, who was still on the firm’s board of directors; and General Electric CEO Jeff Immelt.” As he put it, “I basically restored the New York Fed board to its historic roots as an elite roster of the local financial establishment.” His former colleague on the Obama economic team Paul Volcker even mocked him for being so close to the big banks. These are not the actions of someone who has a distant relationship with Wall Street power players.

An additional lie is that Geithner was never a Wall Street banker. Technically speaking, the New York Federal Reserve, which Geithner headed up for years, is actually a bank on Wall Street. It is in fact a bank of banks—the bank of banks. It’s why Chuck Prince wanted him for the Citigroup job. And Geithner lived like a power player. He entertained Wall Street bigwigs as part of his work and could get anyone in the world on the phone. The New York Fed isn’t subject to federal-government pay caps, so Geithner was paid $411,200 a year, with a $434,668 severance when he went to Treasury. While this is a low salary for a Wall Street banker, it is a lot of money, especially for a public servant. And it’s an especially large amount of money considering the remarkable perk package, which included, as he notes in his book, coffee served by staff on a silver tray and a car with a chauffeur and sirens to get to work every day. In other words, the reason people thought Geithner came from a bank on Wall Street is because, both in a technical and a cultural sense, he did. Geithner knows the New York Federal Reserve Bank is a bank on Wall Street—a special public-private bank, of course, not an investment bank, but a bank nonetheless. Yet he denies this because it sounds better that way.

Of course the Fed isn’t subject to federal-governent pay caps. It isn’t part of the government.

And while he says he was concerned about insufficient capital levels at Citigroup, Sheila Bair says in her book, and more recently told Gretchen Morgenson, that the New York Fed under Geithner was undermining her push for higher capital levels at the Basel Accords. Only a hearing and threat from Barney Frank to Geithner and the Fed allowed Bair to go ahead. The crisis was creeping up on regulators, but Geithner was fighting against the most basic measures to do anything about it.

Geithner offers shifting and inconsistent statements about these bonuses. At Treasury, Geithner says he didn’t want the government to interfere with bonus payments, for fear of scaring the markets. The right time to have imposed executive pay restrictions was when the bailouts themselves happened, but unfortunately, “I had been too consumed with trying to contain the post-Lehman panic to even consider whether we could do anything about executive compensation.” Yet this plainly wasn’t true. Earlier in the book Geithner recalls fighting against Senator Max Baucus during the TARP negotiations. “I didn’t think Congress should mess around with TARP as a way to reform executive compensation,” he said, “not because I approved of the industry’s lavish salaries and bonuses, but because reducing them seemed like a secondary objective in a crisis.” In other words, Geithner first says he sought to preserve bonuses for bailout recipients, and then he says he didn’t.

Aside from all the lies and misleading statements, there are many claims that are difficult to verify. Geithner writes that he tried to get haircuts from banks that were counterparties to AIG, but seven out of eight AIG counterparties refused to take anything less than 100 cents on the dollar. Yet Goldman Sachs CEO Lloyd Blankfein said in press reports that he had never even been asked to take haircuts. If you look at the bailout watchdog reports released at the time, it’s clear efforts to get haircuts cannot even fairly be considered halfhearted. Later on, Geithner says his no-haircut strategy was a “no-brainer.” He wasn’t trying to save taxpayer money; he was trying to appear like he was trying to save taxpayer money while funneling money to banks.

Recognizing this tsunami of deceit is actually central to recognizing what happened during the bailouts. The bailouts were, simply put, done in bad faith. Geithner was hired to lie, steal, and cheat on behalf of bankers, and he did so.

So what is Tiny Timmy up to now?

Geithner told Ezra Klein at Vox that he chose private equity because of ethical concerns: He did not want to go through the revolving door to the banks, he said, and did not want to be involved in companies he had been regulating. Of course, private equity as an industry was actually placed under regulation by none other than Tim Geithner through Dodd-Frank. The industry is heavily dependent on large banks for syndicate financing, so Geithner’s contacts and credibility should come in handy.

Beyond that, one of Warburg’s very first investments with Geithner at the helm was a $100 million infusion of cash into a company called Source, which is a large European asset manager that handles a shadow banking instrument called an exchange-traded fund (ETF). The government recently warned that ETFs may help contribute to the next financial crisis. And amusingly enough, there is a bitter fight between the regulators as to how and whether to regulate these companies, one that Geithner could be swaying behind the scenes (as he did so often with policies he did not like during the crisis). And this is just one example—Warburg owns many companies in the heavily regulated finance space, and I’m sure Geithner can add value to many of them. Already, SEC Chairman Mary Jo White is aggressively fighting to prevent any regulation of these asset managers. White was nominated to be SEC Chairman on January 24, 2013, the day before Geithner left Treasury. Her nomination might have been the last substantive decision he made in government, and it could be profitable for his new employer.

