Flashback:

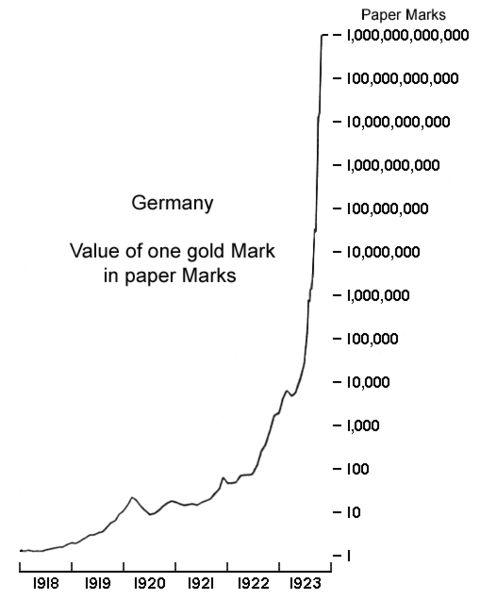

– Gold & Silver Prices Under The Weimar Republic’s Inflation

* * *

Please support I. U.

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

The man who trades freedom for security does not deserve nor will he ever receive either. – Benjamin Franklin

“By failing to prepare, you are preparing to fail.”

– Benjamin Franklin

Don’t miss!

*****

Related info:

– Anita Bailey PhD Interview – Part 1 – Cold Times: Preparing For The Mini Ice-Age (Video)

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

As predicted.

Irlmaier predicted in around 1950 the migrant influx, followed by high inflation, then hyperinflation and much worse coming…

– The Prophecies Of Alois Irlmaier – The Roadmap To WW3 – The 3 Days Of Darkness (Worse Than WW3)

******

– Blain: “Stop Worrying About The Yield Curve, Something Much Worse Is Around The Corner”:

From Blain’s Morning Porridge, Submitted by Bill Blain of Mint Partners

Stop worrying about the US yield curve – its a distortion. Something much worse is around the corner….

For my German speaking readers:

PDF: http://kumhofer.at/irlmaier/buecher/Alois%20Irlmaier,%20Ein%20Mann%20sagt%20was%20er%20sieht.pdf

Here is an article about Alois Irlmaier in English:

– The Prophecies Of Alois Irlmaier – The Roadmap To WW3 – The 3 Days Of Darkness (Worse Than WW3)

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

For my German speaking readers:

PDF: http://kumhofer.at/irlmaier/buecher/Alois%20Irlmaier,%20Ein%20Mann%20sagt%20was%20er%20sieht.pdf

Here is an article about Alois Irlmaier in English:

– The Prophecies Of Alois Irlmaier – The Roadmap To WW3 – The 3 Days Of Darkness (Worse Than WW3)

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

– Whatever Happened to Inflation after All This Money Printing? It Has Arrived!

Related info:

Alois Irlmaier predicted (in 1950) high inflation and then hyperinflation:

– The Prophecies Of Alois Irlmaier – The Roadmap To WW3 – The 3 Days Of Darkness (Worse Than WW3)

*****

H/t reader squodgy:

“Of course the dampened and massaged ‘official’ figures bear no resemblance whatsoever to the reality Joe BigMac sees on the supermarket shelves.

Never forget………. your Government lies to you.”

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

Having observed the economic chaos to emerge as a result of India’s shocking Nov. 8 demonetization announcement, and perhaps confident it can do better, today president Nicolas Maduro of Venezuela, Latin America’s most distressed economy, mired in an economic crisis and facing hyperinflation, likewise shocked the nation when he announced on state TV that just like India, Venezuela would pull its highest denominated, 100-bolivar bill (which is worth about two U.S. cents on the black market), from circulation over the next 72 hours, ahead of the introduction of new, higher-value notes, as large as 20,000.

“I have decided to take out of circulation bills of 100 bolivars in the next 72 hours,” Maduro said. “We must keep beating the mafias.”

To this we would add “and cue economic chaos”, but since this is Venezuela, that’s a given.

Read moreVenezuela Eliminates Half Its Paper Money After Pulling Largest Bill From Circulation

– “Economy Shattered, Currency Collapsing”: Venezuelans Wait In 6 ATM Lines For Enough To Buy Rice:

Is this how the economic crisis will play out in America? A cash strapped population, forced to the brink and stripped of their dignity?

Unfortunately, it is already underway in Venezuela.

Of course there is a higher standard of living in the United States overall, but tens of millions of people are already on the edge of poverty and tens of millions more can be brought to their knees in a matter of hours.

– One Scary Chart: Venezuela’s Currency Disintegrates:

It was just this past Monday when we were reported that the Venezuela currency, the Bolivar, had crashed below 3,000 for the first time ever, losing 15% of its value in just one day as the Venezuela hyperinflation had entered its terminal phase.

