– Saudi Arabia Faces Another “Very Scary Moment” As Economy, FX Regime Face Crude Reality (ZeroHedge, Aug 23, 2015)

Oil Prices

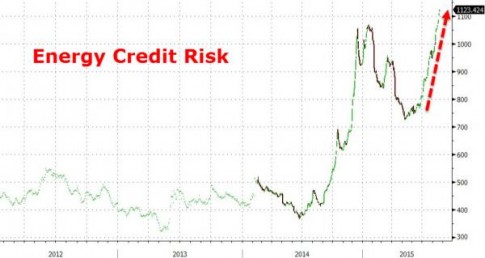

WTI Crude Breaks Below Historic $40 Level, Energy Credit Spikes To Record Highs After Rig Count Rise

– WTI Crude Breaks Below Historic $40 Level, Energy Credit Spikes To Record Highs After Rig Count Rise (ZeroHedge, Aug 21, 2015):

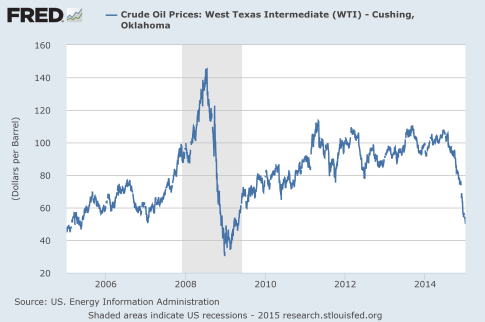

Well, we have a winner – Oil broke to a 3 handle before 10Y rates hit a 1 handle (just – 10Y at 2.04%) following the 5th weekly rise in rig count (+2 to 674). Energy credit risk is soaring to record highs as investors realize ‘there will be blood’ in all those highly-levered loans. This is the first time the front-month crude contract traded below $40 since March 3rd 2009… just before QE was unleashed in all its asset-inflating, malinvestment-driving, zombifying glory.

…

Crude Oil Plummets Most Since February, Nears 16 Year Support Line: Tap On The Shoulder Time?

– Crude Oil Plummets Most Since February, Nears 16 Year Support Line: Tap On The Shoulder Time? (ZeroHedge, July 6, 2015):

Earlier today we commented that while stock markets across the globe, heavily influenced by central bank intervention from the PBOC to the SNB, are doing everything in the central planners’ power to telegraph just how irrelevant Greece is, other indicators are far less sanguine. One example was copper, which plunged to a level not seen since February, and was in danger of breaching its 15 year support level. The commodity weakness today has persisted and is now crushing both WTI crude and Brent, both of which are in freefall, and WTI is now down over $3 on the session, or 6%, to a $53 handle, the biggest one day plunge since February to a level last seen in early April when there was much hope that the dramatic plunge in December and January was finally over. Turns out it wasn’t.

…

Biggest Glut in Recorded Crude-Oil History Taking Shape

H/t reader squodgy:

“Not good, whichever way it pans out.”

– Biggest Glut in Recorded Crude-Oil History Taking Shape (Wolf Street, June 16, 2015):

“The market is flooded with oil and everyone is desperate to sell quickly, so you have a price war,” a marine-fuel trader in Singapore, the largest ship refueling hub in the world, told Reuters as prices for bunker fuel oil are plunging.

OPEC, which produces about 40% of global oil supply, announced on June 5 to “maintain” output at 30 million barrels per day for the next six months. Six days later, the IEA’s Oil Market Report for June clarified that “Saudi Arabia, Iraq, and the United Arab Emirates pumped at record monthly rates” in May and boosted OPEC output to 31.3 million barrels per day, the highest since October 2012, and over 1 MMbpd above target for the third month in a row. OPEC will likely continue pumping at this rate “in coming months,” the IEA said.

Read moreBiggest Glut in Recorded Crude-Oil History Taking Shape

So Much For The Oil Crash: Cali Gas Price Almost Back To Year Ago Levels; Los Angeles Gallon Rises Over $4.00

– So Much For The Oil Crash: Cali Gas Price Almost Back To Year Ago Levels; Los Angeles Gallon Rises Over $4.00 (ZeroHedge, May 18, 2015):

While one could, at least superficially, make the case that for the US consumer (if nobody else) lower oil prices are indeed better than the opposite, we wonder how the same pundits will spin that according to AAA, not only are Los Angeles gas prices now back over $4.00 per gallon, erasing almost all losses from a year ago.

