– Obama the tyrant king unleashes dictatorial order that will now invoke “open rebellion” – Senate aide:

With the stroke of a pen, President Obama has now set America on the path toward open rebellion and revolt. By declaring that he alone has the right to dictate immigration policy without the legislative approval of Congress, he has committed yet another lawless act in a long series of illegal schemes that cement his position in history as nothing more than a sociopathic liar and destroyer of nations.

…

Source: Artizans.com

– Obama extends deportation reprieve to 5 million undocumented immigrants:

President Barack Obama announced an executive order on immigration reform Thursday, which he will sign on Friday. The actions will affect up to 5 million undocumented immigrants in the US, many of whom are the parents or spouses of legal residents.

Obama announced his plan for unilateral action on immigration via a prime-time address from the White House. He will sign the executive order during a rally in Las Vegas on Friday. Because the plan will not be passed by Congress, it could also be easily reversed by a new president after Obama’s term runs out in just over two years.

…

“Accidental discharge”…:

Sure!

– The FBI Is Very Excited About This Machine That Can Scan Your DNA in 90 Minutes:

Rapid-DNA technology makes it easier than ever to grab and store your genetic profile. G-men, cops, and Homeland Security can’t wait to see it everywhere.

…

– Least Transparent Ever – Obama Administration Fighting to Prevent Release of C.I.A. Torture Report:

…

His latest intervention on behalf of the forces of opacity, revolves around the release of a report on CI.A. torture put together by The Senate Intelligence Committee, which is 6,000 pages long and has been five years in the making. Naturally, the Obama Administration is taking painstaking efforts to block its release.

…

– Gold Repatriation Stunner: Dutch Central Bank Secretly Withdrew 122 Tons Of Gold From The New York Fed:

A week ago, we penned “The Real Reason Why Germany Halted Its Gold Repatriation From The NY Fed“, in which we got, for the first time ever, an admission by an official source, namely the bank that knows everything that takes place in Germany – Deutsche Bank – what the real reason was for Germany’s gold repatriation halt after obtaining a meager 5 tons from the NY Fed:

… the gold community paid great attention to the decision of the German Bundesbank to “bring German gold home”. At the beginning of 2013, the Bundesbank announced it would repatriate 300 tonnes of gold stored in the US by 2020. It is well behind schedule, citing logistical difficulties. Yet diplomatic difficulties are more likely to be the chief cause of the delay, especially seeing as the Bundesbank has proven its capacity to organise large-scale gold transports. In the early 2000s, the Bundesbank incrementally repatriated 930 tonnes of German gold held by the Bank of England.

Some took offense with this, pointing out, accurately, that the gold held at the NY Fed in deposit form for foreign institutions had continued to decline into 2014 despite the alleged German halt. Well, today we know the answer: it wasn’t Germany who was secretly withdrawing gold from the NYFed contrary to what it had publicly disclosed.

It was the Netherlands.

…

Rothschild agent

– “Gold Is Money And Nothing Else” – JP Morgan’s Full December 1912 Testimony To Congress:

In December 1912, no lessor man than J.P.Morgan testified to Congress to “justify Wall Street,” during investigations over alleged manipulation and collusion. The transcript reads like it could have been given yesterday (as nothing ever changes) but at its heart the banker laid out 33 “Morgan Epigrams” which appear – in the ensuing 102 years – have been lost to greed and arrogance… The irony is wondrous: “Securities do not always prove good”, “Money is gold, and nothing else”, “I think manipulation is always bad.”

…

– 12 Charts Show Connection Between Roundup and Disease:

Roundup is found in 75% of air and water samples. Many farmers drench crops with Roundup right before harvest. About 100 million pounds are applied to U.S. farms and lawns every year, according to the EPA.

Monsanto claims that Roundup is totally safe, and can be dumped on everything without problem.

Is it true?

In reality, Roundup is linked to a number of diseases. And the ingredients in Roundup are deadly to human cells.

A study from the Journal of Organic Systems includes the following 12 charts which show the correlation between Roundup (technically known as “glyphosate”) and disease:

…

– CIA wants to delete thousands of emails as Obama administration stalls release of torture report:

The CIA wants to erase tens of thousands of internal emails sent by most covert and counterterror officers after they leave the agency, leading US senators and transparency advocates to fear the plan would mean the loss of vital government records.

…

– 10 Examples Of The Social Decay That Is Eating Away At America Like Cancer:

It isn’t just our economy that is crumbling. Something is happening to America that no amount of money will be able to fix. Everywhere around us we can see evidence of the social decay that is systematically eating away at the foundations of our society.