Today, the DolarToday.com website, maintained by a person the WSJ dubbed “Public Enemy No. 1 of Venezuela’s revolutionary government, Gustavo Díaz, a Home Depot Inc. employee in central Alabama” reports that having crossed the psychological 2,000 level ten days ago, and taking out the 3000 barrier earlier this week, the Bolivar has now plunged to a new all time low of 4,609.37 on the black market, dropping by 15% from its latest print of 2,972 reported on Friday of last week, and has lost 60% in its value just in the past month.

So for anyone still unsure what real-time hyperinflation looks like, here is the updated visual answer.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

– Zimbabwe Goes Down The Path Of Hyperinflation… Again:

Some people just don’t learn.

After becoming the most famous case of hyperinflation in modern history roughly ten years ago, Zimbabwe is about to have another go at conjuring paper money out of thin air.

I’m sure this time will be different.

You know the story. Starting in the late 1990s, the Zimbabwe government’s policies under Robert Mugabe began to have some devastating effects.

He confiscated private property from established (mostly white) farmers and redistributed the land in very tiny tracts to his supporters, most of whom had no experience in farming.

Unsurprisingly, Zimbabwe’s once-booming agriculture exports collapsed almost overnight.

Read moreZimbabwe Goes Down The Path Of Hyperinflation… Again

H/t reader squodgy:

“If we can’t all learn from the situation in Venezuels, which has been created by the banksters as a lesson to the people for wanting to share the spoils of their oil assets, then we have no hope.

It is coming to us all, we have had enough warnings and notice, we have no excuse.”

– Total Societal Collapse: What the Media Isn’t Telling You About Venezuela:

Venezuela — Life in Venezuela now consists of empty grocery stores, record rates of violent crime, and widespread shortages of just about everything. The economic and political conditions have been deteriorating for years, but recent stories coming from this once-rich nation are astonishing. Bars have run out of beer, McDonald’s can’t get buns for their Big Macs, and rolling blackouts are a regular occurrence. The average person spends over 35 hours a month waiting in line to buy their rationed goods, and even basics like toilet paper and toothpaste are strictly regulated.

The fiasco began when the price of oil collapsed and sent Venezuelan finances into chaos. The oil-dependent nation, despite its imposing government policies, couldn’t prevent the fallout. The current problems are further compounded by rampant corruption throughout the Venezuelan government. The likelihood of a peaceful resolution is decreasing by the day, and political dissents are likely to be met with brutal crackdowns. The desperation of the masses could explode violently under the right circumstances, and there are few things more dangerous to a nation than a hungry population.

Read moreTotal Societal Collapse: What the Media Isn’t Telling You About Venezuela

@Amazon.com: How to Survive the End of the World as We Know It: Tactics, Techniques, and Technologies for Uncertain Times

If you want to survive a collapse scenario this is a must-listen interview:

https://youtu.be/As9Gomz2124

Survival Expert James Rawles Warns: “There’s Going To Be A Massive Run On Firearms… Bigger Than Anything We’ve Ever Seen Before” If Hillary Win Is Imminent

James Wesley Rawles is a former intelligence officer of the United States Army, prolific author and one of the top survival experts in the world. In his best-selling book series Patriots he paints a terrifying picture of a post-collapse America where food is scarce, currency is worthless, law and order have broken down, and survival is a daily struggle. It’s a fictional tale, of course, but one that is grounded in real-world possibilities.

https://www.youtube.com/watch?v=5e1ImGC3ojY

Jun 10, 2016

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

– Question of the Day: When Was the Last Time the Yield on German 10-Year Bonds Went Negative?:

Think back. Many readers have been trading for 10 or 20 years. A few have been trading for 30 or more years. What was it like the last time German 10-year bond yields went negative?

That is sort of a trick question. Most likely you were not alive, no matter how old you are.

As translated from Spanish, my friend Guru Huky posted the answer on his blog today: And the last time the German bond stood negative was …. surprise surprise.

German 10-Year Yield Since 1807

– How Would You Survive Hyperinflation in Venezuela?:

Venezuela is currently in the throes of a devastating economic collapse that was spawned by the ignorant socialist policies of the Chavez/Maduro government. Everything is falling apart there. The water system, the roads, the electrical grid, the hospital, and especially the food distribution system. Venezuelans are so desperate that they are forced to scrounge for food in dumpsters and hunt down cats and dogs. Crime is rampant as well, and the capital city of Caracas now has the highest murder rate in the world. Mobs of vigilantes are frequently seen picking up the slack of the corrupt police; that is, when they’re not busy looting grocery stores. Venezuela is practically a war zone now.

– The Germans React To Draghi’s Monetary “Tidal Wave”:

Having discussed the market’s disturbing reaction to Mario Draghi’s desperate “all in” monetary gamble – one which saw an early bout of euphoria followed by one of the most aggressive Euro spikes in history, second only to the “December debacle” and the Fed’s March 2009 announcement of QE1, we were waiting for the just as important reaction by the ECB’s nemesis: the one country that not only has seen hyperinflation first hand (and appears to recall it vividly), but is just as aware where the ECB’s monetary lunacy ends: the Germans.

