Well well well…. ( The origins of the next crisis – William White, the former chief economist at the Bank of International Settlements (BIS) gave an important speech at George Soros’ Inaugural Institute of New Economic Thinking (INET) conference in Cambridge.):

In essence, White was saying: “it’s the debt, stupid.” When aggregate debt levels build up across business cycles, economists focused on managing within business cycles miss the key ingredient that leads to systemic crisis. It should be expected that politicians or private sector participants worried about the day-to-day exhibit short-termism. But White says it is particularly troubling that economists and their models exhibit the same tendency because it means there is no long-term oriented systemic counterweight guiding the economy.

This short-termism that White refers to is what I call the asset-based economic model. And, quite frankly, it works – especially when interest rates are declining as they have over the past quarter century. The problem, however, is that you reach a critical state when the accumulation of debt and the misallocation of resources is so large that the same old policies just don’t work anymore. And that’s when the next crisis occurs.

It seems that Mr. Harrison has it figured out. He goes on to spend a lot of digital ink on the periphery of the bottom line, which is that we continue to think of debt in terms of service costs (indeed, you’ll hear Bernanke talk about it, but never about the actual gross financial system debt outstanding.)

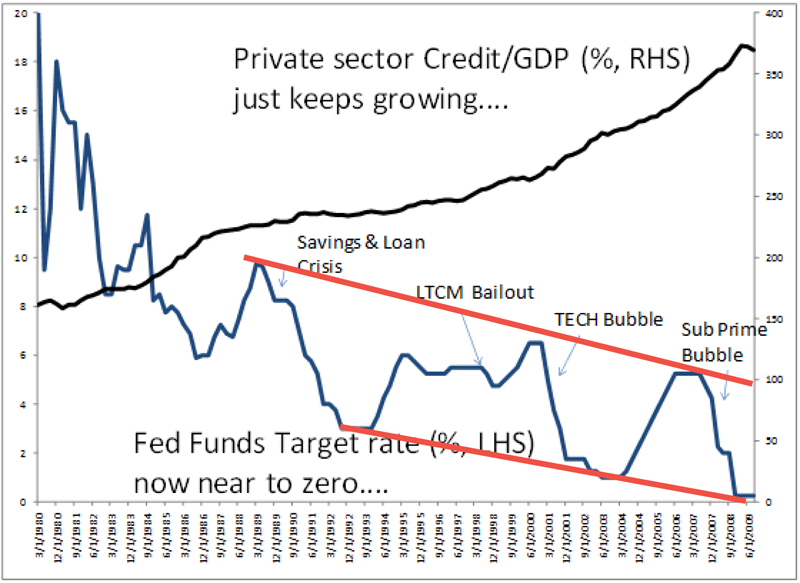

When you boil all this down, however, you get to the following chart (trendline added by moi):

You can see what’s going on here – each “crisis” leads to lower lows and lower highs.

This presents two problems: