– Mystery Surrounding Collapse Of Hong Kong Mercantile Exchange Deepens; Four Arrested (ZeroHedge, May 26, 2013)

precious metals

The Fiat End Game & Gold (Video)

YouTube Added: 24.05.2013

Gold And Silver Inverse Baumgartner’d – Silver Futures Trading Volume 82% Higher Than 100-Day Average

– Gold And Silver Inverse Baumgartner’d (ZeroHedge, May 20, 2013):

UPDATE 1: Chatter of a potential US downgrade from Moody’s is being blamed (but that news out hours ago)UPDATE 2: Silver futures trading volume 82% higher than 100-day average

While the mainstream media will likely be loathed to mention it, gold and silver are surging higher. Gold has retested $1400 and Silver $23 on no news… so it seems the demand for ‘cheaper’ precious metals was enough to warrant a 4.6% rally off overnight lows in gold and 12.5% in silver amid heavy volume in futures markets…

Physical Gold vs. Paper Gold: The Ultimate Disconnect

– Physical Gold vs. Paper Gold: The Ultimate Disconnect (Casey Research, April 23, 2013):

How can we explain gold dropping into the $1,300 level in less than a week?

Here are some of the factors:

- George Soros cut his fund holdings in the biggest gold ETF by 55% in the fourth quarter of 2012.

- He was not alone: the gold holdings of GLD have contracted all year, down about 12.2% at present.

- On April 9, the FOMC minutes were leaked a day early and revealed that some members were discussing slowing the Fed $85 billion per month buying of Treasuries and MBS. If the money stimulus might not last as long as thought before, the “printing” may not cause as much dollar debasement.

- On April 10, Goldman Sachs warned that gold could go lower and lowered its target price. It even recommended getting out of gold.

- COT Reports showed a decrease in the bullishness of large speculators this year (much more on this technical point below).

- The lackluster price movement since September 2011 fatigued some speculators and trend followers.

- Cyprus was rumored to need to sell some 400 million euros’ worth of its gold to cover its bank bailouts. While small at only about 350,000 ounces, there was a fear that other weak European countries with too much debt and sizable gold holdings could be forced into the same action. Cyprus officials have denied the sale, so the question is still in debate, even though the market has already moved. Doug Casey believes that if weak European countries were forced to sell, the gold would mostly be absorbed by China and other sovereign Asian buyers, rather than flood the physical markets.

My opinion, looking at the list of items above, is that they are not big enough by themselves to have created such a large disruption in the gold market.

The Paper Gold Market

Read morePhysical Gold vs. Paper Gold: The Ultimate Disconnect

Bill Fleckenstein Of Fleckenstein Capital: Hold Tight To Your Gold (Video)

Click the play button below to listen to Chris’ interview with Bill Fleckenstein (28m:26s)

– Bill Fleckenstein: Hold Tight To Your Gold (PeakProsperity, April 21, 2013):

Why it’s going to go “one hell of a lot” higher

The bond market is an accident waiting to happen.

When the bond market finally does crack, it is going to be one epic nightmare that is going to make 2008 and 2009 seem like a picnic. It will be a different kind of a crisis; but it will be an enormous crisis. These people that are bullish about stocks and bonds and the bond market, they do not understand anything.

We will hit a moment in time where there will be a rapid acceleration of the perception that people are being cheated via inflation by these money-printing policies. Why Americans seem to think there is no inflation just because the CPI says so, when their checkbooks every day ought to tell them there is, I cannot explain that. But there will be a change in psychology, and there will be a massive stampede into gold here and everywhere else around the world, because it is the only way you can protect yourself against these policies.

Pity the wise money manager these days. Our juiced-up financial markets, force-fed liquidity by the Fed the other major world central banks, are pushing asset prices far beyond what the fundamentals merit.

If you see this reckless central planning behavior for what it is – a deluded attempt to avoid reality for as long as possible – your options are limited if you take your fiduciary duty to your clients seriously.

Read moreBill Fleckenstein Of Fleckenstein Capital: Hold Tight To Your Gold (Video)

Federal Reserve And Bank Of Japan Caused Gold Crash (Telegraph, Ambrose Evans-Pritchard)

Compare Ambrose Evans-Pritchard’s article to …

– Former Assistant Secretary of the Treasury Dr. Paul Craig Roberts: The Assault On Gold – Assault On Gold UPDATE

– Fed and Bank of Japan caused gold crash (Telegraph, Ambrose Evans-Pritchard April 17, 2013):

Commodity prices have been falling since September, culminating in a rout over the past two weeks. That is a classic warning for the global economy.