…

The ‘Revolver Raid’ Arrives: A Wave Of Shale Bankruptcies Has Just Been Unleashed

– The “Revolver Raid” Arrives: A Wave Of Shale Bankruptcies Has Just Been Unleashed (ZeroHedge, April 2, 2015):

Back in early 2007, just as the first cracks of the bursting housing and credit bubble were becoming visible, one of the primary harbingers of impending doom was banks slowly but surely yanking availability (aka “dry powder”) under secured revolving credit facilities to companies across America. This also was the first snowflake in what would ultimately become the lack of liquidity avalanche that swept away Lehman and AIG and unleashed the biggest bailout of capitalism in history. Back then, analysts had a pet name for banks calling CFOs and telling them “so sorry, but your secured credit availability has been cut by 50%, 75% or worse” – revolver raids.

Well, the infamous revolver raids are back. And unlike 7 years ago when they initially focused on retail companies as a result of the collapse in consumption burdened by trillions in debt, it should come as no surprise this time the sector hit first and foremost is energy, whose “borrowing availability” just went poof as a result of the very much collapse in oil prices.

Read moreThe ‘Revolver Raid’ Arrives: A Wave Of Shale Bankruptcies Has Just Been Unleashed

PEMEX Oil Platform Explodes; Injuries Reported As Hundreds Evacuate

– PEMEX Oil Platform Explodes; Injuries Reported As Hundreds Evacuate (ZeroHedge, April 1, 2015):

Mexico’s state-owned PEMEX says an oil platform has exploded in Campeche Bay. 300 workers have been evacuated and the company says 8 boats are attempting to bring the blaze under control.

Here’s the company’s statement posted on Twitter (via Google translate):

We’re taking fire that was raised today at dawn in the Abkatun Permanent platform Campeche.. Nearly 300 workers have been evicted platform. To meet the emergency, it has 8 firefighting boats.

Cerca de 300 trabajadores de la plataforma han sido desalojados. Para atender la emergencia, se cuenta con 8 barcos contraincendio

— Petróleos Mexicanos (@Pemex) April 1, 2015

Read morePEMEX Oil Platform Explodes; Injuries Reported As Hundreds Evacuate

Pink Slips: 100,000 Jobs Wiped Out Amid Oil Price Collapse: “Spreading Like Cancer”

– Pink Slips: 100,000 Jobs Wiped Out Amid Oil Price Collapse: “Spreading Like Cancer” (SHFTplan, March 21, 2015):

Low oil prices are good for America according to President Obama. In fact, he has personally taken credit for the savings you’re experiencing.

In a normal economy lower prices at the pump would certainly help to spur growth in other sectors. The problem, of course, is that the new normal means that oil companies and banks leveraged heavily as prices rose. They assumed, like real estate speculators ahead of the 2008 crash, that the price of oil could only go in one direction. As we’ve seen in recent months, however, oil speculation is exactly that and despite our dependency on black gold the energy industry is not immune from massive price swings.

The consequences will be two-fold and the cracks are already starting to appear.

Read morePink Slips: 100,000 Jobs Wiped Out Amid Oil Price Collapse: “Spreading Like Cancer”

The Perfect Storm For Oil Hits In Two Months: US Crude Production To Soar Just As Storage Runs Out

– The Perfect Storm For Oil Hits In Two Months: US Crude Production To Soar Just As Storage Runs Out (ZeroHedge, March 21, 2015):

At the current rate of record oil production, storage will be exhausted in under two months, some time in mid-May. At that point, with no more storage to buffer the record oil production, the open market dumping begins and prices of WTI will crater as every barrel will have to be sold at any clearing price, since the producers will have no other choice than to, literally, dump the oil. In other words, a perfect storm is shaping up for oil some time in late May, early June. And then we learned something even more startling.

