Authored by Jeffrey Sachs, originally posted at The Boston Globe,

The Panama Papers opened yet another window on the global system of financial corruption, showing how political leaders and businesses use shell companies in secrecy havens like the British Virgin Islands and many US states to evade taxes and hide corruption and other crimes. Yet the system of corruption depends on another factor beyond secrecy, one that is perhaps even more important: impunity. Impunity means that the rich and powerful escape from punishment even when their malfeasance is in full view.

John Paulson

John Paulson Loses Over $300 MILLION On Friday’s Gold Tumble

– John Paulson Loses Over $300 Million On Friday’s Gold Tumble (ZeroHedge, April 13, 2013):

There were many casualties following Friday’s 4% gold rout, but none were hurt more than one-time hedge fund idol John Paulson, who according to estimates, lost more than $300 million of his own money in one day.

Per Bloomberg: “Paulson has roughly $9.5 billion invested across his hedge funds, of which about 85 percent is invested in gold share classes. Gold dropped 4.1 percent today, shaving about $328 million from his net worth on this bet alone.” This is merely the latest insult to what has otherwise been a 3 year-long injury for Paulson and his few remaining investors, whose very inappropriately named Advantage Plus is among the bottom 10 hedge funds for the third year in a row. Yet despite being a one-hit wonder thanks to one lucrative idea (long ABX CDS) generated by one of his former employees (Pelegrini), Paulson still has been lucky enough to somehow amass a $10 billion personal fortune which can have a $300 million downswing in one day, even if it is in an asset class which eventually will go only one way – up. Unless, of course, like so many other fly by night billionaires, Paulson too hasn’t somehow managed to lever up all his equity into numerous other downstream ventures, and where a $300 million blow up leads to margin calls and other terminal liquidity outcomes.

More:

“The recent decline in gold prices has not changed our long-term thesis,” John Reade, a partner and gold strategist at Paulson & Co., said in an e-mailed statement. “We started investing in gold at $900 in April 2009 and while it’s down from its peak to $1500, it’s up considerably from our cost.”

Read moreJohn Paulson Loses Over $300 MILLION On Friday’s Gold Tumble

Gold – It’s Time

In the last few years gold and silver bottomed out around Christmas.

– Gold – It’s Time (ZeroHedge, Dec 12, 2012):

Authored by Lee Quaintance and Paul Brodsky of QBAMCO,

Gold bugs can’t understand how the public can be so unaware, how highly intelligent policy makers can be so immoral, and how the mainstream media can be so incurious. We can’t understand why more men and women in the investment business haven’t joined some of the more successful ones that have come around to precious metals and have taken substantial positions in them for their funds and personal accounts. The list of high profile independent-minded investors that have come out of the proverbial closet is impressive and growing: Kyle Bass, John Paulson, David Einhorn, George Soros, Bill Gross and Paul Singer, to name only a few.

Jacob Rothschild, John Paulson And George Soros Are All Betting That Financial Disaster Is Coming

– Jacob Rothschild, John Paulson And George Soros Are All Betting That Financial Disaster Is Coming (Economic Collapse, Aug 20, 2012):

Are you willing to bet against three of the wealthiest men in the entire world? Jacob Rothschild recently bet approximately 200 million dollars that the euro will go down. Billionaire hedge fund manager John Paulson made somewhere around 20 billion dollars betting against the U.S. housing market during the last financial crisis, and now he has made huge bets that the euro will go down and that the price of gold will go up. And as I wrote about in my last article, George Soros put approximately 130 million more dollars into gold last quarter. So will the euro plummet like a rock? Will the price of gold absolutely soar? Well, if a massive financial disaster does occur both of those two things are likely to happen. The European economy is becoming more unstable with each passing day, and investors all over the globe are looking for safe places to put their money. The mainstream media keeps telling us that everything is going to be okay, but the global elite are sending us a much, much different message by their actions. Certainly Rothschild, Paulson and Soros know about things happening in the financial world that the rest of us don’t. The fact that they are all behaving in a consistent manner right now should be alarming for all of us.

Spiegel: ‘Investors Prepare For Euro Collapse’ – ‘Currency’s Days Seen Numbered’

And now Germany’s Der Spiegel is reporting what we have been saying for years.

And “the dollar’s structure isn’t in doubt”???

What are they smoking?

