– China Sold Second-Largest Amount Ever Of US Treasurys In December: And Guess Who Comes To The Rescue (ZeroHedge, Feb 18, 2014):

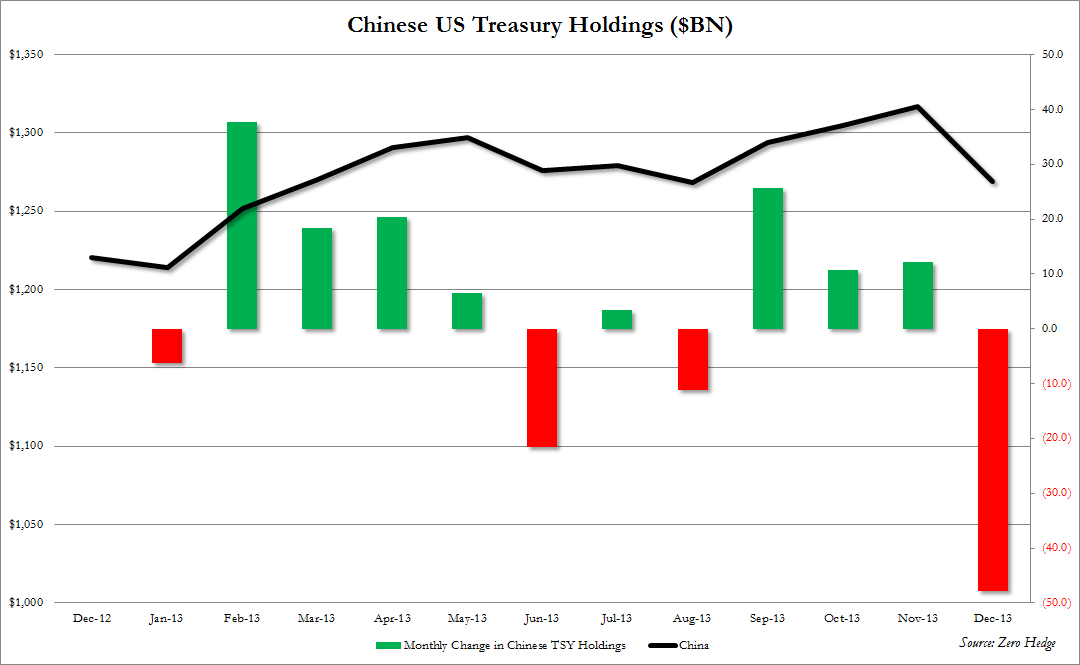

While we will have more to say about the disastrous December TIC data shortly, which was released early today, and which showed a dramatic plunge in foreign purchases of US securities in December – the month when the S&P soared to all time highs and when everyone was panicking about the 3% barrier in the 10 Year being breached and resulting in a selloff in Tsy paper – one thing stands out. The chart below shows holdings of Chinese Treasurys (pending revision of course, as the Treasury department is quite fond of ajdusting this data series with annual regularity): in a nutshell, Chinese Treasury holdings plunged by the most in two years, after China offloaded some $48 billion in paper, bringing its total to only $1268.9 billion, down from $1316.7 billion, and back to a level last seen in March 2013!

This was the second largest dump by China in history with the sole exception of December 2011.

That this happened at a time when Chinese FX reserves soared to all time highs, and when China had gobs of spare cash lying around and not investing in US paper should be quite troubling to anyone who follows the nuanced game theory between the US and its largest external creditor, and the signals China sends to the world when it comes to its confidence in the US.

