– Bernanke – My Goal is to Wreck Social Security (ZeroHedge, July 4, 2012)

Social Security

Ron Paul Admits He’s On Social Security, Even Though He Believes It’s Unconstitutional (Video)

For your information.

– Ron Paul Admits He’s On Social Security, Even Though He Believes It’s Unconstitutional (Huffington Post, June 21, 2012):

Rep. Ron Paul (R-Texas) may rail against Social Security insolvency in the public eye, but that hasn’t stopped him from accepting the government checks.

The libertarian-leaning Republican and former presidential candidate admitted Wednesday that he accepts Social Security checks just minutes after he called for younger generations to wean themselves off the program, in an interview on MSNBC’s “Morning Joe.”

“I want young people to opt out of Social Security, but my goal isn’t to cut,” he said.

The Huffington Post’s Sam Stein then asked Paul, “A bit of a personal question — Are you on Social Security? Do you get social security checks?”

Paul admitted he does, stating, “[It’s] just as I use the post office, I use government highways, I use the banks, I use the federal reserve system. But that doesn’t mean that you can’t work to remove this in the same way on Social Security.”

Paul also said he still pays more into Social Security than he gets in his checks.

Interview With Jim Marrs, Author Of ‘The Trillion Dollar Conspiracy’ (Video)

YouTube Added: 26.04.2012

In case the YouTube video ‘disappears’:

Books from Jim Marrs @Amazon.com:

– The Terror Conspiracy Revisited: What Really Happened On 9/11, And Why We’re Still Paying The Price

– The Rise of the Fourth Reich: The Secret Societies That Threaten to Take Over America

US: Only 1.75 Full-time Private Sector Workers Per Social Security Recipient

– Only 1.75 Full-time Private Sector Workers Per Social Security Recipient (The Patriot Update, Sep. 13, 2011):

There were only 1.75 full-time private-sector workers in the United States last year for each person receiving benefits from Social Security, according to data from the Bureau of Labor Statistics and the Social Security board of trustees.

That means that for each husband and wife who worked full-time in the private sector last year there was a Social Security recipient somewhere in the country taking benefits from the federal government.

Read moreUS: Only 1.75 Full-time Private Sector Workers Per Social Security Recipient

US National Debt At $14 Trillion? Try $211 Trillion!!!

Related article:

– Prof. Kotlikoff: ‘The US is bankrupt’, Government Debt At $200 Trillion – 840 Percent of Current GDP (The Globe And Mail, Oct 27, 2010):

Boston University economist Laurence Kotlikoff says U.S. government debt is not $13.5-trillion (U.S.), which is 60 per cent of current gross domestic product, as global investors and American taxpayers think, but rather 14-fold higher: $200-trillion – 840 per cent of current GDP. “Let’s get real,” Prof. Kotlikoff says. “The U.S. is bankrupt.”

Laurence J. Kotlikoff served as a senior economist on President Ronald Reagan’s Council of Economic Advisers and is a professor of economics at Boston University.

– A National Debt Of $14 Trillion? Try $211 Trillion (NPR, August 6, 2011):

When Standard & Poor’s reduced the nation’s credit rating from AAA to AA-plus, the United States suffered the first downgrade to its credit rating ever. S&P took this action despite the plan Congress passed this past week to raise the debt limit.

The downgrade, S&P said, “reflects our opinion that the fiscal consolidation plan that Congress and the administration recently agreed to falls short of what, in our view, would be necessary to stabilize the government’s medium-term debt dynamics.”

It’s those medium- and long-term debt problems that also worry economics professor Laurence J. Kotlikoff, who served as a senior economist on President Reagan’s Council of Economic Advisers. He says the national debt, which the U.S. Treasury has accounted at about $14 trillion, is just the tip of the iceberg.

“We have all these unofficial debts that are massive compared to the official debt,” Kotlikoff tells David Greene, guest host of weekends on All Things Considered. “We’re focused just on the official debt, so we’re trying to balance the wrong books.”

Kotlikoff explains that America’s “unofficial” payment obligations — like Social Security, Medicare and Medicaid benefits — jack up the debt figure substantially.

“If you add up all the promises that have been made for spending obligations, including defense expenditures, and you subtract all the taxes that we expect to collect, the difference is $211 trillion. That’s the fiscal gap,” he says. “That’s our true indebtedness.”

Read moreUS National Debt At $14 Trillion? Try $211 Trillion!!!

President Obama Says He Cannot Guarantee Social Security Checks Will Go Out On August 3

Oh, sure!

See also:

– Prof. Michael Hudson: Obama’s Debt Ceiling Doublespeak

– Obama says he cannot guarantee Social Security checks will go out on August 3 (CBS NEWS, July 12, 2011):

President Obama on Tuesday said he cannot guarantee that retirees will receive their Social Security checks August 3 if Democrats and Republicans in Washington do not reach an agreement on reducing the deficit in the coming weeks.

“I cannot guarantee that those checks go out on August 3rd if we haven’t resolved this issue. Because there may simply not be the money in the coffers to do it,” Mr. Obama said in an interview with CBS Evening News anchor Scott Pelley, according to excerpts released by CBS News.

The Obama administration and many economists have warned of economic catastrophe if the United States does not raise the amount it is legally allowed to borrow by August 2.

Lawmakers from both parties want to use the threat of that deadline to work out a broader package on long-term deficit reduction, with Republicans looking to cut trillions of dollars in federal spending, while Democrats are pushing for a more “balanced approach,” which would include both spending cuts and increased revenue through taxes.

Democratic and Republican lawmakers are expected to hold another round of negotiations with Mr. Obama at the White House Tuesday afternoon on long-term deficit reduction, though talks have yielded little results to date.

Mr. Obama told Pelley “this is not just a matter of Social Security checks. These are veterans checks, these are folks on disability and their checks. There are about 70 million checks that go out.”

Mr. Obama’s comments followed remarks from the Senate’s top Republican, who said Tuesday that he did not see a way for Republicans and Democrats to come to agreement on meaningful deficit reduction as long as Mr. Obama remains in office.

“After years of discussions and months of negotiations, I have little question that as long as this president is in the Oval Office, a real solution is probably unattainable,” Senate Republican Leader Mitch McConnell said in remarks on the Senate floor.

Still, McConnell said Republicans would “do the responsible thing” to avoid default, suggesting that a deal on the debt ceiling could be reached without a “real” deficit reduction package.

“The president has presented us with three choices: smoke and mirrors, tax hikes, or default. Republicans choose none of the above. I had hoped to do good, but I refuse to do harm. So Republicans will choose a path that actually reflects the will of the people, which is to do the responsible thing and ensure that the government doesn’t default on its obligations,” he said.

Mr. Obama has repeatedly said he wants a deal that would allow the U.S. to avoid confronting the issue again until after the 2012 elections and vowed on Monday that he would “not sign a 30-day or a 60-day or a 90-day extension.”

“This the United States of America and, you know, we don’t manage our affairs in three-month increments. You know, we don’t risk U.S. default on our obligations because we can’t put politics aside,” Mr. Obama told reporters at the White House yesterday.

Meet The Guy Who Robbed A Bank Just To Get Healthcare In Jail

– Meet The Guy Who Robbed A Bank Just To Get Healthcare In Jail (Business Insider, Jun. 21, 2011):

With a undiagnosed growth on his chest and two ruptured disks, Richard James Verone needed medical attention and to get it he handed a note to a bank teller demanding $1.

Verone walked into an RBC bank in North Carolina, handed the teller the note, and she gave him the money. Then, according to the Gaston Gazette, he sat down and waited for the police to show up.

He said, “I didn’t have any fears. I told the teller that I would sit over here and wait for police.”

Never in trouble with the law, Verone worked for Coca-Cola for 17 years, but was laid off three years ago. He’s had part time jobs since, but nothing steady, and nothing with health insurance.

“If you don’t have your health you don’t have anything,” said Verone.

His plan includes a three year stint in prison, multiple surgeries, and then release — just in time to collect social security.

TrimTabs Finds Social Benefits Are Equal To 35 Percent Of All US Wages And Salaries

After yesterday TrimTabs Charles Biderman made it all too clear who runs the stock market, today the same firm exposes the system’s dirty socialist core: “In a research note, TrimTabs highlights that government social benefits —including Social Security, Medicare, Medicaid, and unemployment insurance—were equal to 35% of all private and public wages and salaries in the 12 months ended January, up from 10% in 1960 and 21% in 2000.

“We have no quibble with the view that the U.S. economy is expanding at a moderate pace,” says Madeline Schnapp, Director of Macroeconomic Research at TrimTabs. “But we believe Wall Street does not fully appreciate the degree to which growth depends on government support.”

Schanpp’s conclusion: QE3 is inevitable, leaving aside debt monetization concerns, as without it the US welfare state will collapse. DXY: meet 50, just in time for the NYSE Borse to extends its rollup with the Zimbaber stock exchange.

More from TrimTabs:

“The pressure on the federal government to decrease runaway spending is intense, while state and local governments are slashing payrolls to eliminate deficits,” notes Schnapp. “Further declines in public-sector employment and transfer payments bode ill for wages and salaries, and they will exact an even larger toll on final demand.”“We think very few market participants understand that the economy has become heavily dependent on government largesse,” cautions Schnapp. “We are hardly convinced that the recovery can persist without outside aid, so we expect the Fed to roll out QE3 shortly after QE2 ends at the close of June.”

One thing is certain: socialist status quo under Uber-Comrade Iossif Vissarionovich Bernankestein must continue as usual, or else US will no longer be able to say it is not Libya.