I exposed Mary Jo White for the crony she is the minute she was appointed in the piece: Meet Mary Jo White: The Next SEC Chief and a Guaranteed Wall Street Patsy.

Moreover, the idea that private equity is an ethical industry is a remarkable claim. It is an industry dedicated to financial engineering over creating real value. The government recently came out with its very first analysis of this industry, which is known to most Americans as the place where Mitt Romney somehow got wealthy by laying people off. It turns out that more than half of the private equity funds the SEC examined were engaged in outright violations of laws in their financial dealings (or, more politely, were said to have “material weaknesses of controls”). Private equity funds routinely overstate returns, mislead investors, loot companies they buy, and break the law. Geithner found an industry even scummier than working as an executive at a Too Big to Fail bank and jumped right into it.

I recently noted I believe the private equity industry will turn out to be the primary villain in the next financial crisis in the post: SEC Official Claims Over 50% of Private Equity Audits Reveal Criminal Behavior.

Ultimately, Geithner was a hit man for American democracy—and the middle class that sustained it. Geithner has acknowledged substantial fraud in the crisis, but he won’t even deign to answer why the administration did nothing about the individuals who perpetrated it. He doesn’t discuss distributional questions from the bailout. He sneers at the notion of justice. He argues for “anti-democratic” measures in a financial crisis, including emergency powers for the president similar to those the president has for national security.

Geithner is at heart a grifter, a petty con artist with the right manners and breeding to lie at the top echelons of American finance at a moment when the government and financial services industry needed someone to be the face of their multi-trillion dollar three card monte. He’s going to make his money, now that he’s done living his life of fantastic power after his upbringing of remarkable mysterious privilege. After reading this book and documenting lie after lie after lie, I’m convinced that there’s more here than just a self-serving corrupt official. There’s an entire culture, of figures at Treasury, the Federal Reserve, in the entire Democratic Party elite structure, and in the world of journalism, a culture in which Geithner is seen as some sort of role model.

As a result, the liberal faction in the Democratic Party is beginning to grapple with what it means to have grifters setting the course for economic strategy. There is now a debate about whether and how to purge this toxic culture. Geithner probably wishes there weren’t, which is one reason he wrote the book. He actually has to try and justify the horror show he put on. Believe it or not, that’s progress. Next time there’s a crisis, if reformers learn anything from this book, it’s to make sure that there are no Geithner types anywhere near the levers of power.

I mean what can I say. I salute you for this, Matt Stoller.

Full article here.

That explains this…

The choice of Tim Geithner showed me we had been snookered. It told me Obama was just another scumbag…..and he was swept to power with a global mandate for change……the whole world wanted America restored to it’s former credibility and honor. What a scam….He was the first editor of the Harvard Review who had never submitted a SINGLE paper…….he was planted and planned years in advance.

I remember when I first heard his name, it was from a US media TV junkie. She was talking about his great speech in 2001 or so……I shrugged it off.

Next, they are pushing him for president. His speeches were great, he managed to promise everything to everyone……..and that was enough to make me nervous. He also showed himself to be a warmonger, and that was the last thing we needed…..but that is what the greedy guts wanted.

They put him up against a half senile old man who chose a bigger fool as his running mate. He had graduated the third lowest from the Navy college, and she was an idiot. So, Obama easily won once the staged “war” with Clinton was over……that old bag might run again, and if she does, that means they want the republicans in power again…..it is all a show. They are all puppets controlled by powers we never see.

Seeing this story disgusts me. Obama moved into office, re-established the Clinton administration, continued the status quo with creeps like Geithner. His attorney general is a joke, who works against us at every turn, just like all our leaders.

The evil people behind the scenes are the problem, but people will never face it. The illusion of a republic is easy to maintain. Augustus Caesar would choose the men he wanted to work with him in the senate, ETC, then put up some “straw men” to run against them……usually men nobody ever heard of, and this way Augustus kept the illusion of a republic going throughout his 50 year reign.

They are doing it again, and they are breeding these Manchurian candidates years in advance, just as they did with Obama.

The republic is dead…..along with the constitution. If anyone wants to argue, read NDAA.

It all changed with the coup of 9-11. Things happened before that but that put them in total control.