There are always some that have a lot to celebrate:

– Warren Buffett’s $600 Million INTEREST-FREE Loan From US Taxpayers Or How The Wealthiest Americans Enrich Themselves At Taxpayers Expense

And how about ‘main street’?

– US Census: Number of Poor People May Be Millions Higher

– US: Food Stamps Used by Record 43.2 Million in October, Up 15 Percent From A Year Ago

– Geithner Warns Lawmakers That Failure to Raise US Debt Limit ‘Precipitates a Default by the United States’ With Catastrophic Economic Consequences

– US Consumer Bankruptcies Hit 5-year High in 2010

– Hiding The Greatest Depression: How The US Government Does It:

The real US unemployment rate is not 9.8% but between 25% and 30%. That is a depression level of job losses – so why doesn’t it look like a depression for many people? How can so large of a statistical discrepancy exist, and how is it that holiday shopping malls are so crowded in a depression?

This is the Greatest Depression.

The Great Depression

Most Americans have become so accustomed to the “new normal” of continual economic decline that they don’t even remember how good things were just a few short years ago. Back in 2007, unemployment was very low, good jobs were much easier to get, far fewer Americans were living in poverty or enrolled in welfare programs and government finances were in much better shape. Of course most of this prosperity was fueled by massive amounts of debt, but at least times were better. Unfortunately, things have really deteriorated over the last several years. Since 2007, unemployment has skyrocketed, foreclosures have set new all-time records, personal bankruptcies have soared and U.S. government debt has gotten completely and totally out of control. Poll after poll has shown that Americans are now far less optimistic about the future than they were in 2007. It is almost as if the past few years have literally sucked the hope out of millions upon millions of Americans.

Sadly, our economic situation is continually getting worse. Every month the United States loses more factories. Every month the United States loses more jobs. Every month the collective wealth of U.S. citizens continues to decline. Every month the federal government goes into even more debt. Every month state and local governments go into even more debt.

Unfortunately, things are going to get even worse in the years ahead. Right now we look back on 2005, 2006 and 2007 as “good times”, but in a few years we will look back on 2010 and 2011 as “good times”.

We are in the midst of a long-term economic decline, and the very bad economic choices that we have been making as a nation for decades are now starting to really catch up with us.

So as horrible as you may think that things are now, just keep in mind that things are going to continue to deteriorate in the years ahead.

But for the moment, let us remember how far we have fallen over the past few years. The following are 14 eye opening statistics which reveal just how dramatically the U.S. economy has collapsed since 2007….

#1 In November 2007, the official U.S. unemployment rate was just 4.7 percent. Today, the official U.S. unemployment rate is 9.4 percent.

#2 In November 2007, 18.8% of unemployed Americans had been out of work for 27 weeks or longer. Today that percentage is up to 41.9%.

#3 As 2007 began, there were just over 1 million Americans that had been unemployed for half a year or longer. Today, there are over 6 million Americans that have been unemployed for half a year or longer.

#4 Nearly 10 million Americans now receive unemployment insurance, which is almost four times as many as were receiving it back in 2007.

#5 More than half of the U.S. labor force (55 percent) has “suffered a spell of unemployment, a cut in pay, a reduction in hours or have become involuntary part-time workers” since the “recession” began in December 2007.

#6 According to one analysis, the United States has lost a total of approximately 10.5 million jobs since 2007.

#7 As 2007 began, only 26 million Americans were on food stamps. Today, an all-time record of 43.2 million Americans are enrolled in the food stamp program.

#8 In 2007, the U.S. government held a total of $725 billion in mortgage debt. As of the middle of 2010, the U.S. government held a total of $5.148 trillion in mortgage debt.

#9 In the year prior to the “official” beginning of the most recent recession in 2007, the IRS filed just 684,000 tax liens against U.S. taxpayers. During 2010, the IRS filed over a million tax liens against U.S. taxpayers.

#10 From the year 2000 through the year 2007, there were 27 bank failures in the United States. From 2008 through 2010, there were 314 bank failures in the United States.

#11 According to the U.S. Department of Housing and Urban Development, the number of U.S. families with children living in homeless shelters increased from 131,000 to 170,000 between 2007 and 2009.

#12 In 2007, one poll found that 43 percent of Americans were living “paycheck to paycheck”. Sadly, according to a survey released very close to the end of 2010, approximately 55 percent of all Americans are now living paycheck to paycheck.

#13 In 2007, the “official” federal budget deficit was just 161 billion dollars. In 2010, the “official” federal budget deficit was approximately 1.3 trillion dollars.

#14 As 2007 began, the U.S. national debt was just under 8.7 trillion dollars. Today, the U.S. national debt has just surpassed 14 trillion dollars and it continues to soar into the stratosphere.

So is there any hope that we can turn all of this around?

Unfortunately, the massive amount of debt that we have piled up as a society over the last several decades has made that impossible.

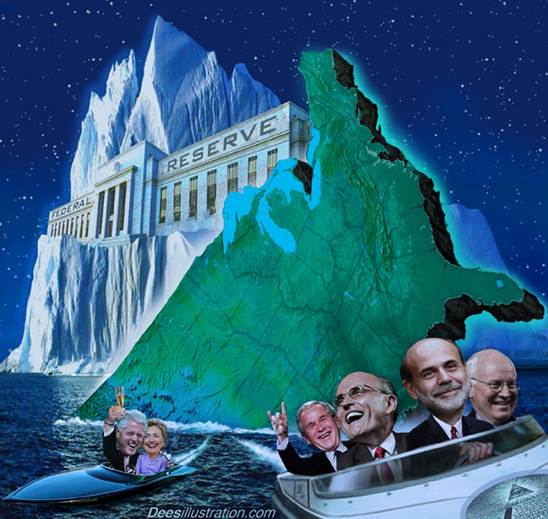

If you add up all forms of debt (government debt, business debt, individual debt), it comes to approximately 360 percent of GDP. It is the biggest debt bubble in the history of the world.

If the federal government and our state governments stop borrowing and spending so much money, our economy would collapse. But if they keep borrowing and spending so much money they will continually make the eventual economic collapse even worse.

We are in the terminal stages of the most horrific debt spiral the world has ever seen, and when the debt spiral gets stopped the house of cards is going to finally come down for good.

So enjoy these times while you still have them. Yes, today is not nearly as prosperous as 2007 was, but today is most definitely a whole lot better than 2015 or 2020 is going to be.

Sadly, we could have avoided this financial disaster completely if only we had listened more carefully to those that founded this nation. Once upon a time, Thomas Jefferson said the following….

I wish it were possible to obtain a single amendment to our Constitution. I would be willing to depend on that alone for the reduction of the administration of our government to the genuine principles of its Constitution; I mean an additional article, taking from the federal government the power of borrowing.

January 10th, 2011

Source: Economic Collapse Blog

‘The Mervy King’ ‘nuked’ the UK with quantitative easing before:

‘The Mervy King’ ‘nuked’ the UK with quantitative easing before: