The number of borrowers collapsing under the weight of their debts has soared to an all-time high.

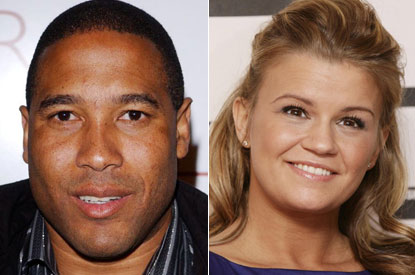

Insolvent: ex-England football star John Barnes and pop singer Kerry Katona

A record 35,242 personal insolvencies were registered in the third quarter of the year — about 3,000 in London — the most since records began in 1960.

The total, up 28 per cent in a year, has been fuelled by a sharp rise in middle class families unable to cope with their finances, according to debt advisers.

Related articles:

– Personal insolvencies rise 28% to 49-year high (Times Online)

– Insolvencies jump to record high (Reuters)

– Largest number of insolvencies in at least half a century (Telegraph)

Famous figures who have filed for bankruptcy in the recession include former England football star John Barnes and former Atomic Kittens singer Kerry Katona.

The tally for 2009 is now certain to pass last year’s figure of 106,544 and could hit 130,000, with some experts predicting a further rise next year and in 2011.

Read moreUK: Personal insolvencies jump to record high as middle class and famous are hit