Read moreTrimTabs Finds Social Benefits Are Equal To 35 Percent Of All US Wages And Salaries

Censored Ron Paul’s 20/20 ABC News Interview With John Stossel (MUST-SEE!!!)

The videos are a flashback and a must-see.

More about Ron Paul:

– Rep. Ron Paul of Texas Wins CPAC Presidential Straw Poll Again

– Ron Paul 2012 – Can you Hear us Now?

– Ron Paul: ‘Is the Gold Really There? Who Owns It?’

1 of 6:

Added: 22. April 2008

2 of 6:

Added: 22. April 2008

3 of 6:

Added: 22. April 2008

4 of 6:

Added: 22. April 2008

5 of 6:

Added: 22. April 2008

6 of 6:

Added: 22. April 2008

US Government ‘Hiding True Amount of Debt’, Engages in ‘Enron Accounting’

Prepare for collapse and the Greatest Depression.

Sept. 20 — THE actual figure of the US’ national debt is much higher than the official sum of $US13.4 trillion ($14.3 trillion) given by the Congressional Budget Office, according to analysts cited on Sunday by the New York Post.

“The Government is lying about the amount of debt. It is engaging in Enron accounting,” said Laurence Kotlikoff, an economist at Boston University and co-author of The Coming Generational Storm: What You Need to Know about America’s Economic Future.

“The problem is we’re seeing an explosion in spending,” added Andrew Moylan, director of government affairs for the National Taxpayers Union.

In 1980, the debt – the accumulated red ink incurred by the Federal Government – was $US909 billion.

This represented some 33 per cent of gross domestic product, according to the Congressional Budget Office (CBO).

Thirty years later, based on this year’s second-quarter numbers, the CBO said the debt was $US13.4 trillion, or 92 per cent of GDP.

The CBO estimates the debt will be at $US16.5 trillion in two years, or 100.6 per cent of GDP.

But these numbers are incomplete.

They do not count off-budget obligations such as required spending for Social Security and Medicare, whose programs represent a balloon payment for the Government as more Americans retire and collect benefits.

In the case of Social Security, beginning in 2016, the US Government will be paying out more than it is collecting in taxes.

Without basic measures – such as payment cuts or higher payroll taxes – the system could be on the road to bankruptcy, according to officials.

“Without changes,” wrote Social Security Commissioner Michael Astrue, “by 2037 the Social Security Trust Fund will be exhausted. There will be enough money only to pay about $US0.76 for each dollar of benefits.”

Mr Kotlikoff and Mr Moylan agree US national debt is much more than the official $US13.4 trillion number, but they disagree over how to add up the exact number.

Mr Kotlikoff says the debt is actually $US200 trillion.

Mr Moylan says the number is likely about $US60 trillion.

That is close to the figure quoted by David Walker, the US Comptroller General from 1998 to 2008.

He launched a campaign to convince Americans that the federal spending and debt is a greater threat than terrorism.

Read moreUS Government ‘Hiding True Amount of Debt’, Engages in ‘Enron Accounting’

John Williams: ‘Times That Try Our Souls’ (U.S. Bankruptcy – Hyperinflation – Great Depression), Preparedness Can Save Your Life

Highly recommended reading.

The Greatest Depression is here.

When Fed Chairman Ben Bernanke admits to seeing an “unusually uncertain” economy ahead, it’s pretty terrifying to imagine what he’s really thinking. What John Williams envisions-and he’s by no means looking to the far horizon-is a systemic collapse, a hyperinflationary great depression and the cessation of normal commerce. Despite that bleak outlook, however, when the economist and editor of ShadowStats.com sat down for this exclusive Energy Report interview, he also had some good news.

The Energy Report: A few months back, John, you said, “if you strangle liquidity you always contract an economy and deliberately or not, liquidity is being strangled, resulting in sharp declines in consumer credit, commercial and industrial loans.” Does this mean it would spur more economic growth if banks actually started lending?

John Williams: It sure wouldn’t hurt. We’re still seeing contractions in liquidity, and that’s adjusted for inflation. In real terms, M3 money supply is down almost 8% year-over-year. It’s the sharpest fall in the post -World War II era. It’s not so much the depth of the decline in the liquidity or the duration, but the fact that the liquidity turns negative year-over-year that signals the economy turning down.

We had the signal in December of 2009 indicating intensification of the downturn, in this case, within six to nine months. We’re in that timeframe now and see softening numbers. People are talking about a weaker economy. Even Mr. Bernanke has described the economy as “unusually uncertain” in terms of its outlook. Wording like that from the Fed is a pretty good indication that something’s afoot.

Meltup (Documentary): The Beginning Of A US Currency Crisis And Hyperinflation.

Added: 13. Mai 2010

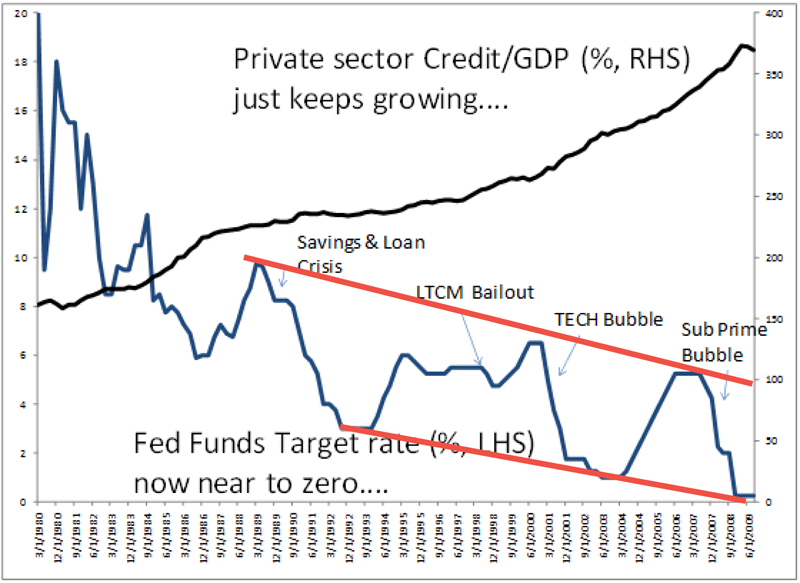

US: Death-Spiral Intercept

Well well well…. ( The origins of the next crisis – William White, the former chief economist at the Bank of International Settlements (BIS) gave an important speech at George Soros’ Inaugural Institute of New Economic Thinking (INET) conference in Cambridge.):

In essence, White was saying: “it’s the debt, stupid.” When aggregate debt levels build up across business cycles, economists focused on managing within business cycles miss the key ingredient that leads to systemic crisis. It should be expected that politicians or private sector participants worried about the day-to-day exhibit short-termism. But White says it is particularly troubling that economists and their models exhibit the same tendency because it means there is no long-term oriented systemic counterweight guiding the economy.

This short-termism that White refers to is what I call the asset-based economic model. And, quite frankly, it works – especially when interest rates are declining as they have over the past quarter century. The problem, however, is that you reach a critical state when the accumulation of debt and the misallocation of resources is so large that the same old policies just don’t work anymore. And that’s when the next crisis occurs.

It seems that Mr. Harrison has it figured out. He goes on to spend a lot of digital ink on the periphery of the bottom line, which is that we continue to think of debt in terms of service costs (indeed, you’ll hear Bernanke talk about it, but never about the actual gross financial system debt outstanding.)

When you boil all this down, however, you get to the following chart (trendline added by moi):

You can see what’s going on here – each “crisis” leads to lower lows and lower highs.

This presents two problems:

US: Lawmakers Propose National ID Card

Graham, left, and Schumer, are calling for national ID cards to combat illegal immigration. (AP)

Lawmakers are proposing a national identification card – what they’re calling “high-tech, fraud-proof Social Security cards” – that would be required for all employees in the United States.

The proposal by Sen. Charles Schumer (D-New York) and Sen. Lindsay Graham (R-South Carolina) comes as the states are grappling to produce another national identification card at the behest of the Department of Homeland Security. Virtually none of the states are in compliance with this Real ID program – adopted in 2005 – requiring state motor vehicle bureaus to obtain and internally scan and store personal information like Social Security cards and birth certificates for a national database.

Now comes a bid for a second card.

Homeland Security officials pointed to the Sept. 11 hijackers’ ability to get driver’s licenses in Virginia using false information as justification for the proposed $24 billion Real ID program. Schumer and Graham point to illegal immigration as cause for their plan.

“We would require all U.S. citizens and legal immigrants who want jobs to obtain a high-tech, fraud-proof Social Security card. Each card’s unique biometric identifier would be stored only on the card; no government database would house everyone’s information,” they said. “The cards would not contain any private information, medical information or tracking devices. The card would be a high-tech version of the Social Security card that citizens already have.”

Jim Harper, director of information policy studies at the Cato Institute, suggests the plan would undoubtedly lead to a national database. He added that “there is no practical way of making a national identity document fraud-proof.”

What’s more, Richard Esguerra, the Electronic Frontier Foundation’s in-house activist, notes that a national ID card likely would expand from its stated purpose.

“Because of the ID card’s proposed universality, it will likely be requested and required by airlines, insurance agencies, health care providers, mortgage lenders, credit card companies, and so forth,” he said.

Rep. Ron Paul At CPAC 2010: ‘We Are On The Brink Of A Financial Cataclysmic Event.’

1 of 3:

Added: 19. Februar 2010

2 of 3:

Added: 19. Februar 2010

3 of 3:

Added: 19. Februar 2010

“I place the economy among the first and most important virtues, and public debt as the greatest of dangers.”

– Thomas Jefferson

“There are two ways to conquer and enslave a nation. One is by the sword. The other is by debt.”

– John Adams

“The one aim of these financiers is world control by the creation of inextinguishable debts.”

