Aug. 28 (Bloomberg) — Rand Refinery Ltd., the world’s largest gold refinery, ran out of South African Krugerrands after an “unusually large” order from a buyer in Switzerland.

The order was for 5,000 ounces and it will take until Sept. 3 for inventories to be replenished, said Johan Botha, a spokesman for Rand Refinery in Germiston, east of Johannesburg. He declined to identify the buyer.

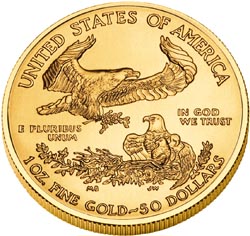

Coins and bars of precious metals are attracting investors as a haven against a sliding dollar and conflict between Russia and its neighbor Georgia. The U.S. Mint suspended sales of one- ounce “American Eagle” gold coins, Johnson Matthey Plc stopped taking orders for 100-ounce silver bars at its Salt Lake City refinery and Heraeus Holding GmbH has a delivery waiting list of as long as two weeks for orders of gold bars in Europe.

“A lot of people are worried about the dollar, they’re worried about inflation and now we have geopolitical risk with what’s happening in Russia,” said Mark O’Byrne, managing director of brokerage Gold and Silver Investments Ltd. in Dublin. O’Byrne said his company’s sales are up fourfold this year, heading for a record since its founding in 2003.

Read moreWorld’s Largest Gold Refiner Runs Out of Krugerrands