…

– Wall Street Stunned As Iceland Dares To Jail Banker Involved In 2008 Crash:

The impossible is possible. Never say never. Wall Street bankers are staring agog at headlines coming from Europe where, in Iceland, the former chief executive of one of the largest banks in the country which was involved in crashing the economy in 2008 has been sentenced to jail time. As Valuewalk reports, in receiving a one year prison sentence, Sigurjon Arnason officially became the first bank executive to be convicted of manipulating the bank’s stock price and deceiving investors, creditors and the authorities between Sept. 29 and Oct. 3, 2008, as the bank’s fortunes unwound, crashing the economy with it. It appears he was as shocked by the verdict as Wall Street-ers are, “this sentence is a big surprise to me as I did nothing wrong.” It was likely all for the people’s own good…

…

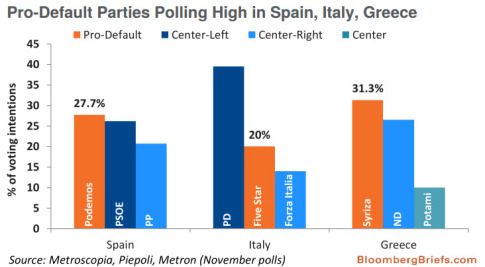

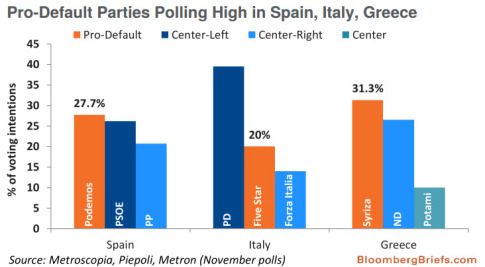

– Europe’s New Scariest Chart:

Recent polls show pro-default parties growing popular in peripheral euro-area countries such as Greece, Italy and Spain. As Bloomberg Brief’s Maxime Sbaihi notes, in a depressed economic environment, their promises to restructure public debt might soon bring them to power and tempt traditional parties to adopt their ideas. This return of political risk in the euro area doesn’t appear to be priced in by market participants. As Italy’s Beppe Grillo recently exclaimed, “we will leave the Euro and bring down this system of bankers, of scum.”

…

FYI:

– ‘AIDS, Ebola, Obama – Thanks Africa’ roadside sign causes a stir in Nebraska:

A homemade sign proclaiming “AIDS, Ebola, Obama – Thanks Africa” caused a commotion in the town of Minden, Nebraska this week after a local man drew the ire of area residents when he erected it on his own property.

…

A “little” late:

– Charles Schwab Urges The Fed To Raise Interest Rates “As Quickly As Possible”:

Authored by Charles Schwab (yes, that Charles Schwab), originally posted op-ed at The Wall Street Journal,

For America’s 44 million senior citizens, plus tens of millions of others who are on the threshold of retirement, last month marked a watershed moment that is worth celebrating. At the end of October, the Federal Reserve announced the first step in returning to a more normal monetary policy. After nearly six years of near-zero interest rates and quantitative easing, the Fed is ending its bond-buying program and has signaled a plan to eventually begin raising the federal-funds rate, raising interest rates to more normal levels by 2017.

U.S. households lost billions in interest income during the Fed’s near-zero interest rate experiment.

…

– Jerusalem mayor: Revoke citizenship for terrorists’ families:

The mayor of Jerusalem has called on Israeli authorities to revoke the citizenship of family members of terrorists. This proposal was made in response to growing tensions between Palestinians and Israelis.

…

– 40,000 to 60,000 tons of sulphur dioxide spewing out of Bárðarbunga volcano per DAY:

A few days ago I posted an article saying that Iceland’s Bardarbunga volcano was pumping out 35,000 tons of sulphur dioxide per day, more than twice the amount spewed from all of Europe’s smokestacks.

Turns out that it’s even worse than that.

According to the Icelandic National Broadcasting Service, RUV, some 40,000 to 60,000 tons […]

…

– TV: US nuclear workers’ brains eaten away, hallucinating, mental capacity of preschooler — Wife films frightened, trembling husband on deathbed — It’s indescribable what they’ve done and they don’t care — They want you to die — Gov’t Experts: It’s allergies from cats or feathers… or B-12 deficiency — Doctor: Quit helping workers get help (VIDEO):

…

KING 5 News, Oct 14, 2014: Gary Sall… [worked at Hanford] for 28 years… 10 years ago… his brain function got worse and worse. Within 5 years he… could barely speak, hallucinated, and operated on the level of a 4-year-old… Doctors diagnosed him with work-related toxic encephalopathy, a degenerative brain disorder… [His wife] Barb documented the suffering in a difficult to watch video taken in 2011… in a hospital bed, trembling and frightened and on a feeding tube… The DOE’s insurer wrote that not Hanford, but alcohol consumption or a B-12 deficiency could be making him sick… He died 3 years ago at the age of 57.