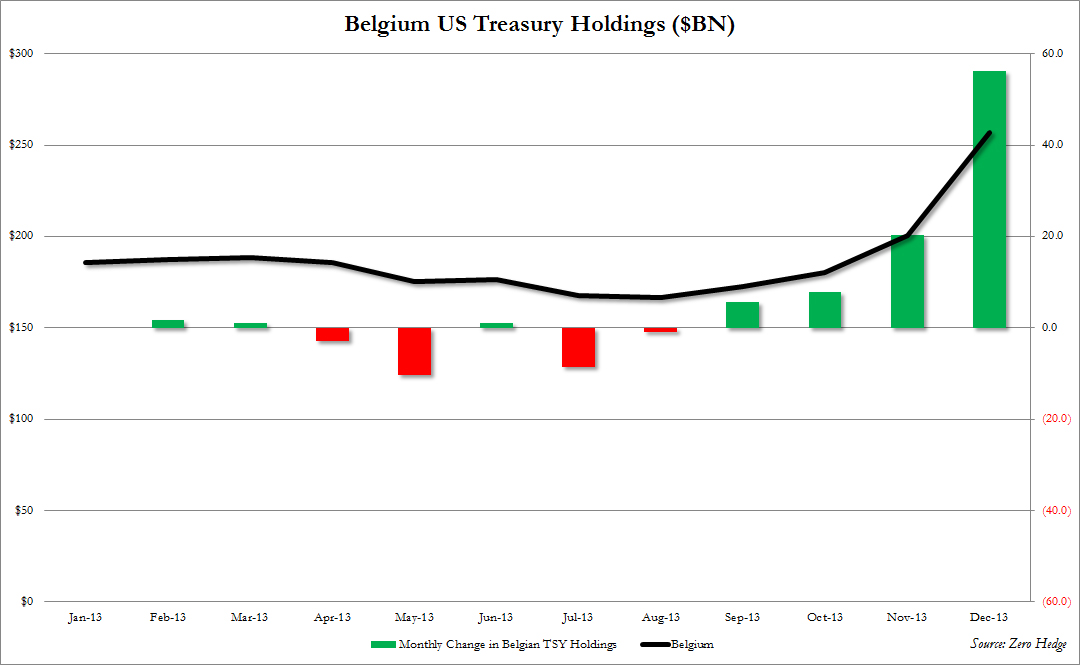

Yet what was truly surprising is that despite the plunge in Chinese holdings, and Japanese holdings which also dropped by $4 billion in December, is that total foreign holdings of US Treasurys increased in December, from $5716.9 billion to 5794.9 billion.

Why? Because of this country. Guess which one it is without looking at legend.

That’s right: at a time when America’s two largest foreign creditors, China and Japan, went on a buyers strike, the entity that came to the US rescue was Belgium, which as most know is simply another name for… Europe: the continent that has just a modest amount of its own excess debt to worry about. One wonders what favors were (and are) being exchanged behind the scenes in order to preserve the semblance that “all is well”?

Belgium? They were close to bankruptcy last year and the ECB had to bail them out. How could they buy up the dumped treasuries except with borrowed funds…….???

The shell game is moving faster. Russia could not sell their bonds, they had to cancel the event last month, and one other planned sale…..they could not get enough customers to respond.

As for Japan, they are lying through their teeth, their export market is in the tank thanks to Fukushima…….many get returned because the items and food are too radioactive. If they were not mfg their vehicles in Mexico and the US, they would not sell, either. Their debt level is over 200% of their GDP and climbing fast. They are no longer in a position to be a lending nation.

China is also in deep trouble financially for all their show of new towns and villages than few in their nation can afford to buy……they have become ghost towns. They built the world’s largest building, complete with its own artificial seashore……over 100 miles away from the ocean. The bottom floor is for shops and businesses, the higher floors are high end housing. The building is nearly empty, their people cannot afford it.

The Euro is made up of member nations, all which have inflated their true worth on paper…..they have far less money than they claimed.

The US is no better.

What is really happening is that the run on the banks are commencing, and people are asking for their money from greedy gut banks in cash……and they don’t have it.

Look at Cyprus and Spain…….the investors have found their accounts cut in large percentages…..called haircuts.

When financial institutions can no longer be trusted, the entire system is entering collapse stage.

The problem is far deeper than this article addresses.

The world wants Belgium’s chocolates, and Belgium wants Treasurys. How strange..