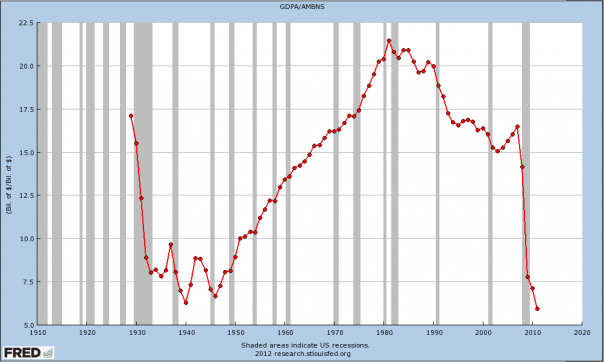

It is correct that the euro, the dollar and the pound will not survive and that a new world currency will be proposed as the only solution to all problems.

Deficit spending (Keynesianism) is an invention of elite criminals that want to loot and bankrupt the people:

“In the absence of the gold standard, there is no way to protect savings from confiscation through inflation. … This is the shabby secret of the welfare statists’ tirades against gold. Deficit spending is simply a scheme for the confiscation of wealth. Gold stands in the way of this insidious process. It stands as a protector of property rights. If one grasps this, one has no difficulty in understanding the statists’ antagonism toward the gold standard.”

– Alan Greenspan

“When a country embarks on deficit financing and inflationism you wipe out the middle class and wealth is transferred from the middle class and the poor to the rich.”

– Ron Paul

“Deficits mean future tax increases, pure and simple. Deficit spending should be viewed as a tax on future generations, and politicians who create deficits should be exposed as tax hikers.”

– Ron Paul

Joseph Stiglitz, one of the world’s leading economists, has warned that the future of the euro is “looking bleak” and the fragile European economic recovery could be irreparably damaged by a “wave of austerity” sweeping the continent.

Joseph Stiglitz, the Nobel prize winner, warned that speculators are putting pressure on Spain

The former chief economist of the World Bank and a Nobel prize winner also predicted that short-term speculators in the market could soon start putting pressure on Spain, which is struggling with a large deficit and high unemployment. Last week, Moody’s cut the country’s credit rating from AAA to Aa1.

The former adviser to President Bill Clinton also says that the banking sector has gone back to “business as usual” too quickly and that there are still risks of another financial crisis despite some improvements in regulation.

Mr Stiglitz, now a professor at Columbia Business School, makes the arguments in an updated edition of his book, Freefall, on the credit crunch. In the new material, exclusively extracted in today’s Sunday Telegraph, he reveals fears that governments around the world will attempt to cut their deficits too quickly and risk a double dip recession.

Tomorrow, George Osborne will outline the Government’s latest plans for multi-billion pound public sector cuts to tackle the historically-high UK deficit. He has faced criticism that the Coalition is in danger of cutting too hard and too fast but the Chancellor has said that without a credible programme for getting the UK economy into balance, interest rates will rise and growth will be choked off.

“The worry is that there is a wave of austerity building throughout Europe and even hitting America’s shores,” Mr Stiglitz said. “As so many countries cut back on spending prematurely, global aggregate demand will be lowered and growth will slow – even perhaps leading to a double-dip recession.

“America may have caused the global recession but Europe is now responding in kind.”

Mr Stiglitz warned that Spain, similarly to Greece, was now in the speculators’ sights.

Read moreJoseph Stiglitz: The Euro May Not Survive