– Yanis Varoufakis Issues a Major Warning to the Greek People:

Varoufakis said that Schäuble, Germany’s finance minister and the architect of the deals Greece signed in 2010 and 2012, was “consistent throughout”. “His view was ‘I’m not discussing the program – this was accepted by the previous [Greek] government and we can’t possibly allow an election to change anything.

“So at that point I said ‘Well perhaps we should simply not hold elections anymore for indebted countries’, and there was no answer. The only interpretation I can give [of their view] is, ‘Yes, that would be a good idea, but it would be difficult. So you either sign on the dotted line or you are out.’”

– From last year’s post: Everything You Need to Know About the Greek Crisis and ECB Fascism in Two Paragraphs

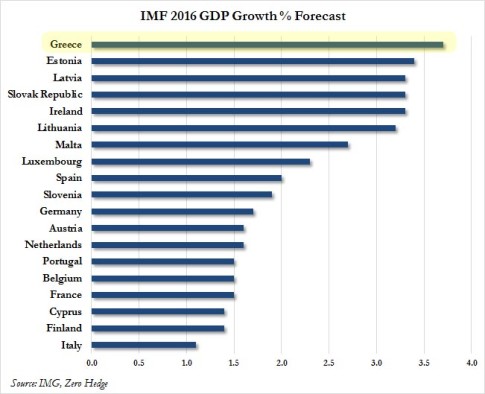

By now, most of you have heard about Wikileaks’ release of internal deliberations between the top two IMF officials in charge of managing the Greek debt crisis – Poul Thomsen, the head of the IMF’s European Department, and Delia Velkouleskou, the IMF Mission Chief for Greece.

Read moreYanis Varoufakis Issues a Major Warning to the Greek People