– Moody’s Downgrades France, Blames “Political Constraints”, Sees No Material Reduction In Debt Burden

Moody’s

The Gloves Come Off: Moody’s Warns Of Greek “Deposit Freeze” As Schauble “Won’t Rule Out Default”

Asked whether he would repeat an assurance he gave in late 2012 that Greece wouldn’t default, Wolfgang Schäuble told The Wall Street Journal and French daily Les Echos that “I would have to think very hard before repeating this in the current situation.” To which Moody’s had just one thing to add: “there is a high likelihood of an imposition of capital controls and a deposit freeze.”

– The Gloves Come Off: Moody’s Warns Of Greek “Deposit Freeze” As Schauble “Won’t Rule Out Default” (ZeroHedge, May 20, 2015):

Ever since Syriza took over the Greek government and has refused, at least until now, to concede to every Troika demand of perpetuating a status quo which it was elected with a mandate to overturn, Europe has done everything in its power to make not only Syriza’s life increasingly difficult and hostile, but has taken every opportunity to turn the Greek population against its rulers, in hopes that a more “moderate”, technocrat government would replace the “radical leftists.” So far it has failed, despite the best attempts by the ECB and the European Commission to sput a terminal bank run.

Moody’s Downgrades Russia’s Credit Rating To Junk, Expects Deep Recession In 2015

– Moody’s “Junks” Russia, Expects Deep Recession In 2015 (ZeroHedge, Feb 20, 2015):

Having put Russia on review in mid-January, Moody’s has decided (somewhat unsurprisingly) to downgrade Russia’s sovereign debt rating to Ba1 (from Baa3) with continuing negative outlook. The reasons:

- *MOODY’S SAYS RUSSIA EXPECTED TO HAVE DEEP RECESSION IN ’15, CONTINUED CONTRACTION IN ’16

- *MOODY’S SEE RUSSIA DEBT METRICS LIKELY DETERIORATING COMING YRS

We assume the low external debt, considerable reserves, lack of exposure to US Treasuries, and major gold backing were not considered useful? Moody’s concludes the full statement (below) by noting that they are unlikely to raise Russian sovereign debt rating in the near-term.

* * *

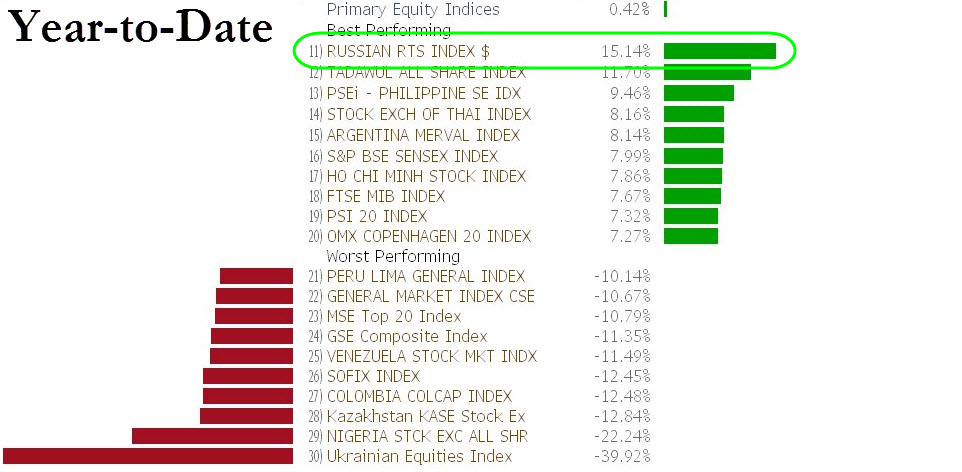

Kind of ironic then that Russia is the best performing stock market in the world this year!!

* * *

Full Moody’s Statement:

Read moreMoody’s Downgrades Russia’s Credit Rating To Junk, Expects Deep Recession In 2015

US Pension Plans Need Massive $110 Billion In 7 Years, Moodys Warns

– US Pension Plans Need Massive $110 Billion In 7 Years, Moodys Warns (ZeroHedge, Nov 6, 2014):

Thanks to improving life expectancy and the Federal Reserve’s financial repression lowering yields, US company pension funds have been hit by a double whammy. As Moody’s warns, companies will have to find $110 billion in the next seven years to fund pension liabilities shortfalls. Moody’s adds, “given these increasing liabilities and cash drains, we expect to see an acceleration in lump sum offers,” as firms try to derisk.

As Chief Investment Officer reports,

Read moreUS Pension Plans Need Massive $110 Billion In 7 Years, Moodys Warns

Public Pension Funds Face $2 Trillion Shortfall, Moodys Warns

– Public Pension Funds Face $2 Trillion Shortfall, Moodys Warns (ZeroHedge, Sep 26, 2014):

“Despite the robust investment returns since 2004, annual growth in unfunded pension liabilities has outstripped these returns,” Moody’s warns in its latest report on the state of public pension systems. As Bloomberg reports, the 25 biggest systems by assets averaged a 7.45% return from 2004 to 2013, but liabilities tripled over the same period leaving them facing a $2 trillion shortfall as investment returns can’t keep up with ballooning obligations. The top 25 funds account for 40% of the entire US public pension system with Illinois, Kentucky, Connecticut, and Louisiana at the top of the ‘most underfunded’ list.

…

Moody’s Downgrades Ukraine’s Credit Rating to ‘Default Imminent’

– Moody’s downgrades Ukraine to ‘default imminent’ (RT, April 5, 2014):

Moody’s Investors Service has downgraded Ukraine’s government bond rating one notch from Caa2 to Caa3, citing the current political crisis and deepening economic instability as reasons for its negative outlook.

The Caa rating is a credit risk grading pertaining to investments that are both very poor quality and entail a high credit risk. The current downgrade drops Ukraine from Moody’s “extremely speculative” rating to “default imminent with little prospect for recovery.”

Moody’s said the downgrade was driven by three factors, which “exacerbate Ukraine’s more longstanding economic and fiscal fragility.”

Read moreMoody’s Downgrades Ukraine’s Credit Rating to ‘Default Imminent’

Moody’s Puts Russia On Downgrade Review; Cites Event Risk, Investor Sentiment, And Weakening Economy

– Moody’s Puts Russia On Downgrade Review; Cites Event Risk, Investor Sentiment, And Weakening Economy (Zerohedge, March 28, 2014):

Hot on the heels of what S&P said was not a “politically motivated” shift to rating watch, Moody’s (who did not downgrade the USA and are not currently in a lawsuit over such terrible misrepresentations) has decided now is the time to put Russia on rating downgrade watch. The decision was triggered by 3 key factors: the weakening of Russia’s economic strength, potential shifts in investor sentiment, and susceptibility to event risk.

Full report below…

Municipal Bankruptcy? Why Not! And So The Floodgates Open

– Municipal Bankruptcy? Why Not! And so The Floodgates Open (Testosterone Pit, Nov 16, 2013):

Today and Monday, individual investors have a unique opportunity to “benefit” from the greatest bond bubble in history, even before institutional investors get to jump in, and buy sewer bonds – yup, that’s where they belong – issued by a county that landed in bankruptcy court because it defaulted on its prior sewer bonds. The money will go to the existing bondholders who’ll get a fashionable haircut as part of the deal – a deal made in bond-bubble heaven.

Jefferson County, which includes Alabama’s largest city, Birmingham, filed for Chapter 9 bankruptcy protection in 2011 when it defaulted on $3.1 billion in sewer bonds. At the time, it was the largest municipal bankruptcy. That record was crushed when Detroit filed in July.

Read moreMunicipal Bankruptcy? Why Not! And So The Floodgates Open

Moody’s Retaliates At Hong Kong For Snowden Insubordination

– Moody’s Retaliates At Hong Kong For Snowden Insubordination (ZeroHedge, June 24, 2013):

Uncle Warren appears unhappy with the humiliating can of whoop-ass Hong Kong unleashed on his favorite crony banana republic. So he has retaliated in the only way he knows: Moody’s.

- HONG KONG BANKING SYSTEM OUTLOOK REVISED TO NEGATIVE BY MOODY’S

- MOODY’S CITES CONCERNS ON PERSISTENT NEG REAL INTEREST RATES

- MOODY’S CITES POTENTIAL HK ‘PROPERTY BUBBLES’ – this one is really good.

But the best reason is:

- MOODY’S CITES HK BANKS’ GROWING EXPOSURES TO MAINLAND CHINA

Yup. Moody’s just figured out Hong Kong has exposure to… China. Of course, Hong Kong’s downgrade of US foreign policy to laughably pathetic, outlook hilarious on Sunday, was a complete coincidence.

S&P Downgrades Warren Buffet’s Berkshire Hathaway From AA+ To AA, Outlook Negative

– S&P Downgrades Berkshire From AA+ To AA, Outlook Negative (ZeroHedge, May 16, 2013):

Obviously with Buffett a major shareholder of Moody’s, the only place where a downgrade of Berkshire could come from was S&P. Moments ago, the rating agency that dared to downgrade the US for which it is being targeted by Eric Holder’s Department of “Justice”, did just that.

Read moreS&P Downgrades Warren Buffet’s Berkshire Hathaway From AA+ To AA, Outlook Negative

Moody’s: Cyprus Euro Exit Risk Substantial

– Moody’s: Cyprus Euro Exit Risk Substantial (ZeroHedge, March 27, 2013):

Though it may seem a little like stating the obvious to many, Moody’s comments:

While the risk of a euro exit by Cyprus is substantial… …following the economic dislocation that will be caused by the restructuring of the island’s two largest banks and the imposition of capital controls in the country, it is possible that the risk of euro exit will increase further.

And so while the talking heads discuss Cyprus as a unique situation and too small to care about, it seems the reality of the last two weeks has actually raised their chance of Euro exit as opposed to bailed them into the Euro.

Moody’s lowers Cyprus’s country ceilings to Caa2

Farewell Eng£AAAnd: Moody’s Downgrades UK’s Credit Rating From AAA To Aa1

– Farewell AAA: Moody’s Downgrades The UK From AAA To Aa1 (ZeroHedge, Feb 22, 2013):

Just the headline for now:

- MOODY’S DOWNGRADES UK’S GOVERNMENT BOND RATING TO Aa1 FROM AAA

Someone must have clued Moody’s on the fact that the UK is about to have its very own Goldman banker, which means consolidated debt/GDP will soon need four digits. In other news, every lawyer in the UK is now celebrating because come Monday Moody’s will be sued to smithereens.

Cable not happy as it tests 31 month lows…

Full report below:

Read moreFarewell Eng£AAAnd: Moody’s Downgrades UK’s Credit Rating From AAA To Aa1

As Euro Banks Return €137 Billion In Cash, Moody’s Warns “European Banks Need More Cash”

– As Euro Banks Return €137 Billion In Cash, Moody’s Warns “European Banks Need More Cash” (ZeroHedge, Jan 25, 2013):

Europe has now officially become the Schrodinger continent, demanding both sides of the economic coin so to speak, and is stuck between the proverbial rock and hard place (or “a cake and eating it”). On one hand it wants to telegraph its financial system is getting stronger, and doesn’t need trillions in implicit and explicit ECB backstops, on the other it needs a liquidity buffer against an economy that, especially in the periphary, is rapidly deteriorating (Spanish bad debt just hit a new all time high while Italian bad loans rose by 16.7% in one year as more and more assets become impaired). On one hand it wants a strong currency to avoid any doubt that there is redenomination risk, on the other it desperately needs a weak currency to spur exports out of the Eurozone (as Spain showed when the EUR plunged in 2012, however that weak currency is now a distant memory and it is now seriously weighing on exports). On the one hand Europe wants to show its banks have solidarity with one another and will support each other, on the other those banks that are in a stronger position can’t wait to shed the stigma of being associated with the weak banks (in this case by accepting LTRO bailouts).

It is the latest that is the most glaring dichotomy because as reported earlier, while some 278 banks, or about half of the original LTRO participants, voluntarily paid back some €137 billion to the ECB, it is none other than Moody’s warning that European banks, especially those in the periphery, will need much more cash.

Read moreAs Euro Banks Return €137 Billion In Cash, Moody’s Warns “European Banks Need More Cash”

Moody’s Warns On USAAA Rating

– Moody’s Warns On USAAA Rating; IMF Piles On (ZeroHedge, Jan 2, 2012):

Moody’s has stepped forward with the first warning shot across the bow that:

- *MOODY’S: MORE MEDIUM TERM ACTIONS MAY BE NEEDED TO SUPPORT Aaa

Has contradicted itself (from September) on the debt-ceiling breach; and warns that while the deal ‘mitigates’ some fiscal drag, it does not remove it. To wit: the IMF piles on:

- *IMF SAYS `MORE REMAINS TO BE DONE’ ON U.S. PUBLIC FINANCES

- *IMF SAYS U.S. DEBT CEILING SHOULD BE RAISED `EXPEDITIOUSLY’

Full statements below.

Moody’s Downgrades France’s Credit Rating From AAA To Aa1 (Full Text)

– One Less In The AAA Club: Moody’s Downgrades FrAAnce From AAA To Aa1 – Full Text (ZeroHedge, Nov 19, 2012):

After hours shots fired, with Moody’s hitting the long overdue one notch gong on France:

- MOODY’S DOWNGRADES FRANCE’S GOVT BOND RATING TO Aa1 FROM Aaa

- FRANCE MAINTAINS NEGATIVE OUTLOOK BY MOODY’S

Euro tumbling. In other news, UK: AAA/Aaa; France: AA+/Aa1… Let the flame wars begin

From the release:

Moody’s decision to downgrade France’s rating and maintain the negative outlook reflects the following key interrelated factors:

Read moreMoody’s Downgrades France’s Credit Rating From AAA To Aa1 (Full Text)

ADP ‘Cancels’ 365,000 Private Jobs Created In 2012: ‘If You Think America Created Jobs, It Didn’t. ADP Made That Happen.’

– ADP “Cancels” 365,000 Private Jobs Created In 2012 (ZeroHedge, Oct 31, 2012):

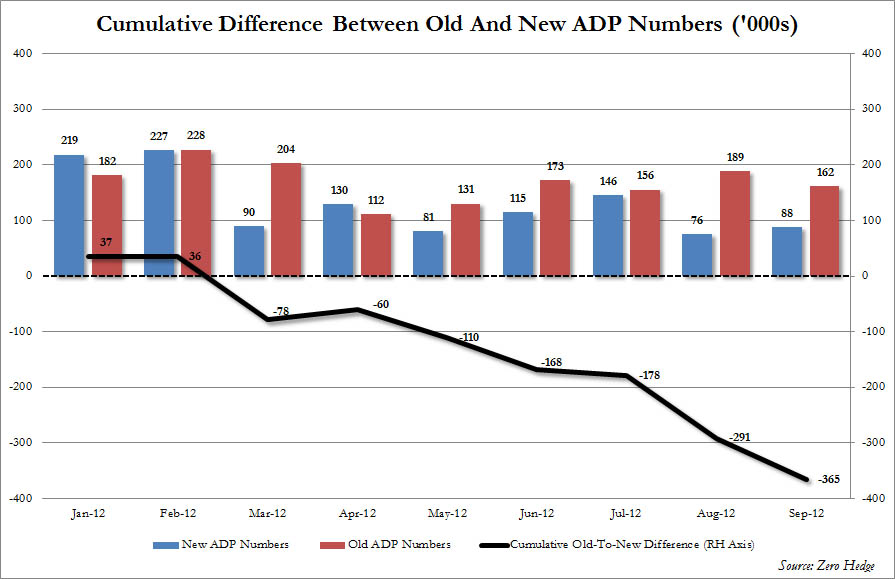

Frequent readers know that in addition of any “data” and “numbers” out of Larry Yun’s National Association of Realtors, which we openly boycott as these are consistently manipulated (recall the massive historical December 2011 revision), slanted and conflicted, the second dataset which we have mocked with a passion is anything coming out of the ADP, which every month releases its “Private Jobs” number a day before the official BLS Non-farm Payroll data. Today, our mockeries have been proven 100% spot on. The reason? A week ago, ADP announced that going forward it would coordinate with Moody’s (yes, that Moody’s), and especially its chief economist, SecTres hopeful (InTrade odds of actually attain that post: 0.00) Mark Zandi, to fudge adjust its data going forward. The data revision was supposed to be publicly disclosed tomorrow when the official October ADP number was released. Well, just like today’s Chicago PMI, and so many other data points recently, this too was released early. What the early release allowed us to promptly calculate is that using the historically revised numbers, and comparing those based on the original methodology, in 2012 alone, the US would have lost a whopping… 365,000 private jobs! Putting thus number in context, according to the revised methodology, the US has generated only 1.172MM jobs in 2012 through September, or in other words, a statistical “fix” magically eliminated over 30% of what the market had previously expected were job gains, a number which the incumbent president has certain taken advantage of on more than one occasions while campaigning.The chart below shows the old data series (which can still be found at the St. Louis Fed), and the new series, which can be extracted from the advance leaked press release. The cumulative difference is the black line. It needs no explanation.