– Henry Ford

“I wish it were possible to obtain a single amendment to our Constitution — taking from the federal government their power of borrowing.”

– Thomas Jefferson

Read moreRep. Ron Paul At CPAC 2010: ‘We Are On The Brink Of A Financial Cataclysmic Event.’

We’re Screwed! Hyperinflation like in the Weimar Republic; Great Depression worse than in the 1930s

The US is already beyond hope!

See also:

– John Williams of Shadowstats: Prepare For The Hyperinflationary Great Depression

This is the Greatest Depression.

ShadowStats.com founder John Williams explains the risk of hyperinflation. Worst-case scenario? Rioting in the streets and devolution to a bartering system.

Courtesy of John WilliamsEconomist/statistician John Williams shifts through the government’s rose-tinted data

Do you believe everything the government tells you? Economist and statistician John Williams sure doesn’t. Williams, who has consulted for individuals and Fortune 500 companies, now uncovers the truth behind the U.S. government’s economic numbers on his Web site at ShadowStats.com. Williams says, over the last several decades, the feds have been infusing their data with optimistic biases to make the economy seem far rosier than it really is. His site reruns the numbers using the original methodology. What he found was not good.

Maymin: So we are technically bankrupt?

Williams: Yes, and when countries are in that state, what they usually do is rev up the printing presses and print the money they need to meet their obligations. And that creates inflation, hyperinflation, and makes the currency worthless.

Obama says America will go bankrupt if Congress doesn’t pass the health care bill.

Well, it’s going to go bankrupt if they do pass the health care bill, too, but at least he’s thinking about it. He talks about it publicly, which is one thing prior administrations refused to do. Give him credit for that. But what he’s setting up with this health care system will just accelerate the process.

Where are we right now?

In terms of the GDP, we are about halfway to depression level. If you look at retail sales, industrial production, we are already well into depressionary. If you look at things such as the housing industry, the new orders for durable goods we are in Great Depression territory. If we have hyperinflation, which I see coming not too far down the road, that would be so disruptive to our system that it would result in the cessation of many levels of normal economic commerce, and that would throw us into a great depression, and one worse than was seen in the 1930s.

What kind of hyperinflation are we talking about?

I am talking something like you saw with the Weimar Republic of the 1930s. There the currency became worthless enough that people used it actually as toilet paper or wallpaper. You could go to a fine restaurant and have an expensive dinner and order an expensive bottle of wine. The next morning that empty bottle of wine is worth more as scrap glass than it had been the night before filled with expensive wine.

We just saw an extreme example in Zimbabwe. … Probably the most extreme hyperinflation that anyone has ever seen. At the same time, you still had a functioning, albeit troubled, Zimbabwe economy. How could that be? They had a workable backup system of a black market in U.S. dollars. We don’t have a backup system of anything. Our system, with its heavy dependence on electronic currency, in a hyperinflation would not do well. It would probably cease to function very quickly. You could have disruptions in supply chains to food stores. The economy would devolve into something like a barter system until they came up with a replacement global currency.

What can we do to avoid hyperinflation? What if we just shut down the Fed or something like that?

We can’t. The actions have already been taken to put us in it. It’s beyond control. The government does put out financial statements usually in December using generally accepted accounting principles, where unfunded liabilities like Medicare and Social Security are included in the same way as corporations account for their employee pension liabilities. And in 2008, for example, the one-year deficit was $5.1 trillion dollars. And that’s instead of the $450 billion, plus or minus, that was officially reported.

Wow.

These numbers are beyond containment. Even the 2008 numbers, you can take 100 percent of people’s income and corporate profit and you’d still be in deficit. There’s no way you can raise enough money in taxes.

What about spending?

If you eliminated all federal expenditures except for Medicare and Social Security, you’d still be in deficit. You have to slash Social Security and Medicare. But I don’t see any political will to rein in the costs the way they have to be reined in. There’s just no way it can be contained. The total federal debt and net present value of the unfunded liabilities right now totals about $75 trillion. That’s five times the level of GDP.

Ron Paul: The US is Bankrupt

Change you can believe in!

Added: 17. November 2009

Landmark health care bill passes House on close vote

“A triumphant Speaker Nancy Pelosi compared the legislation to the passage of Social Security in 1935 and Medicare 30 years later.”

Excellent comparison Mrs. Pelosi:

– US: THIS is Big Government (Yahoo Finance):

Social Security was established in 1935 – they’ve had 74 years to get it right; it is broke.

Medicare and Medicaid were established in 1965 – they’ve had 44 years to get it right; they are both broke; and now our government dares to mention them as models for all US health care.

– Judge Napolitano: Everything the Government Runs is Bankrupt!:

“Medicare is broke.”

“Medicaid is broke.”

“Social security is a bigger Ponzi scheme and a bigger fraud than anything Bernie Madoff ever dreamed of and it’s broke.”

Change!

