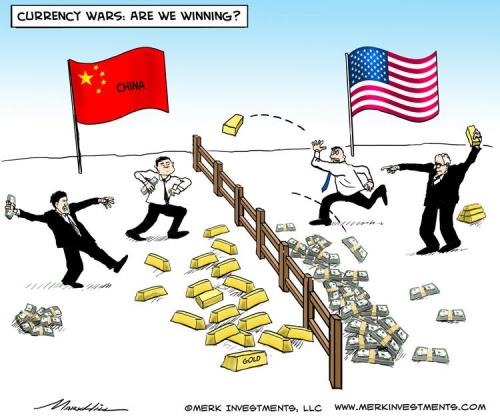

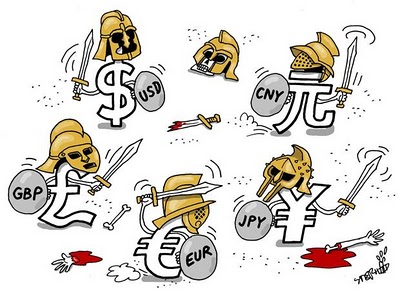

– China “Loses Battle Over Yuan”, And Now The Global Currency War Begins (ZeroHedge, Aug 11, 2015):

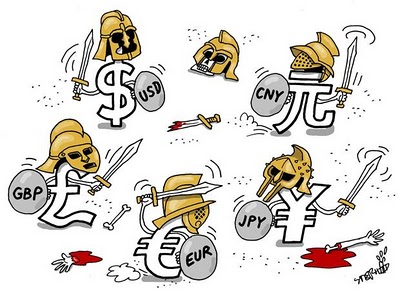

Almost exactly seven months ago, on January 15, the Swiss National Bank shocked the world when it admitted defeat in a long-standing war to keep the Swiss Franc artificially weak, and after a desperate 3 year-long gamble, which included loading up the SNB’s balance sheet with enough EUR-denominated garbage to almost equal the Swiss GDP, it finally gave up and on one cold, shocking January morning the EURCHF imploded, crushing countless carry-trade surfers.

Fast forward to the morning of August 11 when in a virtually identical stunner, the PBOC itself admitted defeat in the currency battle, only unlike the SNB, the Chinese central bank had struggled to keep the Yuan propped up, at the cost of nearly $1 billion in daily foreign reserve outflows, which as this website noted first months ago, also included the dumping of a record amount of US government treasurys.

And with global trade crashing, Chinese exports tumbling, and China having nothing to show for its USD peg besides a propped and manipulated stock “market” which has become the laughing stock around the globe, at the cost of even more reserve outflows, it no longer made any sense for China to avoid the currency wars and so, first thing this morning China admitted that, as Market News summarized, the “PBOC lost Battle Over Yuan.”

That’s only part of the story though, because as MNI also adds, the real, global currency war is only just starting.

Read moreChina “Loses Battle Over Yuan”, And Now The Global Currency War Begins