What is also of note, is that had ADP used its revised methodology, it would have missed 5 out of the past 7 Wall Street consensus estimates.

As an added bonus, whereas according to the previous release, which we were lucky enough to tag here, the US generated +4,000 manufacturing jobs in September, the new release indicates that in the same month, the US actually lost -17,400 manufacturing jobs. Perhaps it is time to rerun the Ohio presidential speeches one more time…

And that is how “precise” supposedly the far more accurate ADP (at least in comparison to the NFP’s wild X-12-ARIMA extrapolated goalseeked data) was historically.

Moody’s Warns Of 1 Notch Downgrade If A Bitterly Divided Congress Does Not Begin To Cooperate

– Moody’s Warns Of 1 Notch Downgrade If A Bitterly Divided Congress Does Not Begin To Cooperate (ZeroHedge, Sep 11, 2012):

13 months ago, in the aftermath of the debt ceiling fiasco, which we now know was a last minute compromise achieved almost entirely thanks to the market plunging to 2011 lows, S&P had the guts to downgrade the US. Moody’s did not. Now, it is Moody’s turn to fire up the threat cannon with a release in which it says that should the inevitable come to pass, i.e. should congressional negotiations not “lead to specific policies that produce a stabilization and then downward trend in the ratio of federal debt to GDP over the medium term” then “Moody’s would expect to lower the rating, probably to Aa1” or a one notch cut. Moody’s also warns that should a repeat of last year’s debt ceiling fiasco occur, it will also most likely cut the US. Of course, that the US/GDP has risen by about 8% since the last August fiasco has now been apparently forgotten by both S&P and Moodys. Sadly, continued deterioration in the US credit profile is inevitable, as every single aspect of modern day lives that is “better than its was 4 years ago” has been borrowed from the future. More importantly, with the S&P at multi year highs courtesy of Bernanke using monetary policy to replace the need for fiscal policy, Congress will see no need to act, and Moody’s warning will be completely ignored. This will continue until it no longer can.From Moody’s:

Budget negotiations during the 2013 Congressional legislative session will likely determine the direction of the US government’s Aaa rating and negative outlook, says Moody’s Investors Service in the report “Update of the Outlook for the US Government Debt Rating.”

If those negotiations lead to specific policies that produce a stabilization and then downward trend in the ratio of federal debt to GDP over the medium term, the rating will likely be affirmed and the outlook returned to stable, says Moody’s.

If those negotiations fail to produce such policies, however, Moody’s would expect to lower the rating, probably to Aa1.

Moody’s Says U.S. Faces Aaa Cut Without Budget Deal in 2013

– Moody’s Says U.S. Faces Aaa Cut Without Budget Deal in 2013 (Bloomberg, Sep 11, 2012):

Moody’s Investors Service said it may join Standard & Poor’s in downgrading the U.S.’s credit rating unless Congress next year reduces the percentage of debt- to-gross-domestic-product during budget negotiations.

The U.S. economy will probably tip into recession next year if lawmakers and President Barack Obama can’t break an impasse over the federal budget and if George W. Bush-era tax cuts expire in what’s become known as the “fiscal cliff,” according to a report by the nonpartisan Congressional Budget Office published on Aug. 22. The rating would likely be cut to Aa1 from Aaa if an agreement on the debt ratio isn’t reached, Moody’s said in a statement today.

Read moreMoody’s Says U.S. Faces Aaa Cut Without Budget Deal in 2013

Moody’s Downgraded Nearly 300 US Municipals

Moody’s downgraded nearly 300 U.S. municipal issuers in the second quarter, the most for any quarter in more than a decade and the latest sign of the potential pressure building in the market where states and local governments raise money.

Local areas across the U.S. have been struggling for several years after the recession sharply undercut revenues, with three cities in California recently filing for bankruptcy in an attempt to alleviate their financial burdens.

Tax receipts have rebounded but not enough to compensate for rising costs, which include healthcare spending, social welfare and labor.

UK Economic Outlook Slumps – UK May Lose Triple-A Rating If GDP Growth Continues To Disappoint, Warns Moody’s

– UK economic outlook slumps on eurozone crisis (Guardian, July 31, 2012):

UK may lose triple-A rating if GDP growth continues to disappoint, Moody’s ratings agency warns

The UK’s economic outlook has weakened as a result of the eurozone debt crisis, Moody’s has said in a fresh blow to the chancellor George Osborne.