We got it from Germany’s Handelsblatt, when in an article titled “The dangerous game with the money of the German savers”, the authors provide a metaphorical rendering of what is happening in Europe as follows:

They also paint an oddly accurate caricature of the man behind this last ditch monetary policy:

And write the following:

A determined ECB chief Mario Draghi plows ahead with his negative interest rate policy. The positive effects on the economy are low. Great, however, are the risks: this is the greatest redistribution of wealth in Europe since World War II.

Read moreThe Germans React To Draghi’s Monetary “Tidal Wave”

“Everything calls peace, Schalom! Then it will occur – a new Middle East war suddenly flames up, big naval forces are facing hostiley in the Mediterranean – the situation is strained. But the actual firing spark is set on fire in the Balkan: I see a “large one” falling, a bloody dagger lies beside him – then impact is on impact. …”

There is not much information about Alois Irlmaier available on the internet in English and even less good quality information.

He made his predictions before, during and after WW2.

For more and accurate information I recommend this book (in German):

He predicted the migrant crisis.

He predicted hyperinflation, financial collapse, revolution, civil war, WW3 and the “3 Days Of Darkness”, which will set in during WW3 and will put an immediate end to all combat operations.

He saw (around 1950) people using smartphones in the future.

When Germany was occupied territory he was visited by General Lucius D. Clay’s sister and could clearly describe her home without ever being there. General Clay invided Irlmaier to come to Frankfurt, but he declined. Additionally he was offered and invited many times by a lot of people to come to America (Amerika in German) and earn a lot of money there with his abilities, but he declined. He clearly stated that he was not interested in earning a lot of money.

In case you think that foreseeing the future is impossible I give you some examples of his abilities:

Alois Irlmaier, my favorite seer, warned the citizens of his hometown during the end of WW2 April, 25, 1945, that at the moment of his warning British bombers were started in England and would arrive within a few hours to bomb the city of Freilassing in Bavaria.

He told the people where to go to be safe and he pointed out exactly to some people, which houses will be destroyed, partially destroyed or which houses will survive almost unharmed or totally unharmed.

He warned people in Rosenheim, Bavaria days ahead of the heavy bombardment on April 18, 1945. He told the people, that when going into the bunker to NOT go to the safest spot, which is in the middle, but to stay near the entrance, because the roof of the bunker would collapse in the middle. It happened just as he predicted and so only a few soldiers who ridiculed and ignored Irlmaier’s warning were buried.

You could give him a picture of any soldier and he could tell you exactly in what condition that soldier was at the moment: Well, injured or dead.

He clearly saw all of this right in front of his eyes, as a picture or like a movie. He did not want to have this ability at all.

It would take an entire book to describe his abilities, his life and what has been said about him.

Here is what lies ahead of us according to him:

A migrant crisis, high inflation, then hyperinflation, financial economic collapse, chaos, revolution, civil war in Italy (Pope will have to flee the Vatican, most priests will be killed), France (Paris will burn, will be set on fire by its own people), Germany, etc.

If my interpretation of what he said is correct, then the greatest revolution of all times will happen in America.

The crisis in the middle east will escalate even further, a highranked (at the level of Trump) will be killed, then within 24h Russian tanks will be rolling all over Europe.

The U.S. will use drones & advanced chemical weapons to create a death strip to cut of the Russian ordnance.

The Russians drop a bomb (nuclear weapon) into the North Sea, creating a gigantic tsunami, which will flood parts of England, France, Holland, Germany and Denmark.

The start of WW3 is predicted to happen “when the grain will be ready for harvest” (perfect timing!), that means around late July, beginning of August. A lot of other seers have seen the same time of the outbreak of WW3 in their visions.

The war will last around 3 months, then the earth changes will set in. Irlmaier saw a heavenly body, which is probably responsible for the “3 Days Of Darkness”.

The “3 Days of Darkness” will include a pole shift. So you need to be living in a high place, having a safe place that is pretty much airtight, protecting against the (big) dust particles from the heavenly body and you need lots of supplies and water.

After that he predicts a peaceful time.

“….After these events a long, lucky time comes. Those, who will experience it, will be very happy and can praise themselves lucky. But the people have to begin there, where their grandfathers began.”

And because of the climatic changes, caused by the pole shift, oranges will grow in Bavaria.

The events mentioned in the following article are not in the correct chronological order, but luckily for us somebody made the effort to translate what Irlmaier said.

– The Prophecies Of Alois Irlmaier

On this page statements of Alois Irlmaier are listed, which refer to a big war in the future. Conrad Adlmaier got these statements when discussing with Alois Irlmaier and published them later. In addition also statements are listed, which Conrad Adlmaier did not publish in his books, but indicated to a third person orally. In these statements Alois Irlmaier shows an almost precise description of a large battle in the future.

What causes the war?

“Everything calls peace, Schalom! Then it will occur – a new Middle East war suddenly flames up, big naval forces are facing hostiley in the Mediterranean – the situation is strained. But the actual firing spark is set on fire in the Balkan: I see a “large one” falling, a bloody dagger lies beside him – then impact is on impact. …”

“Two men kill a third highranked. They were paid by other people. …”

“The third murder occurred. Then the war starts. …”