CEO Jamie Dimon revealed Thursday that JPMorgan had suffered a $2 billion trading loss.

– Fitch downgrades JPMorgan Chase (CNN Money, May 11, 2012):

NEW YORK (CNNMoney) — The closing bell brought no relief for JPMorgan Chase on Friday, as a major credit rating agency moved to downgrade its debt almost exactly 24 hours after the bank revealed a $2 billion trading loss.

Fitch Ratings downgraded both JPMorgan’s short-term and long-term debt, with the latter falling to A+ from AA-. The bank, the country’s largest by assets, was also placed on ratings watch negative.

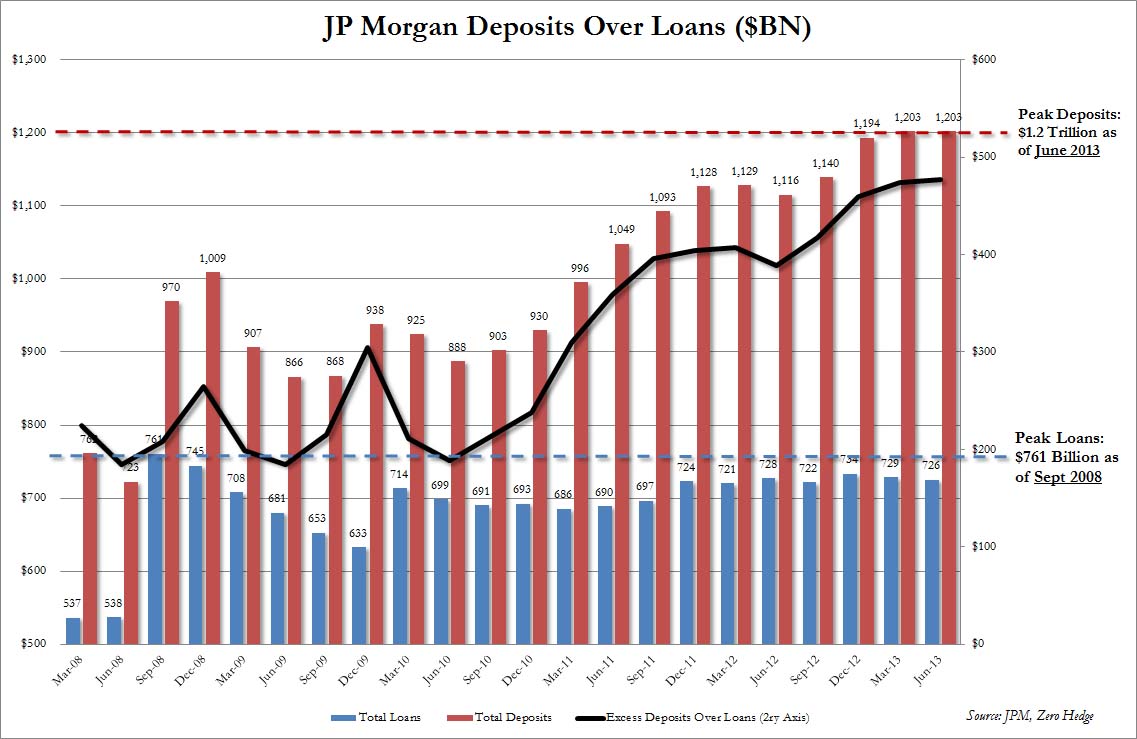

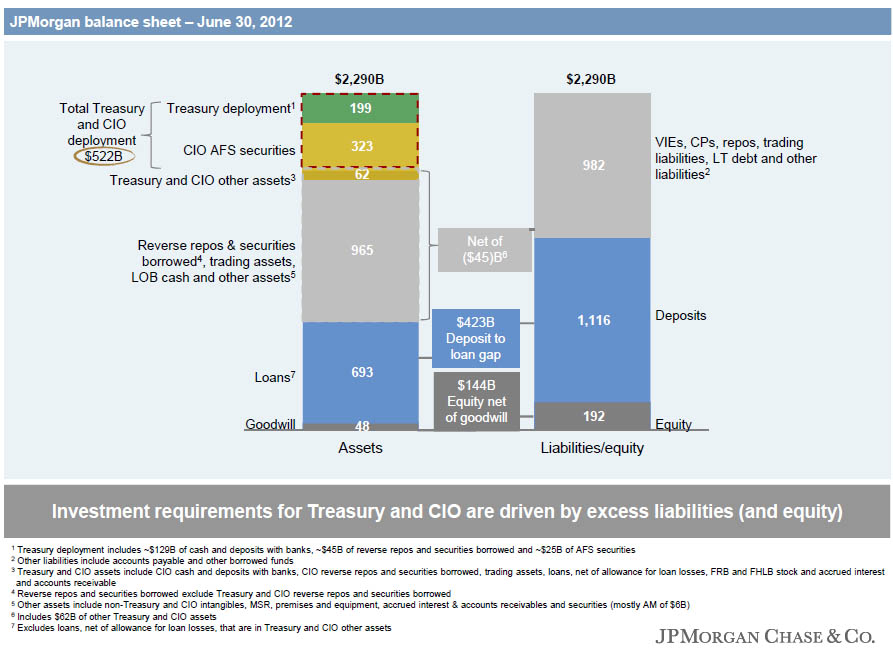

Fitch said it views the $2 billion loss as “manageable” but added that “the magnitude of the loss and ongoing nature of these positions implies a lack of liquidity.”

– Fitch Downgrades JPM To A+, Watch Negative (ZeroHedge, May 11, 2012):

Update: now S&P is also one month behind Egan Jones: JPMorgan Chase & Co. Outlook to Negative From Stable by S&P. Only NRSRO in pristinely good standing is Moodys, and then the $2.1 billion margin call will be complete.

So it begins, even as it explains why the Dimon announcement was on Thursday – why to give the rating agencies the benefit of the Friday 5 o’clock bomb of course:

- JPMorgan Cut by Fitch to A+/F1; L-T IDR on Watch Negative

What was the one notch collateral call again? And when is the Morgan Stanley 3 notch cut coming? Ah yes:

So… another $2.1 billion just got Corzined? Little by little, these are adding up.

Oh and guess who it was that downgraded JPM exactly a month ago. Who else but SEC public enemy number one: Egan-Jones:

Synopsis: Reliance on prop trading and inv bkg income remain. LLR declines (down $1.7B QoQ and $3.87B YoY) offset DVA losses in the investment bank. Wholesale loans were up 23% YoY and 2% QoQ. Middle Mkt, Cmml Term, Corp Client and Cmml Real Estate lending increased by 9%, 2%, 16% and 19% YoY. Middle Mkt and Corp lending was up 2% and 3% QoQ respectively, while Cmml Term, and Cmml Real Estate lending were down 2%, and 9% respectively. Card and consumer loans were down 2% and 5% YoY respectively (down 5% and 1% QoQ respectively). Non accruals are up 14% QoQ due to weakness in JPM’s student loan portfolio. Reserve coverage is good and capital is adequate. We believe JPM will experience further weakness in its retail portfolio due to a softening economy. We are downgrading.

Full Fitch “analysis”:

Read moreFitch Downgrades JPMorgan Chase To A+, Watch Negative … After A $2 Billion Trading Loss