…

Just as Global Oil Glut Deepens, China Cuts Oil Imports

From the article:

“I don’t think there is much space left to fill, …”

– Just as Global Oil Glut Deepens, China Cuts Oil Imports (Testosterone Pit, March 20, 2015):

“We don’t want to lose our share in the market,” Kuwait Oil Minister Ali al-Omair said on Thursday. OPEC had to maintain production despite the plunge in price since last summer, he said, underscoring Saudi Arabia’s position. OPEC would not cut production to goose prices. It would not let the American fracking boom off the hook.

The price of oil promptly dropped, annihilating much of the Fed-inspired rally the day before.

No one wants to cut production. In the US, production is still soaring. Demand is lackluster. What gives? Crude oil is piling up around the globe.

Commercial inventories across all OECD countries can now supply 28 days’ of OECD demand, near the very top of the range, the EIA reported.

Read moreJust as Global Oil Glut Deepens, China Cuts Oil Imports

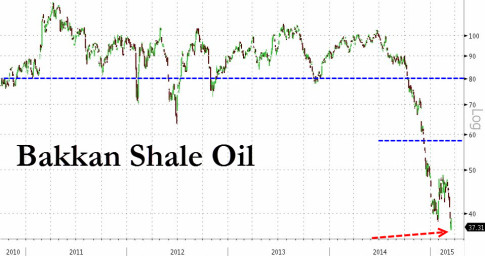

How Many Shale Oil Plays Make Money At $37 Per Barrel? (Spoiler Alert: None)

– How Many Shale Oil Plays Make Money At $37 Per Barrel? (Spoiler Alert: None) (The Burning Platform, March 18, 2015):

I’m tossing you a softball. Now think carefully. The choices are:

A. Zero

B. Zero

C. Zero

D. Zero

I know Americans are math challenged and need a calculator to subtract 10 from 20, but I think even a CNBC bimbo or Princeton economic professor could get this one right.

Last year there was much banter from the Wall Street shysters and Bakkan shale oil experts about the true breakeven price for shale oil not being $80 (which is the truth) but actually being as low as $58 a barrel. They were spreading this lie in order to keep idiot investors buying the stocks and bonds of these fly by night shale oil companies.

Read moreHow Many Shale Oil Plays Make Money At $37 Per Barrel? (Spoiler Alert: None)

What Saudi Arabia Told The Bank Of England About Why Oil Crashed And Where It Is Headed Next

– What Saudi Arabia Told The Bank Of England About Why Oil Crashed And Where It Is Headed Next (ZeroHedge, March 16, 2015):

…

“Ladies and gentlemen. A few weeks ago, in Riyadh, I was at a small, private function along with the British central bank governor, Mark Carney. Mr Carney asked me two questions. First, why did the oil price drop? And the second, where is the price heading? I will tell you today what I said to him then.”

– Ibrahim Al-Muhanna, Advisor to the Minister of Petroleum and Mineral Resources for Saudi Arabia

…

And now a special challenge for Zero Hedge readers: spot the number of lies uttered by the advisor in the text above. We exclude his repeat denials of the “conspiracy theories” – those don’t count.

Commodities Crushed: WTI Plunges To $48 Handle, Copper Breaks Key Support

– Commodities Crushed: WTI Plunges To $48 Handle, Copper Breaks Key Support (ZeroHedge, Feb 23, 2015):

Perhaps the world is beginning to realize that “it’s the demand, stupid” as crude oil prices are collapsing this morning (not helped by “all out production” news from Oman). While ‘markets’ rallied peculiarly after last week’s epic surge in inventories and production data, that has all been given back as one trader noted “the market got ahead of itself, even though the rig count has been falling it is not until mid-yr that we are going to see some impact on supply.” WTI is back under $49. To complete the gloom, Copper is probing lower, breaking key support with projections to 222.50 if this move takes shape.

…

Another Conspiracy Theory Becomes Fact: The Entire Oil Collapse Is All About Crushing Russian Control Over Syria

– Another Conspiracy Theory Becomes Fact: The Entire Oil Collapse Is All About Crushing Russian Control Over Syria (ZeroHedge, Feb 4, 2015):

While the markets are still debating whether the price of oil is more impacted by the excess pumping of crude here, or the lack of demand there, or if it is all just a mechanical squeeze by momentum-chasing HFT algos who also know to buy in the milliseconds before 2:30pm, we bring readers’ attention back to what several months ago was debunked as a deep conspiracy theory.