‘Currency’s Days Seen Numbered’

– Investors Prepare for Euro Collapse (Spiegel, Aug 13, 2012):

Banks, companies and investors are preparing themselves for a collapse of the euro. Cross-border bank lending is falling, asset managers are shunning Europe and money is flowing into German real estate and bonds. The euro remains stable against the dollar because America has debt problems too. But unlike the euro, the dollar’s structure isn’t in doubt.

Otmar Issing is looks a bit tired. The former chief economist at the European Central Bank (ECB) is sitting on a barstool in a room adjoining the Frankfurt Stock Exchange. He resembles a father whose troubled teenager has fallen in with the wrong crowd. Issing is just about to explain again all the things that have gone wrong with the euro, and why the current, as yet unsuccessful efforts to save the European common currency are cause for grave concern.

Read moreSpiegel: ‘Investors Prepare For Euro Collapse’ – ‘Currency’s Days Seen Numbered’

Hilarious: Sino Forest Seeks $4 Billion From Muddy Waters In Damages … As It Files For Bankruptcy

– Friday Funny: Sino Forest Seeks $4 Billion From Muddy Waters In Damages… As It Files For Bankruptcy (ZeroHedge, Mar 30, 2012):

Actually, in retrospect this may well be the funniest pair of headlines in one place ever.

- SINO-FOREST TO FILE FOR BANKRUPTCY, MAY SEEK SALE OF COMPANY

But…

- SINO FOREST SEEKING $4B IN DAMAGES AGAINST MUDDY WATERS

Uh? What? #Ref! #Ref! #Ref! We wonder: if Sino Forest files for bankruptcy in its forest of imaginary trees, did it really file for bankruptcy.

In other news, how many of the following analysts who had a buy on the stock as of the day the Muddy Waters report saved countless other investors the 100% certainty of a full wipe out by putting their money in Sino Forest, have been terminated.

The Following Sino Forest Sell-Side Analysts Should Be Terminated Immediately

As we pointed out the day after we broke the news that Paulson is about to suffer a historic loss on the Sino Forest Chinese fraud (a loss that has now been realized), the Paulson analyst who suggested this humiliating investment for the man who is now best known for hiring Paolo Pellegrini, have long since seen the pink slip. The story however does not end there: below we present again the sell side analysts who had Buy and Outperform ratings on what is now the biggest financial ponzi fraud since Madoff. In order to protect the reputation of such host firms as Raymond James, Dundee Securities, TD Newcrest, Credit Suisse, RBC, BMO and Scotia Capital, we urge the management teams to immediately terminate the following sell-side “analysts” whose work on TRE.TO was nothing but piggybacking on groupthink, doing absolutely no actual due diligence, costing clients billions in losses, and whose names will now forever be enshrined in the pantheon of “most worthless sellside analysts” ever.

Horrible News For Goldbugs – Billionaire John Paulson Is Bullish On Gold Again; Next – Nouriel Roubini?

🙂 ROFL! 🙂

– Horrible News For Goldbugs – Paulson Is Bullish On Gold Again; Next – Roubini? (ZeroHedge, Feb. 17, 2012):

We wish we had good news, but we are not going to lie: This is the worst possible news for any gold bull out there.

From Bloomberg:

Gold traders are getting more bullish after billionaire hedge-fund manager John Paulson told investors it’s time to buy the metal as protection against inflation caused by government spending.

“By the time inflation becomes evident, gold will probably have moved, which implies that now is the time to build a position in gold,” New-York based Paulson said in a letter to investors obtained by Bloomberg. Armel Leslie, a spokesman for Paulson, declined to comment.

The 56-year-old manager’s SPDR Gold Trust holdings fell 15 percent in the fourth quarter as his $23 billion hedge fund company had its worst-ever year. His Advantage Plus Fund lost 51 percent in 2011, and the firm said in a third-quarter letter that financial services companies were the “primary drag.” Paulson became a billionaire in 2007 by betting against the U.S. subprime mortgage market. Gold rose 10 percent last year in New York trading, an 11th consecutive annual gain.

And so the Paulson overhang is back. Couldn’t Paulson just go ahead and buy Bank of America or some other worthless biohazard again?All that remains is for Roubini to say he prefers gold over spam (and always has, he was merely “misunderstood“) and the crash will be imminent.

