– A 918 Point Stock Market Crash In Japan And Deutsche Bank Denies That It Is About To Collapse:

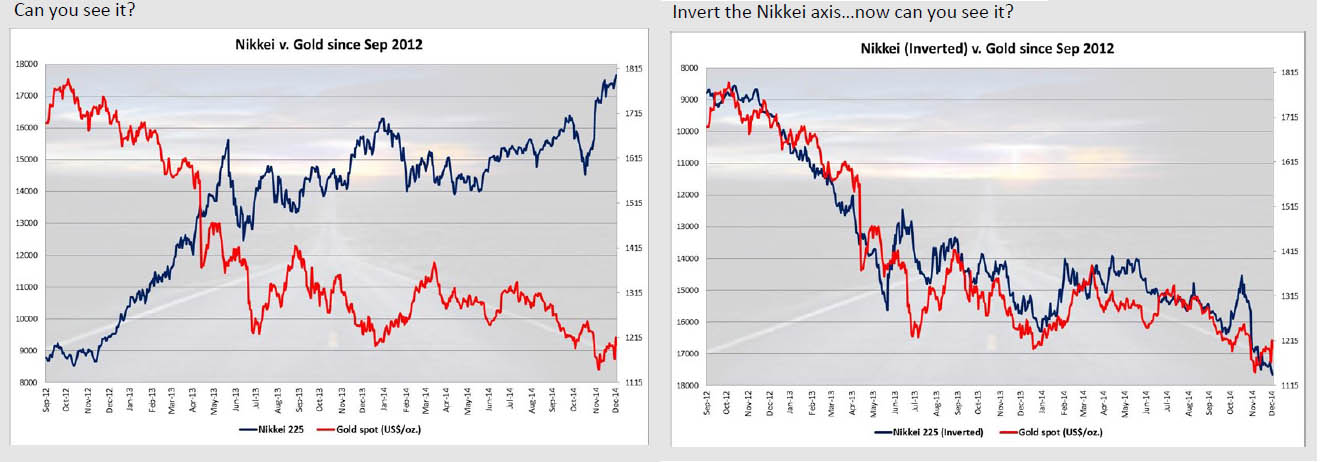

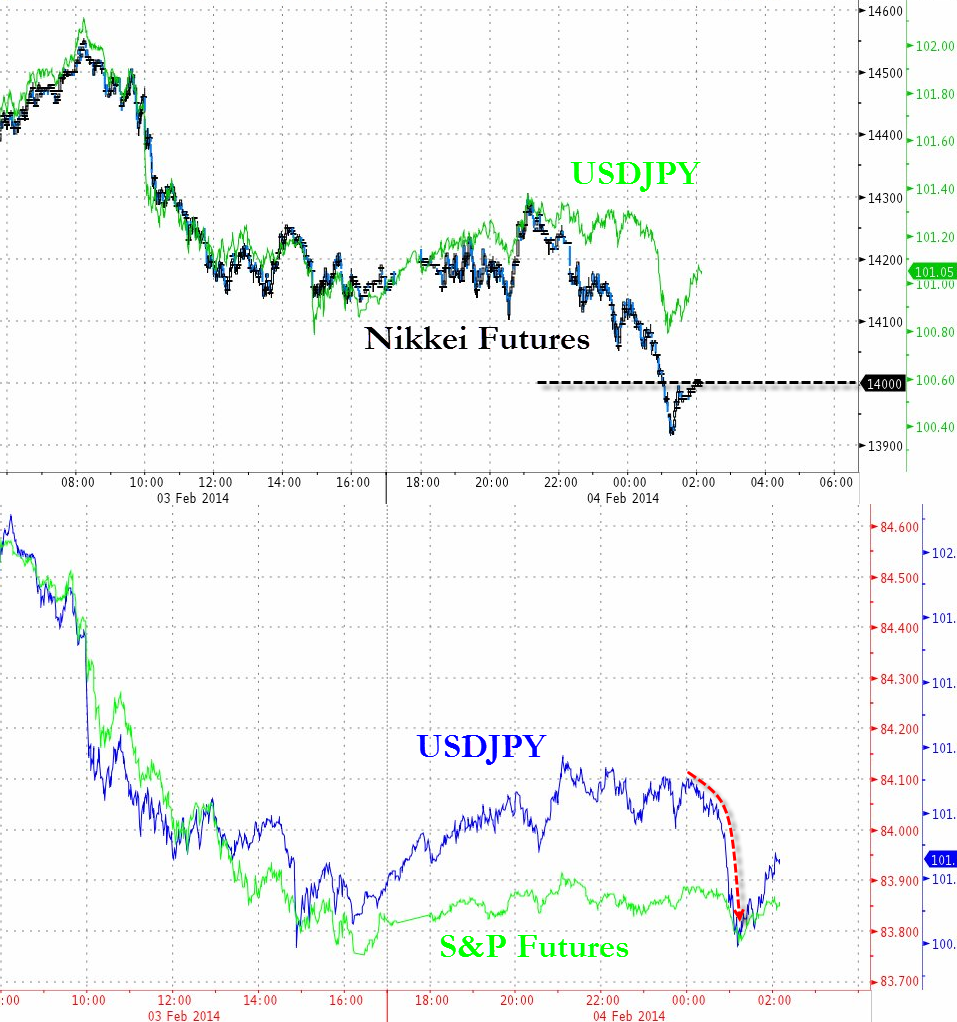

On Tuesday junk bonds continued to crash, the price of oil briefly dipped below 28 dollars a barrel, Deutsche Bank was forced to deny that it is on the verge of collapse, but the biggest news was what happened in Japan. The Nikkei was down a staggering 918 points, but that stock crash made very few headlines in the western world. If the Dow had crashed 918 points today, that would have been the largest single day point crash in all of U.S. history. So what just happened in Japan is a really big deal. The Nikkei is now down 23.1 percent from the peak of the market, and that places it solidly in bear market territory. Overall, a total of 16.5 trillion dollars of global stock market wealth has been wiped out since the middle of 2015. As I stated yesterday, this is what a global financial crisis looks like.

Just as we saw during the last financial crisis, the big banks are playing a starring role, and this is definitely true in Japan. Right now, Japanese banking stocks are absolutely imploding, and this is what drove much of the panic last night. The following numbers come from Wolf Richter…