– The Biggest Monetary Shock In 52 Years:

I recently revealed that the so-called “BRICS+” countries will announce the creation of a new currency at its annual leaders’ summit conference on August 22–24.

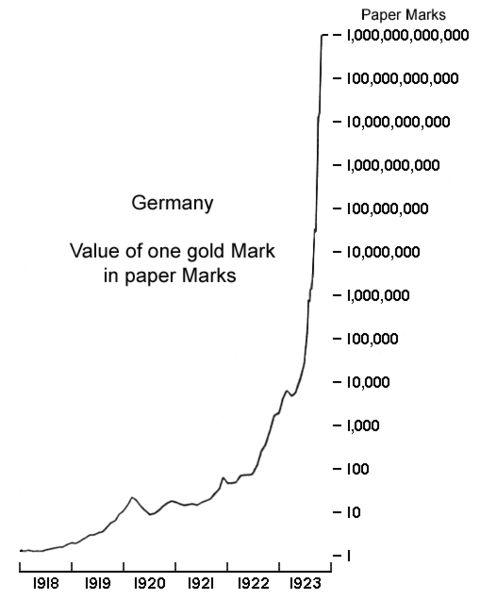

This will be the biggest upheaval in international finance since 1971. It’s taking direct aim at the dollar.

Quite simply, the world is unprepared for this geopolitical shock wave.

It appears likely that the new BRICS+ currency will be linked to a weight of gold. This plays to the strengths of BRICS members Russia and China. These countries are the two largest gold producers in the world, and are ranked sixth and seventh respectively among the 100 nations with gold reserves.

One difficulty in considering the impact of the new BRICS currency on the dollar is that all dollar indexes compare currency to currency. But that’s meaningless since the dollar, euro and sterling could all suffer from a loss of confidence at the same time.

If gold goes from $2,000 to $10,000 per ounce, that is better understood as an 80% devaluation of the dollar: from 0.0005 ounces per dollar to 0.0001 ounces per dollar. That’s a collapse of confidence but you’ll miss it if you’re looking at euros or yen.

Those currencies will all be collapsing at the same time.

The Only Way to Measure the Dollar

The only objective metric for dollar strength is the dollar price of gold by weight since gold is not a central bank currency. This resolves any valuation conundrum as follows:

Read moreJim Rickards: The Biggest Monetary Shock In 52 Years