The ratings agency cut its forecasts for GDP growth, after figures last week showed the UK economy shrank by 0.7% in the second quarter – far more than expected.

Moody’s expects GDP to grow by just 0.4% this year and 1.8% in 2013, which is considerably more optimistic than many economists, who expect the economy to contract this year. Gerard Lyons at Standard Chartered said after the GDP figures were published: “I think it’s inconceivable that there will be positive growth this year.”

Moody’s warned on Tuesday that Britain could lose its triple-A rating if economic growth did not meet expectations, and if the country’s debt burden increased. It said the weaker economic environment could challenge the government’s efforts to reduce debt in the coming years.

Moody’s Changes Aaa-Rated Germany, Netherlands, Luxembourg Outlook To Negative

– Moody’s Changes Aaa-Rated Germany, Netherlands, Luxembourg Outlook To Negative (ZeroHedge, July 23, 2012):

In a first for Moody’s, the rating agency, traditionally about a month after Egan Jones (whose rationale and burdensharing text was virtually copied by Moody’s: here and here), has decided to cut Europe’s untouchable core, while still at Aaa, to Outlook negative, in the process implicitly downgrading Germany, Netherlands and Luxembourg, and putting them in line with Austria and France which have been on a negative outlook since February 13, 2012.The only good news goes to Finland, whose outlook is kept at stable for one simple reason: the country’s attempts to collateralize its European bailout exposure, a move which will now be copied by all the suddenly more precarious core European countries.

From the report:

Moody’s changes the outlook to negative on Germany, Netherlands, Luxembourg and affirms Finland’s Aaa stable rating

London, 23 July 2012 — Moody’s Investors Service has today revised to negative from stable the outlooks on the Aaa sovereign ratings of Germany, the Netherlands and Luxembourg. In addition, Moody’s has also affirmed Finland’s Aaa rating and stable outlook.

All four sovereigns are adversely affected by the following two euro-area-wide developments:

1.) The rising uncertainty regarding the outcome of the euro area debt crisis given the current policy framework, and the increased susceptibility to event risk stemming from the increased likelihood of Greece’s exit from the euro area, including the broader impact that such an event would have on euro area members, particularly Spain and Italy.

2.) Even if such an event is avoided, there is an increasing likelihood that greater collective support for other euro area sovereigns, most notably Spain and Italy, will be required. Given the greater ability to absorb the costs associated with this support, this burden will likely fall most heavily on more highly rated member states if the euro area is to be preserved in its current form.

Read moreMoody’s Changes Aaa-Rated Germany, Netherlands, Luxembourg Outlook To Negative

Moody’s Downgrades Italy’s To Baa2 From A3, Negative Outlook (Full Text)

– Moody’s Downgrades Italy’s To Baa2 From A3, Negative Outlook – Full Text (ZeroHedge, July 12, 2012):

Just like Spain before everyone took the country to a Sub-A rating, Fitch is once again the decider. S&P has Italy at BBB+, and Now Moody’s just took italy under A to Baa2; only Fitch is still at A-, outlook negative. When all three rating agencies go sub A, there is a 5% ECB repo hike as we explained back in April.

From Moody’s

Frankfurt am Main, July 13, 2012 — Moody’s Investors Service has today downgraded Italy’s government bond rating to Baa2 from A3. The outlook remains negative. Italy’s Prime-2 short-term rating has not changed.

The decision to downgrade Italy’s rating reflects the following key factors:

Read moreMoody’s Downgrades Italy’s To Baa2 From A3, Negative Outlook (Full Text)

Moody’s Downgrades Credit Ratings Of 28 Spanish Banks By 1-4 Notches

– Moody’s cuts ratings of 28 Spanish banks (RT, June 25, 2012):

Ratings agency Moody’s has cut the ratings of 28 Spanish banks following a June 13 downgrade of Spain’s sovereign rating by three notches.

The banks’ long-term debt and deposit ratings have been downgraded by one to four notches. The rating of Bankia, one the country’s largest banks, has been cut to junk status.