Speaker Nancy Pelosi, center, is joined by (L-R) House Majority Leader Steny Hoyer and Rep. George Miller, D-Calif. during a press conference at the U.S. Capitol, Saturday, Nov. 7, 2009 in Washington after the passage in the house of the health care reform bill. at the U.S. Capitol, Saturday, Nov. 7, 2009 in Washington. (AP Photo/Alex Brandon)

WASHINGTON — The Democratic-controlled House has narrowly passed landmark health care reform legislation, handing President Barack Obama a hard won victory on his signature domestic priority.

Republicans were nearly unanimous in opposing the plan that would expand coverage to tens of millions of Americans who lack it and place tough new restrictions on the insurance industry.

The 220-215 vote late Saturday cleared the way for the Senate to begin a long-delayed debate on the issue that has come to overshadow all others in Congress.

A triumphant Speaker Nancy Pelosi compared the legislation to the passage of Social Security in 1935 and Medicare 30 years later.

Read moreLandmark health care bill passes House on close vote

Paul Craig Roberts: The Economy is a Lie, too

Ben Bernanke IS RIGHT, ‘the recession is over.’

It is now the ‘Greatest Depression’.

Paul Craig Roberts was Assistant Secretary of the Treasury during President Reagan’s first term. He was Associate Editor of the Wall Street Journal. He has held numerous academic appointments, including the William E. Simon Chair, Center for Strategic and International Studies, Georgetown University, and Senior Research Fellow, Hoover Institution, Stanford University.

Paul Craig Roberts

Americans cannot get any truth out of their government about anything, the economy included. Americans are being driven into the ground economically, with one million school children now homeless, while Federal Reserve chairman Ben Bernanke announces that the recession is over.

|

|

| At the urging of Larry Summers and Goldman Sachs’ CEO Henry Paulson, the Securities and Exchange Commission and the Bush administration went along with removing restrictions on debt leverage. | |

The spin that masquerades as news is becoming more delusional. Consumer spending is 70% of the US economy. It is the driving force, and it has been shut down. Except for the super rich, there has been no growth in consumer incomes in the 21st century. Statistician John Williams of shadowstats.com reports that real household income has never recovered its pre-2001 peak.

The US economy has been kept going by substituting growth in consumer debt for growth in consumer income. Federal Reserve chairman Alan Greenspan encouraged consumer debt with low interest rates. The low interest rates pushed up home prices, enabling Americans to refinance their homes and spend the equity. Credit cards were maxed out in expectations of rising real estate and equity values to pay the accumulated debt. The binge was halted when the real estate and equity bubbles burst.

As consumers no longer can expand their indebtedness and their incomes are not rising, there is no basis for a growing consumer economy. Indeed, statistics indicate that consumers are paying down debt in their efforts to survive financially. In an economy in which the consumer is the driving force, that is bad news.

The banks, now investment banks thanks to greed-driven deregulation that repealed the learned lessons of the past, were even more reckless than consumers and took speculative leverage to new heights. At the urging of Larry Summers and Goldman Sachs’ CEO Henry Paulson, the Securities and Exchange Commission and the Bush administration went along with removing restrictions on debt leverage.

When the bubble burst, the extraordinary leverage threatened the financial system with collapse. The US Treasury and the Federal Reserve stepped forward with no one knows how many trillions of dollars to “save the financial system,” which, of course, meant to save the greed-driven financial institutions that had caused the economic crisis that dispossessed ordinary Americans of half of their life savings.

The consumer has been chastened, but not the banks. Refreshed with the TARP $700 billion and the Federal Reserve’s expanded balance sheet, banks are again behaving like hedge funds. Leveraged speculation is producing another bubble with the current stock market rally, which is not a sign of economic recovery but is the final savaging of Americans’ wealth by a few investment banks and their Washington friends. Goldman Sachs, rolling in profits, announced six figure bonuses to employees.

The rest of America is suffering terribly.

The unemployment rate, as reported, is a fiction and has been since the Clinton administration. The unemployment rate does not include jobless Americans who have been unemployed for more than a year and have given up on finding work. The reported 10% unemployment rate is understated by the millions of Americans who are suffering long-term unemployment and are no longer counted as unemployed. As each month passes, unemployed Americans drop off the unemployment role due to nothing except the passing of time.

The inflation rate, especially “core inflation,” is another fiction. “Core inflation” does not include food and energy, two of Americans’ biggest budget items. The Consumer Price Index (CPI) assumes, ever since the Boskin Commission during the Clinton administration, that if prices of items go up consumers substitute cheaper items. This is certainly the case, but this way of measuring inflation means that the CPI is no longer comparable to past years, because the basket of goods in the index is variable.

The Boskin Commission’s CPI, by lowering the measured rate of inflation, raises the real GDP growth rate. The result of the statistical manipulation is an understated inflation rate, thus eroding the real value of Social Security income, and an overstated growth rate. Statistical manipulation cloaks a declining standard of living.

