This is just a screenshot visit the interactive map.

Research credit: The Survival Center

The man who trades freedom for security does not deserve nor will he ever receive either. – Benjamin Franklin

This is just a screenshot visit the interactive map.

Research credit: The Survival Center

University Medical Center

Medicaid cuts leave no choice, says doctors, hospitals

Budget cuts in the state’s Medicaid program are forcing a major shift in where Nevada’s poor can seek health care.

Cancer patients who had received outpatient treatment at University Medical Center, for instance, will have to seek treatment at other hospitals and clinics because UMC, citing reductions in Medicaid payments, says it can no longer afford to offer cancer treatment.

Low-income children with bone and spine problems may need to leave Las Vegas altogether for treatment, because pediatric orthopedists are no longer accepting payment from Medicaid because of cutbacks to their reimbursements.

And on Tuesday, UMC administrators will tell Clark County commissioners what treatments and programs they may need to drop because Medicaid payments don’t cover the hospital’s costs, and the hospital can’t afford to go in the hole.

Indeed, the Nevada State Medical Association said other pediatric specialists may also stop taking Medicaid patients because the government reimbursements don’t cover the cost of delivering the care.

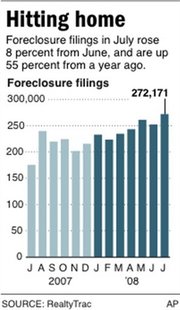

WASHINGTON (AP) – The number of homeowners stung by the dramatic decline in the U.S. housing market jumped last month as foreclosure filings grew by more than 50 percent compared with the same month a year ago, according to data released Thursday.

Nationwide, more than 272,000 homes received at least one foreclosure-related notice in July, up 55 percent from about 175,000 in the same month last year and up 8 percent from June, RealtyTrac Inc. said. That means one in every 464 U.S. households received a foreclosure filing last month.

At least 29 states plus the District of Columbia, including several of the nation’s largest states, faced an estimated $48 billion in combined shortfalls in their budgets for fiscal year 2009 (which began July 1, 2008 in most states.) At least three other states expect budget problems in fiscal year 2010.

April 15 (Bloomberg) — U.S. foreclosure filings jumped 57 percent and bank repossessions more than doubled in March from a year earlier as adjustable mortgages increased and more owners lost their homes to lenders.

More than 234,000 properties were in some stage of foreclosure, or one in every 538 U.S. households, Irvine, California-based RealtyTrac Inc., a seller of default data, said today in a statement. Nevada, California and Florida had the highest foreclosure rates. Filings rose 5 percent from February.

About $460 billion of adjustable-rate loans are scheduled to reset this year, according to New York-based analysts at Citigroup Inc. Auction notices rose 32 percent from a year ago, a sign that more defaulting homeowners are “simply walking away and deeding their properties back to the foreclosing lender” rather than letting the home be auctioned, RealtyTrac Chief Executive Officer James Saccacio said in the statement.