– Moody’s Downgrades Six German Bank Groups, And Their Subsidiaries, By Up To Three Notches (ZeroHedge, June 5, 2012):

First Moody’s cut the most prominent Austrian banks, and now it is Germany’s turn, if not that of the most undercapitalized German bank yet: “The ongoing rating review for Deutsche Bank AG and its subsidiaries will be concluded together with the reviews for other global firms with large capital markets operations.“

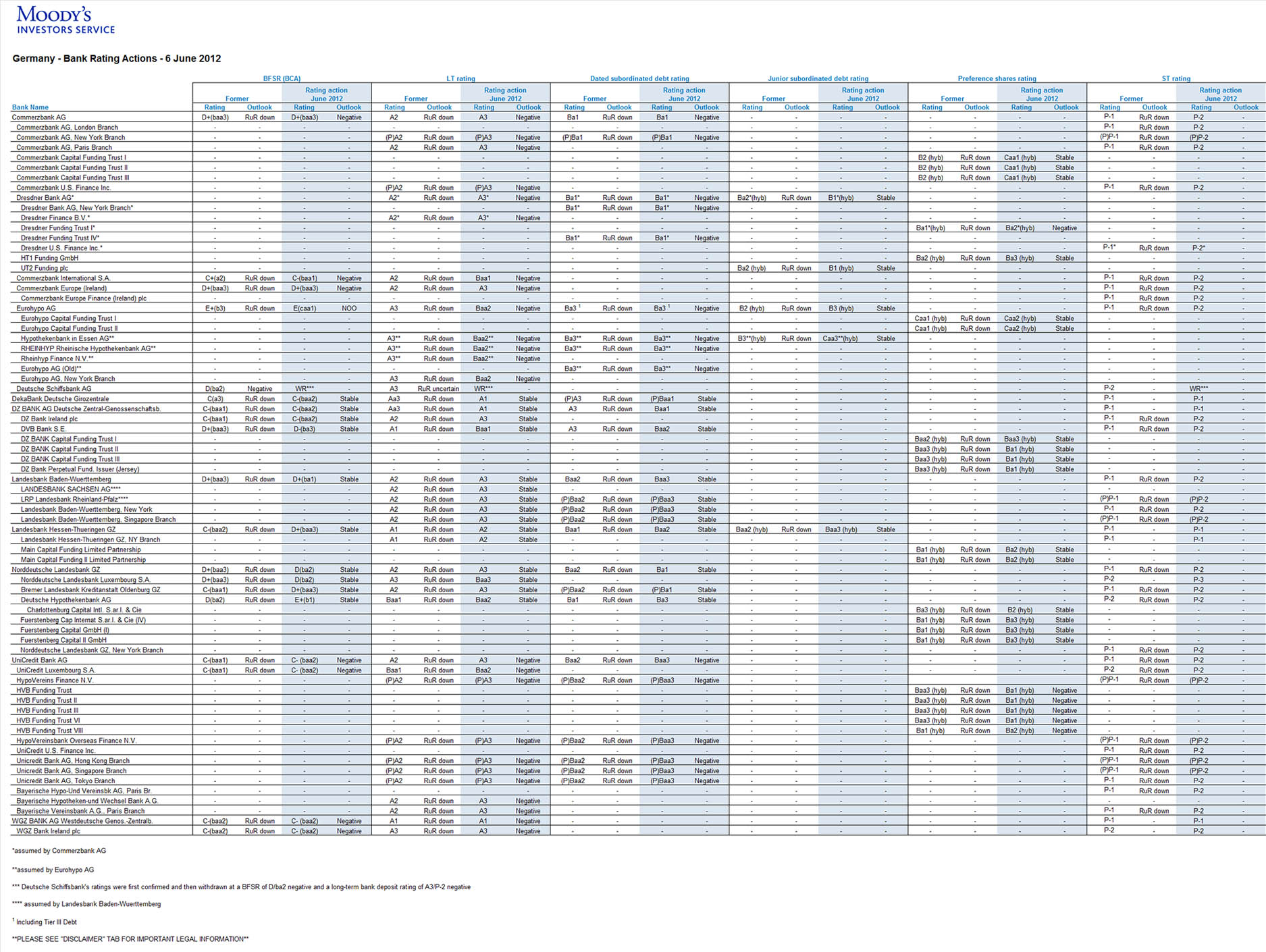

The full downgrade Matrix:

From Moody’s

Moody’s takes multiple actions on German banks’ ratings; most outlooks now stable

Frankfurt am Main, June 06, 2012 — Moody’s Investors Service has today taken various rating actions on seven German banks and their subsidiaries, as well as one German subsidiary of a foreign group. As a result, the long-term debt and deposit ratings for six groups and one German subsidiary of a foreign group have declined by one notch, while the ratings for one group were confirmed. Moody’s also downgraded the long-term debt and deposit ratings for several subsidiaries of these groups, by up to three notches. At the same time, the short-term ratings for three groups as well as one German subsidiary of a foreign group have been downgraded by one notch, triggered by the long-term rating downgrades.

Read moreMoody’s Downgrades Six German Bank Groups, And Their Subsidiaries, By Up To Three Notches