Or perhaps we will learn following the next $1000 up move in gold that Gartman will have been long gold in Vietnamese Dong.

Well, at least cheap entry points will be available.

The Rumors Were True: John Paulson Liquidates A Third Of His GLD Gold Share Class; Buys More Bank Of America And Capital One

– The Rumors Were True: Paulson Liquidates A Third Of His GLD Gold Share Class; Buys More Bank Of America And Capital One (ZeroHedge, Nov. 14, 2011):

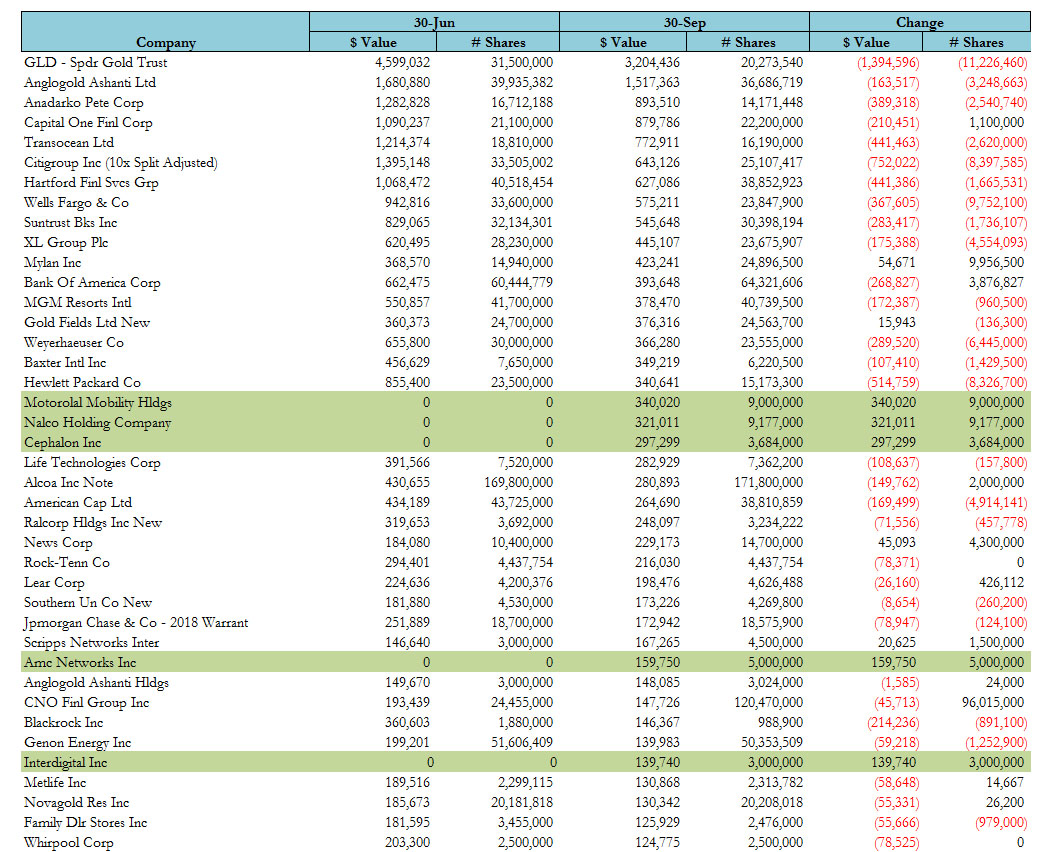

Well, he may not be liquidating, and he may be telling others he has experienced barely any redemptions, but Paulson’s gold share class, represented entirely by the fund’s GLD holdings would beg to differ: as of September 30, Paulson’s total holdings of GLD were down by a third from 31.5 million shares or $4.6 billion at the end of Q2, to 20.2 million or $3.2 billion. And as is well known, GLD is not an actual investment for Paulson, but merely a representative asset class for those who opt to have their fund holdings represented in gold (the smart ones) instead of in dollars. Indicatively the only Paulson & co investors who made any money, or at least did not lose much, were those who opted for a gold share class. Either way, it is now safe to assume that at least a third of the fund has been permanently redeemed, further confirmed by the drop in the AUM from $29 billion to $20.7 billion as per the actual filing. But wait, there’s more: while Paulson was busy selling across the board, in the process liquidating all of his JPM holdings as well as his positions in Comcast (no CNBC for you), Savvis, NYSE Euronext and State Street, and following in Tepper’s footsteps in selling across the board, the former Bear trader did what all other allegedly doomed institutions do and added to, you guessed it, the biggest loser Bank of America, increasing his position by almost 4 million shares… even as the total value of his 64 million BAC stake, which closed Q3 at the same price it is today, dropped by $269 million! And that’s why he is a billionaire and you are not. At least we know who Tepper was selling to. But that’s not all: Paulson also added 1.1 million share to his CapitalOne position, bringing the total to 22.2 million shares, even as the total value of his revised position dropped by $210 million to $880 million. And so forth. Some other names in which he took brand new stakes in (picture that: he did not spend all of Q3 selling) in Motorola Mobility, Nalco, Cephalon, AMC and a bunch of irrelevant others. So to all those who are now in the same place they were in 2008: tough, but at least your fees made JP into a multi-billionaire. Congratulations.

25 Richest Hedge Fund Managers Made $22 Billion Last Year

Here is how those guys ‘bet’:

– Goldman Sachs ‘Had Duty’ to Keep ‘Relatively Unknown’ Billionaire John Paulson’s Bets Secret

John Paulson is heavily invested in GOLD!

NEW YORK (By Matthew Goldstein) – The richest 25 hedge fund managers made a bit less money last year.

But don’t cry too hard. Collectively, this privileged class of traders did quite well for itself — raking in some $22 billion in compensation, according to AR Magazine.

Topping the charts in hedge fund pay was John Paulson, who reportedly earned $4.9 billion. Paulson’s name at the top of the “rich list” isn’t too surprising, given that his $36 billion Paulson & Co has emerged as one of the industry’s top performing funds.

AR reports that Paulson’s 2010 earnings even bested the $3.7 billion he made in 2007, when he rocketed to hedge fund fame with his enormously successful wager on the housing market’s collapse.

Other top earning managers were: Bridgewater Associates’ Ray Dalio with $3.1 billion, Renaissance Technologies’ Jim Simons with $2.5 billion, Appaloosa Management’s David Tepper with $2.2 billion and SAC Capital Advisors’ Steve Cohen with $1.3 billion.

Overall, the hedge fund trade publication reports that compensation for the top 25 managers declined by 13 percent from 2009. But 2010 still came in as the third best year for hedge fund pay since AR began estimating industry compensation in 2001.

Read more25 Richest Hedge Fund Managers Made $22 Billion Last Year

George Soros’ and John Paulson’s Biggest Holding Is GOLD

Remember that George Soros told the world that gold is a bubble and afterwards invested heavily in gold?

Flashback:

George: Soros:

– George Soros not only doubled his gold investment, but also bought call options

– George Soros More Than Doubled Gold ETF Stake in 4th Quarter

John Paulson:

– Hedge fund manager John Paulson to invest $250m in new gold fund

– World’s top hedge fund manager has a gold position of at least $5.5bn

– Paulson group buys into AngloGold

Gold’s 23 percent surge this year to a record is proving no deterrent to George Soros, John Paulson and Paul Touradji, whose investments signal more gains for the longest winning streak in at least nine decades.

Securities and Exchange Commission filings this month by Soros Fund Management LLC, Paulson & Co. and Touradji Capital Management LP listed investments in gold as their biggest holdings. Exchange-traded products own 2,088 metric tons, equal to nine years of U.S. mine supply, data compiled by Bloomberg show. Precious metals will produce the best commodity returns in the next year, Goldman Sachs Group Inc. said in a Nov. 9 report.

The purchases show how investors are snapping up hard assets as governments and central banks led by the Federal Reserve pump more than $2 trillion into the world financial system. Gold in exchange-traded products, as much as half of which may be held by individual investors according to BlackRock Inc., is equal to more bullion than the official reserves of every country except the U.S., Germany, Italy and France.

“People who are selling gold here are making a big mistake,” said Michael Pento, a senior economist at Euro Pacific Capital Inc. in New York who correctly predicted gold’s highs the past two years. “The gold bull market will end when real interest rates become positive and we’re very far away from that. The Fed believes it’s going to have to print more money to keep real interest rates from rising and rescue the economy.”

Read moreGeorge Soros’ and John Paulson’s Biggest Holding Is GOLD

Hedge Funds Bet Europe’s $1 Trillion Bailout Won’t Solve Crisis, Forecast Jump in Inflation, Buy Gold

John Paulson, who made $15 billion betting on the subprime trade, is one manager who may not be replicating the CDS trade he used three years ago. Earlier this month, in a conference call with investors, he called Europe’s debt problems “manageable.”

A weaker euro will benefit French and German exporters, he told clients. Like Bass, he’s been forecasting a jump in inflation, which is why he’s been a buyer of gold and gold producers since at least last year.

J. Kyle Bass smiles in the office of his company, Hayman Capital Partners, in Dallas. (Bloomberg)

May 19 (Bloomberg) — Kyle Bass, who made $500 million in 2007 on the U.S. subprime collapse, is betting Europe’s debt crisis won’t be solved by the $1 trillion loan package the International Monetary Fund and European Union agreed on last week.

“The EU and the IMF effectively went all-in with a bad hand in the highest stakes game of financial poker ever played with the world,” wrote Bass, head of Dallas-based Hayman Advisors LP, in a letter to clients sent after the bailout was announced.

Bass bought gold last week and took other steps to position the fund for hyperinflation and a “competitive devaluation” by Europe, Japan and the U.S. that he is forecasting, according to the letter. Christopher Kirkpatrick, general counsel for Hayman, declined to elaborate on the comments.

Goldman Sachs ‘Had Duty’ to Keep ‘Relatively Unknown’ Billionaire John Paulson’s Bets Secret

The company (Goldman) failed to disclose that hedge fund Paulson & Co., run by billionaire John Paulson, helped pick the underlying securities in a collateralized debt obligation and then bet against them, …

‘Relatively Unkown’

Participants knew “someone had to take the other side of the portfolio risk,” and disclosing that “the relatively unknown Paulson” was betting against the CDO wouldn’t have been material to the investors, Goldman Sachs said in the September document. The facts show “no one in fact considered Paulson’s role important and that no one was misled.”

Paulson, who oversees about $32 billion in hedge funds, became more prominent after his firm generated about $3 billion of profit in 2007, fueled by bets against subprime mortgages. He was featured in the book “The Greatest Trade Ever: The Behind- the-Scenes Story of How John Paulson Defied Wall Street and Made Financial History.”

Relatively unkown! ROFL!

April 20 (Bloomberg) — Goldman Sachs Group Inc., being sued by the U.S. Securities and Exchange Commission over claims that it deceived investors about one of its financial products, tried to fend off regulators last fall by arguing it had a duty to keep the information confidential.

The company failed to disclose that hedge fund Paulson & Co., run by billionaire John Paulson, helped pick the underlying securities in a collateralized debt obligation and then bet against them, the SEC said in a lawsuit filed April 16. After being told in July 2009 that the SEC planned to bring a complaint, New York-based Goldman Sachs argued it had been compelled to keep Paulson’s role secret.

The SEC’s “proposed theory ignores the fact that, as a broker-dealer acting as an intermediary on behalf of a client, Goldman Sachs had a duty to keep information concerning its client’s (Paulson’s) trades, positions and trading strategy confidential,” the company said in a Sept. 10, 2009, document addressed to the agency.

Goldman Sachs, the most profitable company in Wall Street history, created and sold CDOs linked to subprime mortgages in 2007, using ACA Management LLC, a firm that analyzes credit risk, to select underlying securities. Goldman Sachs knew that at least one prospective investor, Dusseldorf, Germany-based IKB Deutsche Industriebank AG, wasn’t likely to invest in a CDO that didn’t have a collateral manager to analyze and select the portfolio, according to the SEC’s lawsuit. Goldman Sachs misled investors by not disclosing that Paulson had a hand in picking the portfolio, according to the SEC’s lawsuit.

Now we know the truth: The financial meltdown wasn’t a mistake – it was a con

Hiding behind the complexities of our financial system, banks and other institutions are being accused of fraud and deception, with Goldman Sachs just the latest in the spotlight. This has become the most pressing election issue of all

Goldman Sachs was in the spotlight last November when demonstrators protested outside its Washington offices against executive bonuses. (Bloomberg via Getty Images)

The global financial crisis, it is now clear, was caused not just by the bankers’ colossal mismanagement. No, it was due also to the new financial complexity offering up the opportunity for widespread, systemic fraud. Friday’s announcement that the world’s most famous investment bank, Goldman Sachs, is to face civil charges for fraud brought by the American regulator is but the latest of a series of investigations that have been launched, arrests made and charges made against financial institutions around the world. Big Finance in the 21st century turns out to have been Big Fraud. Yet Britain, centre of the world financial system, has not yet levelled charges against any bank; all that we’ve seen is the allegation of a high-level insider dealing ring which, embarrassingly, involves a banker advising the government. We have to live with the fiction that our banks and bankers are whiter than white, and any attempt to investigate them and their institutions will lead to a mass exodus to the mountains of Switzerland. The politicians of the Labour and Tory party alike are Bambis amid the wolves.

Just consider the roll call beyond Goldman Sachs. In Ireland Sean FitzPatrick, the ex-chair of the Anglo Irish bank was arrested last month and questioned over alleged fraud. In Iceland last week a dossier assembled by its parliament on the Icelandic banks – huge lenders in Britain – was handed to its public prosecution service. A court-appointed examiner found that collapsed investment bank Lehman knowingly manipulated its balance sheet to make it look stronger than it was – accounts originally audited by the British firm Ernst and Young and given the legal green light by the British firm Linklaters. In Switzerland UBS has been defending itself from the US’s Internal Revenue Service for allegedly running 17,000 offshore accounts to evade tax. Be sure there are more revelations to come – except in saintly Britain.

Read moreNow we know the truth: The financial meltdown wasn’t a mistake – it was a con

Hedge fund manager John Paulson to invest $250m in new gold fund

Billionaire John Paulson

Hedge fund manager John Paulson plans to invest as much as $250m (£149m) of his $6bn personal fortune in a new gold fund he is in the process of establishing.

Mr Paulson, best known for making $3.7bn from bets on the collapse of the US sub-prime mortgage market, is believed to have told investors that the new fund, to be run by Paulson & Co, will invest not just in gold miners but also in other investments related to the precious metal.

Related articles:

– World’s top hedge fund manager has a gold position of at least $5.5bn

– Paulson group buys into AngloGold

Although not Paulson & Co’s first foray into gold, given approximately 10pc of the $30bn it has under management is in gold-related investments, it would be the firm’s first pure-play gold fund.

Read moreHedge fund manager John Paulson to invest $250m in new gold fund

World’s top hedge fund manager has a gold position of at least $5.5bn

My prediction for the future is that gold will be at least at $2000/oz within one year from now.

Just look at the increase of the money supply in the US to realize that this is – per definition – not a deflation scenario.

The greatest financial collapse in history will be a hyperinflationary depression.

The ‘Greatest Depression’ is here. Got gold … and silver (plus food and water for several months)?

China has doubled its bullion reserves and left us in no doubt that it will spend more of its $40bn monthly surplus on hard assets rather than the toxic paper of Western democracies.

The world’s top hedge fund manager John Paulson has built a gold position of at least $5.5bn, the biggest such move since George Soros and Sir James Goldsmith bet on Newmont Mining in 1993.

Britain has become the first of the Anglo-Saxon “AAA” club to face a downgrade. As feared, the cancer of bank leverage is spreading to sovereign cores.

Gold prices tend to slide in late May and languish through the summer, because of the seasonal ups and downs of jewellery demand. The trader reflex would be to short gold at this stage after its $90 vault to $959 an ounce over the past month. They may think again this year.

Paulson & Co has bought $2.9bn in SPDR Gold Trust, the biggest of the gold exchange traded funds (ETFs), which now holds 1106 tonnes – three times the Brown-gutted reserves of the United Kingdom.

Mr Paulson has also built up a $2.3bn holding of Anglo Ashanti, Goldfields, Kinross Gold, and Market Vectors Gold Miners. The fact that he is launching a “Paulson Real Estate Recovery Fund”, reversing the bet against sub-prime securities that made him rich, tells us all we need to know about his thinking. This is a liquidity-reflation play.

Read moreWorld’s top hedge fund manager has a gold position of at least $5.5bn

Paulson group buys into AngloGold

Paulson & Co spent $1.28bn buying Anglo American’s stake in gold miner AngloGold Ashanti on Tuesday as the New York hedge fund moved from betting against banks to betting against governments.

Paulson, founded by billionaire John Paulson, bought 11.3 per cent of the Johannesburg miner as part of its bet that gold benefits as paper currencies suffer from the financial crisis and from governments printing money.

Mr Paulson has become one of the most closely followed hedge fund managers after his bet against subprime mortgages became the most profitable trade in history in 2007, securing profits of more than $10bn for his funds.

Looks like John Paulson knows what he is doing:

– Paulson May Have Made $428 Million Shorting Lloyds

– Paulson Fund Makes at Least $420 Million Shorting RBS

Gold is a traditional safe-haven purchase and has become increasingly popular with hedge funds this year as they worry about paper currencies being debased, causing inflation.

The deal comes as a surprise as Anglo American said last month it intended to “remain a significant shareholder in AngloGold Ashanti in the medium term”.

Paulson May Have Made $428 Million Shorting Lloyds

March 11 (Bloomberg) — Paulson & Co., the hedge fund run by billionaire John Paulson, may have made 311 million pounds ($428 million) since September by short selling Lloyds Banking Group Plc and HBOS Plc.

The firm took short positions in London-based Lloyds and HBOS that were valued at 367 million pounds in September, based on the holdings and share prices on the dates they were reported. The stake fell below the reporting threshold on March 9, regulatory filings show.

Paulson, which made $3 billion anticipating the U.S. housing market would collapse, gained as Lloyds, HBOS and Royal Bank of Scotland Group Plc sought bailouts from British taxpayers. Lloyds surrendered control to the government on March 7 in exchange for asset guarantees. Paulson made least 295 million pounds shorting RBS, bringing its profit from betting U.K. banking stocks would drop to 606 million pounds, according to earlier disclosures.

Paulson May Have Made $67 Million in Lloyds Plunge

Feb. 13 (Bloomberg) — Paulson & Co., the hedge fund run by billionaire John Paulson, may have made as much as $67 million in 25 minutes today as Lloyds Banking Group Plc lost about 5.9 billion pounds ($8.5 billion) in market value.

Related article: Lloyds hit by £10bn HBOS losses (Financial Times)

Lloyds fell the most in 20 years after saying HBOS Plc, the U.K. lender it took over last month, would report a 10 billion- pound pretax loss. The shares plunged as much as 43 percent in less than 25 minutes of London trading.

Paulson, who made billions from betting against the subprime mortgage market, held a Lloyds short position representing 0.79 percent of the bank, or 129.3 million shares, as of Jan. 20, according to a regulatory filing. DataExplorers.com, which tracks share borrowing from London, said 1.1 percent of the stock was on loan as of Feb. 11, the most recent data available. That’s down from as much as 8 percent six months ago and suggests Paulson held the bulk of the remaining short position.

Paulson Fund Makes at Least $420 Million Shorting RBS

John Alfred Paulson, president of Paulson and Co., speaks during a hearing of the House Committee on Oversight and Government Reform on Capitol Hill November 13, 2008. Photographer: Brendan Smialowski/Bloomberg News

Jan. 27 (Bloomberg) — Paulson & Co., the hedge fund run by billionaire John Paulson, made at least 295 million pounds ($420 million) since September by short selling Royal Bank of Scotland Group Plc.

Paulson held a short position of 0.87 percent in Edinburgh- based RBS on Sept. 19, according to regulatory filings. The shares traded at 213.5 pence at the time, and Paulson’s disclosure indicates he borrowed and sold almost 144 million RBS shares with plans to buy them back at a lower price. He reduced his short position to less than 0.25 percent, or about 98.6 million shares, as of Jan. 23, according to a filing yesterday.

Related article: Paulson reaps £270m ‘shorting’ RBS (Financial Times)

“They took positions in U.K. banks and their bearishness has been handsomely rewarded,” said Leigh Goodwin, a London-based analyst at Fox-Pitt Kelton Ltd. who has an “in-line” rating on RBS. “They timed their exit well.”

Paulson would have made 295 million pounds, assuming it still had a 0.25 percent short position on Jan. 23, when RBS closed at 12.1 pence. RBS, which said this month it will take as much as 20 billion pounds of writedowns in 2008 and post the biggest loss in U.K. history, is down 94 percent since Sept. 19. Paulson & Co. said its funds made more than $3 billion for the firm in 2007 by judging that the U.S. housing market and subprime mortgages would collapse.

Read morePaulson Fund Makes at Least $420 Million Shorting RBS