It is becoming ever clearer that the roaring boom in global equities since last summer has priced in an economic recovery that does not in fact exist. The International Monetary Fund has had to nurse down its global growth forecasts yet again. We are still stuck in an old-fashioned trade depression, with pervasive over-capacity in manufacturing plant and a record global savings rate of 25pc of GDP.

German car sales fell 17pc in March. That should puncture the last illusions that Germany is about to pull Europe out of a self-inflicted slump.

As you can see from the chart below, the divergence between stock markets and the Deutsche Bank index of raw materials is astonishing to behold, so like the pattern in early 1929.

Read moreFederal Reserve And Bank Of Japan Caused Gold Crash (Telegraph, Ambrose Evans-Pritchard)

Why Are The Banksters Telling Us To Sell Our Gold When They Are Hoarding Gold Like Crazy?

Today:

And so it begins …

DH: How soon do you see things taking place?

RB: They already are in motion. If you’re looking for a date I can’t tell you. Remember, the objectives are the same, but plans, well, they adapt. They exploit. Watch how this fiscal cliff thing plays out. This is the run-up to the next big economic event.

I can’t give you a date. I can tell you to watch things this spring. Start with the inauguration and go from there. Watch the metals, when they dip. It will be a good indication that things are about to happen. I got that little tidbit from my friend at [REDACTED].

– Goldman Sachs Buying Gold, Selling Treasurys To Muppets Whom It Advises To Do Opposite (April 10, 2013):

– Why Are The Banksters Telling Us To Sell Our Gold When They Are Hoarding Gold Like Crazy? (Economic Collapse, April 10, 2013):

The big banks are breathlessly proclaiming that now is the time to sell your gold. They are warning that we have now entered a “bear market” for gold and that the price of gold will continue to decline for the rest of the year. So should we believe them? Well, their warnings might be more credible if the central banks of the world were not hoarding gold like crazy. During 2012, central bank gold buying was at the highest level that we have seen in almost 50 years. Meanwhile, insider buying of gold stocks has now reached multi-year highs and the U.S. Mint cannot even keep up with the insatiable demand for silver eagle coins. So what in the world is actually going on here? Right now, the central banks of the world are indulging in a money printing binge that reminds many of what happened during the early days of the Weimar Republic. When you flood the financial system with paper money, that is eventually going to cause the prices for hard assets to go up dramatically. Could it be possible that the banksters are trying to drive down the price of both gold and silver so that they can gobble it up cheaply? Do they want to be the ones sitting on all of the “real money” once the paper money bubble that we are living in finally bursts?

Over the past few weeks, nearly every major newspaper in the world has run at least one story telling people that it is time to sell their gold. For example, the following is from a recent Wall Street Journal article entitled “Goldman Sachs Turns Bearish on Gold“…

Read moreWhy Are The Banksters Telling Us To Sell Our Gold When They Are Hoarding Gold Like Crazy?

How Cyprus Exposed The Fundamental Flaw Of Fractional Reserve Banking

– How Cyprus Exposed The Fundamental Flaw Of Fractional Reserve Banking (ZeroHedge, March 31, 2013):

In the past week much has been written about the emerging distinction between the Cypriot Euro and the currency of the Eurozone proper, even though the two are (or were) identical. The argument goes that all €’s are equal, but those that are found elsewhere than on the doomed island in the eastern Mediterranean are more equal than the Cypriot euros, or something along those lines. This of course, while superficially right, is woefully inaccurate as it misses the core of the problem, which is a distinction between electronic currency and hard, tangible banknotes. Which is why the capital controls imposed in Cyprus do little to limit the distribution and dissemination of electronic payments within the confines of the island (when it comes to payments leaving the island to other jurisdictions it is a different matter entirely), and are focused exclusively at limiting the procurement and allowance of paper banknotes in the hands of Cypriots (hence the limits on ATM and bank branch withdrawals, as well as the hard limit on currency exiting the island).

Read moreHow Cyprus Exposed The Fundamental Flaw Of Fractional Reserve Banking

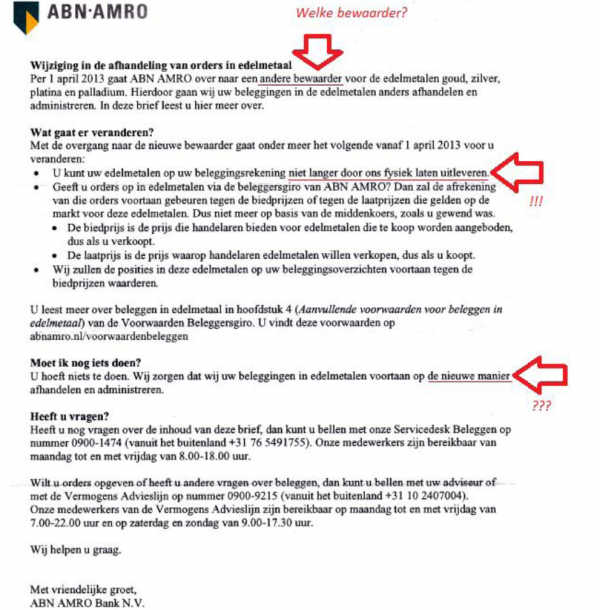

Dutch Megabank ABN Amro To Halt Physical Gold Delivery – Another Gold Shortage?