In bygone days of American prosperity, American incomes rose with productivity. It was the real growth in American incomes that propelled the US economy.

In today’s America, the only incomes that rise are in the financial sector that risks the country’s future on excessive leverage and in the corporate world that substitutes foreign for American labor. Under the compensation rules and emphasis on shareholder earnings that hold sway in the US today, corporate executives maximize earnings and their compensation by minimizing the employment of Americans.

Try to find some acknowledgement of this in the “mainstream media,” or among economists, who suck up to the offshoring corporations for grants.

The worst part of the decline is yet to come. Bank failures and home foreclosures are yet to peak. The commercial real estate bust is yet to hit. The dollar crisis is building.

When it hits, interest rates will rise dramatically as the US struggles to finance its massive budget and trade deficits while the rest of the world tries to escape a depreciating dollar.

Since the spring of this year, the value of the US dollar has collapsed against every currency except those pegged to it. The Swiss franc has risen 14% against the dollar. Every hard currency from the Canadian dollar to the Euro and UK pound has risen at least 13 % against the US dollar since April 2009. The Japanese yen is not far behind, and the Brazilian real has risen 25% against the almighty US dollar. Even the Russian ruble has risen 13% against the US dollar.

What sort of recovery is it when the safest investment is to bet against the US dollar?

US: Hyperinflation Nation

Hyperinflation Nation starring Peter Schiff, Ron Paul, Jim Rogers, Marc Faber, Tom Woods, Gerald Celente, and others.

Prepare now before the US dollar is worthless.

Part 1 :

US: THIS is Big Government

– The US is in a ‘Death Spiral’ and ‘in the Tank Forever’, says Davidowitz

National debt projections (approaching $10 trillion) have increased 400% in the last six months.

The U.S. Postal Service was established in 1775 – they’ve had 234 years to get it right; it is broke, and even though heavily subsidized, it can’t compete with private sector FedEx and UPS services.

Social Security was established in 1935 – they’ve had 74 years to get it right; it is broke.

Fannie Mae was established in 1938 – they’ve had 71 years to get it right; it is broke. Freddie Mac was established in 1970 – they’ve had 39 years to get it right; it is broke. Together Fannie and Freddie have now led the entire world into the worst economic collapse in 80 years.

The War on Poverty was started in 1964 – they’ve had 45 years to get it right; $1 trillion of our hard earned money is confiscated each year and transferred to “the poor”; it hasn’t worked.

Medicare and Medicaid were established in 1965 – they’ve had 44 years to get it right; they are both broke; and now our government dares to mention them as models for all US health care.

AMTRAK was established in 1970 – they’ve had 39 years to get it right; last year they bailed it out as it continues to run at a loss!

This year, a trillion dollars was committed in the massive political payoff called the Stimulus Bill of 2009; it shows NO sign of working; it’s been used to increase the size of governments across America, and raise government salaries while the rest of us suffer from economic hardships. It has yet to create a single new private sector job. Our national debt projections (approaching $10 trillion) have increased 400% in the last six months.

Judge Napolitano: Everything the Government Runs is Bankrupt!

“Medicare is broke.”

“Medicaid is broke.”

“Social security is a bigger Ponzi scheme and a bigger fraud than anything Bernie Madoff ever dreamed of and it’s broke.”

Added: August 19, 2009

Real change or why you should have voted for Ron Paul:

Liberty and Economics – Ludwig von Mises

Added: August 18, 2009

Get Ready for Inflation and Higher Interest Rates: The unprecedented expansion of the money supply could make the ’70s look benign

Rahm Emanuel was only giving voice to widespread political wisdom when he said that a crisis should never be “wasted.” Crises enable vastly accelerated political agendas and initiatives scarcely conceivable under calmer circumstances. So it goes now.

Here we stand more than a year into a grave economic crisis with a projected budget deficit of 13% of GDP. That’s more than twice the size of the next largest deficit since World War II. And this projected deficit is the culmination of a year when the federal government, at taxpayers’ expense, acquired enormous stakes in the banking, auto, mortgage, health-care and insurance industries.

With the crisis, the ill-conceived government reactions, and the ensuing economic downturn, the unfunded liabilities of federal programs — such as Social Security, civil-service and military pensions, the Pension Benefit Guarantee Corporation, Medicare and Medicaid — are over the $100 trillion mark. With U.S. GDP and federal tax receipts at about $14 trillion and $2.4 trillion respectively, such a debt all but guarantees higher interest rates, massive tax increases, and partial default on government promises.

But as bad as the fiscal picture is, panic-driven monetary policies portend to have even more dire consequences. We can expect rapidly rising prices and much, much higher interest rates over the next four or five years, and a concomitant deleterious impact on output and employment not unlike the late 1970s.

About eight months ago, starting in early September 2008, the Bernanke Fed did an abrupt about-face and radically increased the monetary base — which is comprised of currency in circulation, member bank reserves held at the Fed, and vault cash — by a little less than $1 trillion. The Fed controls the monetary base 100% and does so by purchasing and selling assets in the open market. By such a radical move, the Fed signaled a 180-degree shift in its focus from an anti-inflation position to an anti-deflation position.

The percentage increase in the monetary base is the largest increase in the past 50 years by a factor of 10 (see chart). It is so far outside the realm of our prior experiential base that historical comparisons are rendered difficult if not meaningless. The currency-in-circulation component of the monetary base — which prior to the expansion had comprised 95% of the monetary base — has risen by a little less than 10%, while bank reserves have increased almost 20-fold. Now the currency-in-circulation component of the monetary base is a smidgen less than 50% of the monetary base. Yikes!

US Federal Obligations Rise To A Record $546,668 Per Household

“In Debt We Trust.”

Yes, we can … spend the U.S. into oblivion:

– Famous investor Marc Faber: U.S. will go into Hyperinflation, Approaching Zimbabwe Levels

– Richard Fisher, president of the Dallas Federal Reserve Bank:

The“very big hole” in unfunded pension and health-care liabilities is over $99 trillion.

(Full article: Here)

– Glenn Beck: United States Debt Obligations Exceed World GDP

– Federal obligations exceed world GDP

The US is totally broke.

Leap in U.S. debt hits taxpayers with 12% more red ink

Taxpayers are on the hook for an extra $55,000 a household to cover rising federal commitments made just in the past year for retirement benefits, the national debt and other government promises, a USA TODAY analysis shows.

The 12% rise in red ink in 2008 stems from an explosion of federal borrowing during the recession, plus an aging population driving up the costs of Medicare and Social Security.

That’s the biggest leap in the long-term burden on taxpayers since a Medicare prescription drug benefit was added in 2003.

The latest increase raises federal obligations to a record $546,668 per household in 2008, according to the USA TODAY analysis. That’s quadruple what the average U.S. household owes for all mortgages, car loans, credit cards and other debt combined.

Read moreUS Federal Obligations Rise To A Record $546,668 Per Household

Paul Craig Roberts: Was the Bailout Itself a Scam?

Paul Craig Roberts [email him] was Assistant Secretary of the Treasury during President Reagan’s first term. He was Associate Editor of the Wall Street Journal. He has held numerous academic appointments, including the William E. Simon Chair, Center for Strategic and International Studies, Georgetown University, and Senior Research Fellow, Hoover Institution, Stanford University.

A Program of Financial Concentration

Professor Michael Hudson (CounterPunch, March 18) is correct that the orchestrated outrage over the $165 million AIG bonuses is a diversion from the thousand times greater theft from taxpayers of the approximately $200 billion “bailout” of AIG. Nevertheless, it is a diversion that serves an important purpose. It has taught an inattentive American public that the elites run the government in their own private interests.

Americans are angry that AIG executives are paying themselves millions of dollars in bonuses after having cost the taxpayers an exorbitant sum. Senator Charles Grassley put a proper face on the anger when he suggested that the AIG executives “follow the Japanese example and resign or go commit suicide.”

Yet, Obama’s White House economist, Larry Summers, on whose watch as Treasury Secretary in the Clinton administration financial deregulation got out of control, invoked the “sanctity of contracts” in defense of the AIG bonuses.

But the Obama administration does not regard other contracts as sacred. Specifically: labor unions had to agree to give-backs in order for the auto companies to obtain federal help; CNN reports that “Veterans Affairs Secretary Eric Shinseki confirmed Tuesday [March 10] that the Obama administration is considering a controversial plan to make veterans pay for treatment of service-related injuries with private insurance”; the Washington Post reports that the Obama team has set its sights on downsizing Social Security and Medicare.

According to the Post, Obama said that “it is impossible to separate the country’s financial ills from the long-term need to rein in health-care costs, stabilize Social Security and prevent the Medicare program from bankrupting the government.”

After Washington’s trillion dollar bank bailouts and trillion dollar gratuitous wars for the sake of the military industry’s profits and Israeli territorial expansion, there is no money for Social Security and Medicare.

The US government breaks its contracts with US citizens on a daily basis, but AIG’s bonus contracts are sacrosanct. The Social Security contract was broken when the government decided to tax 85% of the benefits. It was broken again when the Clinton administration rigged the inflation measure in order to beat retirees out of their cost-of-living adjustments. To have any real Medicare coverage, a person has to give up part of his Social Security check to pay Medicare Part B premium and then take out a private supplemental policy. The true cost of Medicare to beneficiaries is about $6,000 annually in premiums, plus deductibles and the Medicare tax if the person is still earning.

Treasury Secretary Geithner, the fox in charge of the hen house, has resolved the problem for us. He is going to withhold $165 million (the amount of the AIG bonuses) from the next taxpayer payment to AIG of $30,000 million. If someone handed you $30,000 dollars, would you mind if they held back $165?