Oct. 22 (Bloomberg) — Investors are taking losses of up to 90 percent in the $1.2 trillion market for collateralized debt obligations tied to corporate credit as the failures of Lehman Brothers Holdings Inc. and Icelandic banks send shockwaves through the global financial system.

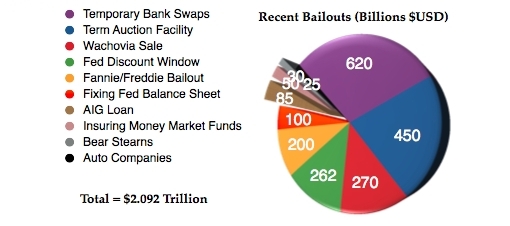

The losses among banks, insurers and money managers may spark the next round of writedowns on CDOs after $660 billion in subprime-related losses. They may force lenders to post more reserves against losses after governments worldwide announced $3 trillion in financial-industry rescue packages since last month, according to Barclays Capital.

“We’ll see the same problems we’ve seen in subprime,” said Alistair Milne, a professor in banking and finance at Cass Business School in London and a former U.K. Treasury economist. “Banks will take substantial markdowns.”

The collapse of Lehman Brothers, Washington Mutual Inc. and the three banks in Iceland prompted Susquehanna Bancshares Inc., a Lititz, Pennsylvania-based lender, to lower the value of $20 million in so-called synthetic CDOs by almost 88 percent last week.

Read moreCDO Cuts Show $1 Trillion Corporate-Debt Bets Toxic