Back then we wrote about a certain visit by John Kerry to Saudi Arabia, on September 11 of all days, to negotiate a secret deal with the now late King Abdullah so as to get a “green light” in order “to launch its airstrikes against ISIS, or rather, parts of Iraq and Syria. And, not surprising, it is once again Assad whose fate was the bargaining chip to get the Saudis on the US’ side, because in order to launch the incursion into Syrian sovereign territory, it “took months of behind-the-scenes work by the U.S. and Arab leaders, who agreed on the need to cooperate against Islamic State, but not how or when. The process gave the Saudis leverage to extract a fresh U.S. commitment to beef up training for rebels fighting Mr. Assad, whose demise the Saudis still see as a top priority.“

We concluded:

Crude Crumbles To Fresh Lows: $43 Handle

– Crude Crumbles To Fresh Lows: $43 Handle (Zerohedge, Jan 29, 2015):

Yet again this morning’s “bounce” to $45 was heralded as maybe possibly could be the stability that markets are looking for. And once again it was not as WTI makes fresh cycle lows to a $43 handle.. and once again, energy stocks plunged back to energy credit’s reality…

…

Why The U.S. Shale Boom May Come To Abrupt End

– Why The U.S. Shale Boom May Come To Abrupt End (Zerohedge, Jan 28, 2015):

U.S tight oil production from shale plays will fall more quickly than most assume. Why? High decline rates from shale reservoirs is given. The more interesting reasons are the compounding effects of pad drilling on rig count and poorer average well performance with time.

…

Crude Contagion: California’s Kern County Declares Fiscal Emergency Due To Plunging Oil Price

– Crude Contagion: California’s Kern County Declares Fiscal Emergency Due To Plunging Oil Price (Zerohedge, Jan 28, 2015):

At this point only an act of god, or a sudden Saudi change of heart to cut crude production by 50% (unclear which is more probable) can prevent a recession in Texas. However, one state that few thought would be impaired as a result of the crude plunge, is California. Yet as the LA Times reports, it is precisely California, and specifically Kern County located in the middle of the state and containing the farmer town of Bakersfield and countless oil rigs, that yesterday declared a state of fiscal emergency during the weekly supervisors’ meeting on Tuesday. The reason: predictions of a massive shortfall in property tax revenues because of tanking oil prices.

Oil companies account for about 30% of the county’s property tax revenues, a percentage that has been declining in recent decades but still represents a critical cushion for county departments and school districts.

Crude Supplies Surge To Highest Since At Least 1982

– Crude Supplies Surge To Highest Since At Least 1982 (Zerohedge, Jan 28, 2015):

Remember how exuberant yesterday’s small gains in Crude Oil were perceived to be? Yeah – that’s all over, with WTI back near a $44 handle – following a large 12.7 million barrel inventory build according to API (EIA reports the ‘main event’ at 1030ET today – which Saxo Bank warns “a bigger-than-expected build would likely push the mkt over the cliff edge.”) Additional weakness overnight is also likely due to Goldman’s shift to a ‘sell’ for the next 3 months.

…

Saudi King Abdullah Has Died; Crude Prices Jump

– Saudi King Abdullah Has Died; Crude Prices Jump (ZeroHedge, Jan 22, 2015):

After first falling ill and being hospitalized in December, Saudi Arabia officials have announced:

- *CROWN PRINCE SALMAN SUCCEEDS ABDULLAH AS SAUDI KING: STATE TV

As we noted previously when considering this possibility, “a new King can do (almost) anything he wants, including changing oil policy.” 79-year-old Crown Prince Salman has been named succesor (and has his own health issues). Oil prices popped around 80c on the news.

As we detailed before, Abdullah’s 79-year-old half-brother has his own health issues and leaves larger questions over the line of succession in one of the world’s most important oil producers remain unanswered.