– Another Gold Shortage? Dutch ABN To Halt Physical Gold Delivery (ZeroHedge, March 24, 2013):

Based on a letter to clients over the weekend, it appears Dutch megabank ABN Amro is changing its precious metals custodian rules and “will no longer allow physical delivery.” Have no fear, they reassuringly add, your account will be settled at the bid or offer price in the ‘market’ and “you need to do nothing” as “we have your investments in precious metals.”

Via Google Translate,

Changes in the handling of orders in bullion

On 1 April 2013,. ABN AMRO to another custodian for the precious metals gold, silver, platinum and palladium. This we your investments in precious metals otherwise handle and administer. In this letter you can read more about it.

Read moreDutch Megabank ABN Amro To Halt Physical Gold Delivery – Another Gold Shortage?

Governments Worldwide Are Implementing Orwellian Gold Confiscation Today. You Just Haven’t Realized it Yet.

– Governments Worldwide are Implementing Orwellian Gold Confiscation Today. You Just Haven’t Realized it Yet. (ZeroHedge, March 7, 2013):

Bankers Have Flipped Monetary Truth Upside Down

Bankers have flipped the paradigm of monetary truth upside down today. People believe in fiat digital money that is, by definition of the term, counterfeit and have zero belief in money that is real, and thus lasted over 5000 years of global history. In fact so few people today have an understanding of monetary history and truth that when I tell them that all money in wide use and circulation today is the equivalent of counterfeit money, even though this is true, they look at me like my beliefs, not their beliefs, are crazy. Hopefully this article will finally open some eyes and answer the question, “What is money and what is not?”

Executive Order 6102 Was Passed to Force Americans to Use Counterfeit Instead of REAL Money

AND NOW: Selling Gold, Silver And Other PM’s In Houston Now Requires Fingerprinting And Photograph

Next time you try to sell gold, silver or other precious metals in Houston you can expect to be fingerprinted and photographed.

– City council passes ordinance to fingerprint, photograph precious metal sellers (ABC13/KTRK, Feb 6, 2013):

HOUSTON (KTRK) — Next time you try to sell gold, silver or other precious metals you can expect to be fingerprinted and photographed.

The Houston City Council passed an ordinance meant to help track down criminals who try to resell stolen valuables. Gold-buying businesses will now be required to photograph and fingerprint sellers as well as photograph the items that are being sold to the dealer.

“It’s going to allow us the tools necessary to combat a lot of the high-end jewelry thefts that’s going on in the city, whether it’s robberies or burglaries,” said Houston Police Officer Rick Barajas.

A similar ordinance is already in place for scrap metal sellers and dealers.

– Brown calls new rules on jewelry dealers ‘safety theater’ (Houston Chronicle, Feb 6, 2013):

Houston City Council on Wednesday passed new rules on precious metals dealers despite a lengthy attempt to water down the ordinance by Councilwoman Helena Brown, who called it “safety theater” that would burden businesses and invade jewelry sellers’ privacy.

Officers in the Houston Police Department’s precious metals unit said reputable dealers already implement many of the new rules but said the ordinance – which requires a photograph and thumbprint of each seller and mandates dealers enter transactions into an online database – will help them catch crooks and recover stolen goods.

Brown sought to remove criminal penalties for violating the ordinance, to allow dealers more flexibility in when and how to report transactions and to scrap the rule requiring sellers to have a photo and thumbprint taken. Each amendment was easily defeated.

“Why even ask the legal, law-abiding people to submit to this? It’s not going to prevent crime and it’s not going to solve any crimes,” Brown said. “It’s ludicrous. We’ve gone way beyond what our Founding Fathers envisioned for this nation.”

Gold And Silver Registration Coming To Illinois?

– Is Gold and Silver Registration Coming to Illinois? (Liberty Blitzkrieg Blog, Jan 10, 2013):

So let me get this straight. First they want gun registration and now precious metal registration? I’m sure the government would only use such information in our best interests, because as we all know: Your Government Loves You. Sounds reasonable, after all, only “terrorists” buy guns and gold anyway.

Meet the ” Precious Metal Purchasing Act” or SB3341, brought to you by the lovely folks at the Illinois 97th General Assembly: