(AXcess News) – Gas pumps in the United States tell the same story as rice prices in Thailand: Inflation is a global phenomenon this year.

Oil hit a record $112 per barrel this week, and a United Nations official warned of continued pressure on food prices, which by one index are up 45 percent in the past year.

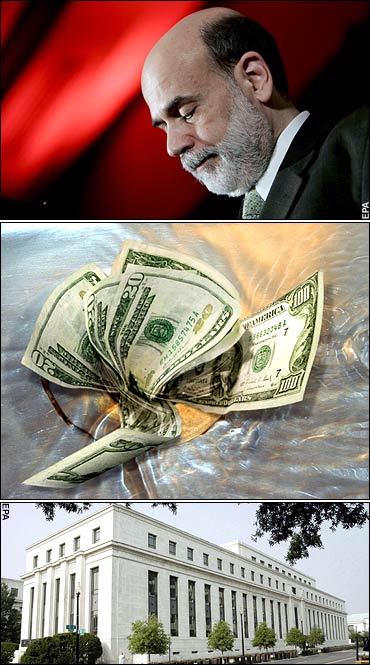

The challenges are worst in developing nations, where raw materials account for a larger share of consumer spending. But another factor – the sagging value of the US dollar – means that imports cost more in America and other nations that peg their currencies to the dollar.

Still, regardless of this currency phenomenon, several broad forces are pushing prices up.

After years of strong global economic growth, prices of oil, grains, and some metals have spiked. Investors are adding fuel to that fire by buying up hard assets like commodities, which are viewed as a hedge against inflation.

More fundamentally, many nations have been relatively loose in the creation of money supply. For all the news about interest-rate cuts by the Federal Reserve, this trend goes well beyond US shores.