…

– Twice as much Fukushima radiation near California coast than originally reported; Highest levels found anywhere in Eastern Pacific — Scientist: Very little we can do… It’s unprecedented… God forbid anything else happens — Gundersen: Multiple plumes now along west coast… Will be coming “for century or more” (AUDIO)

– Ice forces earliest closure EVER of upper Mississippi:

Halts shipments of corn, soybeans, wheat, fertilizer, salt and other goods from the most northern reaches of the nation’s busiest waterway.

…

– New York State officials – Things will only get worse:

Another three feet (1 meter) of snow forecast for Buffalo.

…

– Buffalo – 30 major roof collapses, 100 minor collapses:

More collapses expected. Homeowners and store employees scrambling to remove the snow before rainfall adds even more weight to overloaded roofs.

…

FYI:

– ‘We will hunt you down’: KKK threatens to shoot Anonymous ‘n***** lovers’:

A bitter war of words between hacker collective Anonymous and the Klu Klux Klan risks spilling over into real violence, with the right-wing hate group allegedly threatening to shoot dead activists wearing the Guy Fawkes mask in southern Missouri.

…

– Obesity price tag: $2trn annually and ‘rapidly getting worse’:

Around 30 percent of the world’s population is now obese, while 50 percent is expected to fall into the category by 2030. Meanwhile, 5 percent of global deaths each year are linked to the condition, creating a drag on the global economy.

…

– Stocks Close At Recordest Highs As All Central Banks Go All In:

Despite the knee-trembling awesomeness of a double-whammy promise of liquidity, US equity markets ended the week on a decidedly down note. The realization that Draghi’s all talk (no impact on US stocks) and PBOC’s move is not a liquidity surge and has limited impact on the economy left stocks tumbling once the opening OPEX levels had printed. The USD rose notably on the day after EUR plunged under 1.24 on Draghi (USD +0.9% on the week). Despite USD strength, gold rose 1% (as did Silver) on the week, rising for the 3rd week in a row for the first time in 4 months (and the 3rd Friday surge in a row). Oil rose 1% on the week, breaking an 8-week losing streak but Copper prices fell around 0.3% on the week, having given back the kneejerk gains post-PBOC today. Treasury yields dropped after kneejerking higher on PBOC. 30Y at 3.01% had its 2nd lowest weekly close since May 2013. VIX melted down into the close to 13.01. Late-day buying panic lifts stocks off their lows leaving Dow & S&P at all-time recordest highs of all-time ever in history (as small caps closed red).

…

– NO ONE TOLD YOU WHEN TO RUN, YOU MISSED THE STARTING GUN:

…

I stumbled across two mind blowing charts yesterday that had me pondering how generations of Americans had frittered their lives away, spending money they didn’t have on things they didn’t need, utilizing easy to acquire debt, and saving virtually nothing for their futures or a rainy day. We are a nation of Peter Pans who never grew up. While I was driving home from work, one of my favorite Pink Floyd tunes came on the radio and the lyrics to Time seemed to fit perfectly with the charts I had just discovered.

…

– HFT War Stories: The Algo that Couldn’t Count:

This is the first in MKTSTK’sHFT War Stories series. Submitted anonymously by a high frequency trader. Names of people, places, and products have been omitted:

Algo trading has a way of making your hair turn white. Sometimes it’s the wild market action. The response then is to cut risk and keep on trading. The big losses come from avoidable human errors. Those are the losses you might not come back from.

The trading world is increasingly automated. Every year there are fewer human eyes watching the market at any given time. Traders employ algorithms to cut latency and market impact. Dealers find automation indispensable in quoting thousands of different exchange traded derivatives.

…

– Russia Can Survive An Oil Price War:

After a frosty reception at the G20 summit in Australia this week, Russian President Vladimir Putin required some much needed rest, at least according to the official explanation given for his conspicuously early departure from the proceedings. All things considered it could have been a lot worse. Russia finds itself in familiar territory after a controversial half-year, highlighted by the bloody and still unresolved situation in Ukraine. Nonetheless, the prospect of further sanctions looms low and Russia’s stores of oil and gas remain high.

…

– Did The Tech Bubble Just Quietly Pop?:

While some might scoff at the idea of there even being a bubble in hi-tech start-ups, it appears the massive wall of money that has been thrown at dot-com 2.0 names – all money-losing, social, mobile, cloud name-droppers – has dried up. As The TechCrunch Bubble Index shows, the last 90 days have seen startup-funding announcements collapse over 40% to their lowest level in almost 3 years…

…

– Gold Tops $1200 As China Cuts, Draghi Jawbones:

First Mario Draghi made some strong statements speaking in Asia that “It is essential to bring back inflation to target and without delay,” which sent EURUSD tumbling BUT did not spark moves in the S&P 500 (though Gold slipped). It was not until the PBOC cut rates (and sent AUD surging) that the US equity market perked up and started ripping… along with gold and as the morning progressed, gold has kept going as it is clear the Central Banks of the world have only one policy left… (no wonder the Dutch want their gold back)

…