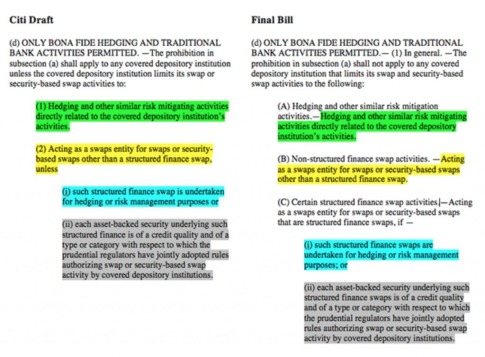

I have gone on record that the most dangerous organization is the now French led IMF with Christine Lagarde at the helm, which has presented a concept report that debt cuts for over-indebted states are uncompromising and are to be performed more effectively in the future by defaulting on retirement accounts held in life insurance, mutual funds and other types of pension schemes, or arbitrarily extending debt perpetually so you cannot redeem. Yes you read correctly, The new IMF paper is described in great detail exactly how to now allow the private sector, which has invested in government bonds, to be expropriated to pay for the national debts of the socialist governments.

I have been warning that there is an idea that has been running around behind the curtain that the national debt of the USA could be settled by usurping all pension funds in the country. Here is a remarkable blueprint that throws all previous considerations concerning the purchase of government bonds over the cliff. The IMF working paper from December 2013 states boldly:

“The distinction between external debt and domestic debt can be quite important. Domestic debt issued in domestic currency typically offers a far wider range of partial default options than does foreign currency–denominated external debt. Financial repression has already been mentioned; governments can stuff debt into local pension funds and insurance companies, forcing them through regulation to accept far lower rates of return than they might otherwise demand.”

id/Page 8 (IMF-Sovereign-Debt-Crisis)

Already in October 2013, the International Monetary Fund (IMF), suggested the Euro Crisis should be handled by raising taxes. The IMF lobbied for a property tax in Europe that should be imposed where there are no such taxes. The IMF has advocated for a general “debt tax” in the amount of 10 percent for each household in the Eurozone, which also has only modest savings.

Read moreChristine Lagarde – The Most Dangerous Woman in the World – IMF Advocates Taking Pensions & Extending Maturities of Gov’t Debt to Prevent Redemption