And for some (idiots) this is not enough …

– Paul Krugman: QE3 Should Have Been ‘More Stronger’ (Quote Of The Day)

… versus those who can clearly see what is coming:

– Marc Faber: ‘Fed Will Destroy The World’ (Video)

– Ron Paul On QE3: ‘Country Should Panic Over Fed’s Decision’ – ‘We Are Creating Money Out Of Thin Air’ – ‘We’ve Lost Control!’ (Video)

From the article:

“Even when unwinding its balance sheet would mean sacrificing 30% of US GDP and, let’s be honest about it, civil war.”

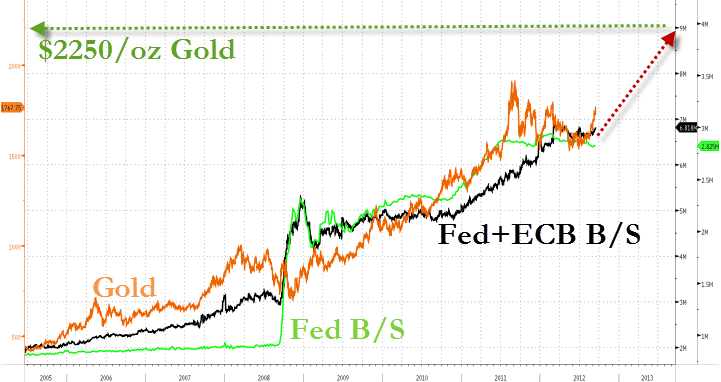

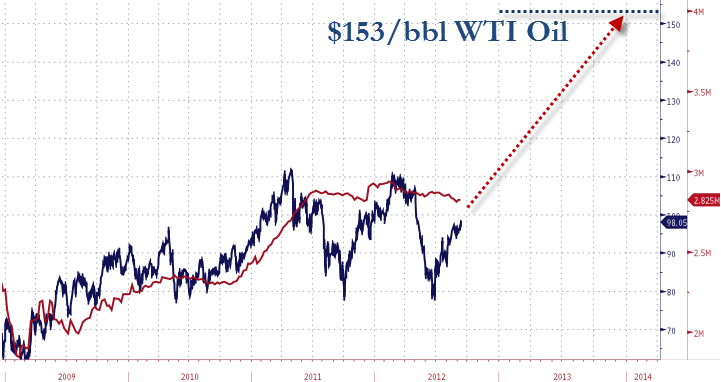

– BofA Sees Fed Assets Surpassing $5 Trillion By End Of 2014… Leading To $3350 Gold And $190 Crude (ZeroHedge, Sep 14, 2012):

Yesterday, when we first presented our calculation of what the Fed’s balance sheet would look like through the end of 2013, some were confused why we assumed that the Fed would continue monetizing the long-end beyond the end of 2012. Simple: in its statement, the FOMC said that “If the outlook for the labor market does not improve substantially, the Committee will continue its purchases of agency mortgage backed securities, undertake additional asset purchases, and employ its other policy tools as appropriate until such improvement is achieved in a context of price stability.” Therefore, the only question is by what point the labor market would have improved sufficiently to satisfy the Fed with its “improvement” (all else equal, which however – and here’s looking at you inflation – will not be). Conservatively, we assumed that it would take at the lest until December 2014 for unemployment to cross the Fed’s “all clear threshold.” As it turns out we were optimistic. Bank of America’s Priya Misra has just released an analysis which is identical to ours in all other respects, except for when the latest QE version would end. BofA’s take: “We do not believe there will be “substantial” improvement in the labor market for the next 1.5-2 years and foresee the Fed buying Treasuries after the end of Operation Twist.” What does this mean for total Fed purchases? Again, simple. Add $1 trillion to the Zero Hedge total of $4TRN. In other words, Bank of America just predicted at least 2 years and change of constant monetization, which would send the Fed’s balance sheet to grand total of just over $5,000,000,000,000 as the Fed adds another $2.2 trillion MBS and Treasury notional to the current total of $2.8 trillion.

In other words, for once we actually were shockingly optimistic on the US economy. Assuming BofA is correct, and it probably is, this is how the Fed’s balance sheet will look like for the next 2 years:

Or, in terms of US GDP, the Fed’s balance sheet will have “LBOed” just shy of 30% of all US goods and services.

It gets worse:

Read moreBank Of America Sees Fed Assets Surpassing $5 Trillion By End Of 2014 … Leading To $3350 Gold And $190 Crude