– Is This The End Of CNBC As We Know It?:

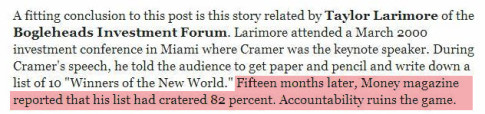

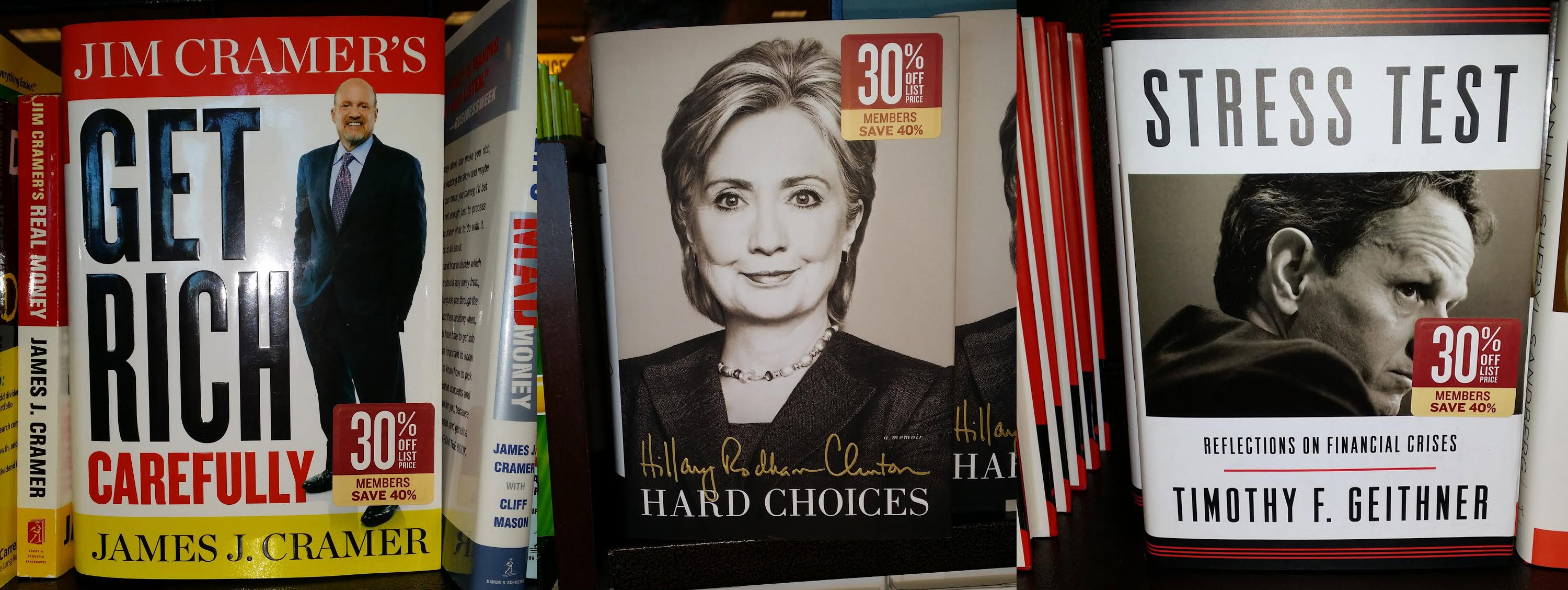

One of the core aspects of mainstream financial media in general, and outlets like CNBC in particular, more so even than their chronic permabullish bias, is the seemingly endless gallery of “experts”, “pundits”, and other talking heads whose only requirement is wearing a business suit (in some very notable exemptions) who show up on TV, offer trade advice and recommendations – while either pitching their own trading services or hoping to offload their own existing positions – and if (or rather when) said advice leads to material losses are not heard from again until a certain period of time passes, and those who suffered listening to said “experts” have moved on, at which point the farce repeats itself.