Canada Crude Contagion: Calgary Home Prices Drop Most In 2 Years

– Canada Crude Contagion: Calgary Home Prices Drop Most In 2 Years (ZeroHedge, Jan 14, 2015):

For the 2nd month in a row, home prices in Calgary – corporate hub of Canada’s oil industry – have fallen. This is the biggest 2-month-drop in almost 2 years (and comes on the heels of yesterday’s news that Suncor is slashing jobs and capex). As Bloomberg reports, Bank of Canada Deputy Governor Tim Lane said yesterday development of the more expensive deposits are threatened by lower crude oil prices. “The dive in energy prices will put pressure on house prices in the Western provinces in the coming months,” warns one economist and as the following chart shows, more pain is likely...

…

The Crashing Price Of Oil Is Going To Rip The Global Economy To Shreds

– Boom Goes The Dynamite: The Crashing Price Of Oil Is Going To Rip The Global Economy To Shreds (Economic Collapse, Jan 12, 2015):

f you were waiting for a “black swan event” to come along and devastate the global economy, you don’t have to wait any longer. As I write this, the price of U.S. oil is sitting at $45.76 a barrel. It has fallen by more than 60 dollars a barrel since June. There is only one other time in history when we have seen anything like this happen before. That was in 2008, just prior to the worst financial crisis since the Great Depression. But following the financial crisis of 2008, the price of oil rebounded fairly rapidly. As you will see below, there are very strong reasons to believe that it will not happen this time. And the longer the price of oil stays this low, the worse our problems are going to get. At a price of less than $50 a barrel, it is just a matter of time before we see a huge wave of energy company bankruptcies, massive job losses, a junk bond crash followed by a stock market crash, and a crisis in commodity derivatives unlike anything that we have ever seen before. So let’s hope that a very unlikely miracle happens and the price of oil rebounds substantially in the months ahead. Because if not, the price of oil is going to absolutely rip the global economy to shreds.

Read moreThe Crashing Price Of Oil Is Going To Rip The Global Economy To Shreds

Goldman, BofA Warn Crude Crash Will Have Negative Impact On GDP, Earnings

– The Confessions Begin: Goldman, BofA Warn Crude Crash Will Have Negative Impact On GDP, Earnings (ZeroHedge, Jan 12, 2015):

It took Wall Street’s “best and brightest”to admit what we said would happen back in October. In retrospect, we are amazed it only took them three months…

…

Saudi Prince Warns “We Will Not See $100 Oil Again”, Calls Anti-Russia Conspiracy “Baloney”

H/t reader squodgy:

“If he says it is Baloney, it must be true.”

– Saudi Prince Warns “We Will Not See $100 Oil Again”, Calls Anti-Russia Conspiracy “Baloney” (ZeroHedge, Jan 11, 2015):

Speaking to his favorite money-honey, billionaire Saudi Prince Alwaleed bin Talal told Maria Bartiromo that the negative impact of a 50% decline in oil has been wide and deep. As USA Today reports, the prince of the Saudi royal family said that while he disagrees with the government on most aspects, he agreed with their decision on keeping production where it is, adding that “if supply stays where it is, and demand remains weak, you better believe it is gonna go down more. I’m sure we’re never going to see $100 anymore… oil above $100 is artificial. It’s not correct.“ On the theory that the US and the Saudis have agreed to keep prices low to pressure Russia, the prince exclaimed, that is “baloney and rubbish,” adding that, “Saudi Arabia and Russia are in bed together here… both being hurt simultaneously.”

Read moreSaudi Prince Warns “We Will Not See $100 Oil Again”, Calls Anti-Russia Conspiracy “Baloney”

The Road To War With Russia … We’re not only on it; we’ve already arrived

From the article:

“If it looks like a war, acts like a war and smells like a war, it may just be a war. The US has been waging economic, financial, trade, political and even kinetic war-by-proxy against Russia.”

– The Road To War With Russia (Peak Prosperity, Jan 8, 2015):

We’re not only on it; we’ve already arrived

For several weeks now the anti-Russian stance in the US press has quieted down. Presumably because the political leadership has moved its attention on to other things, and the media flock has followed suit.

Have you read much about Ukraine and Russia recently?

I thought not, despite the fact that there’s plenty of serious action — both there as well as related activity in the US — going on that deserves our careful attention.

Read moreThe Road To War With Russia … We’re not only on it; we’ve already arrived