– Moody’s Downgrades Spanish Banking Sector By 1-4 Notches (ZeroHedge, June 25, 2012):

The long anticipated downgrade of the recently bailed out Spanish banking sector has arrived. Moody’s just brought the hammer down on 28 Spanish banks. Also apparently in Spain banks are now more stable than the country: “The ratings of both Banco Santander and Santander Consumer Finance are one notch higher than the sovereign’s rating, due to the high degree of geographical diversification of their balance sheet and income sources, and a manageable level of direct exposure to Spanish sovereign debt relative to their Tier 1 capital, including under stress scenarios. All the rest of the affected banks’ standalone ratings are now at or below Spain’s Baa3 rating.” Can Spain borrow from Santander then? They don’t need the ECB.

Full Spanish Bank downgrade Matrix (pdf source):

Read moreMoody’s Downgrades Credit Ratings Of 28 Spanish Banks By 1-4 Notches

Moody’s To Junk The Entire Spanish Banking System In Hours

– Moody’s To Junk Spanish Banking System In Hours (ZeroHedge, June 25, 2012):

Nearly two weeks ago we penned “These Three Spanish Banks Will Be Downgraded Tomorrow” which showed which banks had a rating higher than the sovereign following Moody’s long overdue Spanish downgrade, and thus were about to be downgraded by many notches. Today, after a ridiculously long delay whose only purpose was to buy time, Moody’s is about to junk virtually the entire Spanish banking sector, as was widely expected.The downgrade is expected to happen within hours.

From Expansion (google translated)

After cutting the rating of Baa3 and Spain to threaten to put Spanish debt at the level of junk bond no later than 30 days, has reviewed the notes of all banks. “We have reported a reduction of two or three notches (steps) to almost everyone. Do not look at individual financial statements of each entity. Do not discriminate, “added the sources.

Read moreMoody’s To Junk The Entire Spanish Banking System In Hours

Here We Go: Moody’s Downgrade Is Out – Morgan Stanley Cut Only 2 Notches, To Face $6.8 Billion In Collateral Calls

– Here We Go: Moody’s Downgrade Is Out – Morgan Stanley Cut Only 2 Notches, To Face $6.8 Billion In Collateral Calls (ZeroHedge, June 21, 2012):

Here it comes:

- MOODY’S CUTS 4 FIRMS BY 1 NOTCH

- MOODY’S CUTS 10 FIRMS’ RATINGS BY 2 NOTCHES

- MOODY’S CUTS 1 FIRM BY 3 NOTCHES

- MORGAN STANLEY L-T SR DEBT CUT TO Baa1 FROM A2 BY MOODY’S

- MOODY’S CUTS MORGAN STANLEY 2 LEVELS, HAD SEEN UP TO 3

- MORGAN STANLEY OUTLOOK NEGATIVE BY MOODY’S

- MORGAN STANLEY S-T RATING CUT TO P-2 FROM P-1 BY MOODY’S

But the kicker:

ONLY MORGAN STANLEY, HSBC CUT LESS THAN MOODY’S ORGINAL MAXIMUM.

And there you have it – the reason for the delay were last minute negotiations, most certainly involving extensive monetary explanations, by Morgan Stanley’s Gorman (potentially with Moody’s investor Warren Buffett on the call) to get only a two notch downgrade. And Wall Street wins again.

Recall, from MS’ 10-Q:

“In connection with certain OTC trading agreements and certain other agreements associated with the Institutional Securities business segment, the Company may be required to provide additional collateral or immediately settle any outstanding liability balances with certain counterparties in the event of a credit rating downgrade. At March 31, 2012, the following are the amounts of additional collateral, termination payments or other contractual amounts (whether in a net asset or liability position) that could be called by counterparties under the terms of such agreements in the event of a downgrade of the Company’s long-term credit rating under various scenarios: $868 million (A3 Moody’s/A- S&P); $5,177 million (Baa1 Moody’s/ BBB+ S&P); and $7,206 million (Baa2 Moody’s/BBB S&P). Also, the Company is required to pledge additional collateral to certain exchanges and clearing organizations in the event of a credit rating downgrade. At March 31, 2012, the increased collateral requirement at certain exchanges and clearing organizations under various scenarios was $160 million (A3 Moody’s/A- S&P); $1,600 million (Baa1 Moody’s/ BBB+ S&P); and $2,400 million (Baa2 Moody’s/BBB S&P).”

So instead of $9.6 billion, MS will face only $6.8 billion in collateral calls.

Still the firm is not out of the woods: