See also:

– Fluoride: A Chronological History (Must-read!)

– Scientific Facts on the Biological Effects of Fluoride

– The Drugging Of America with Fluoride

– Fluoride & The Manhattan Project (Declassified Government Documents)

– Fluoridation: A Horror Story

– Fluoride: The Phosphate Connection

Fluoride, added to the water supply of many cities and counties and sold by WalMart in its nursery water, has a tendency to accumulate not only in developing teeth causing discoloration, and in bones making them brittle. The mineral is associated with cancer and it also accumulates in the pineal gland, an important hormone control center, where it wreaks considerable havoc.

Paul Connett of Fluoride Action Network comments on Jennifer Luke’s research which was part of her PhD thesis and had just been published in Caries Research under the title: Fluoride Deposition in the Aged Human Pineal Gland.

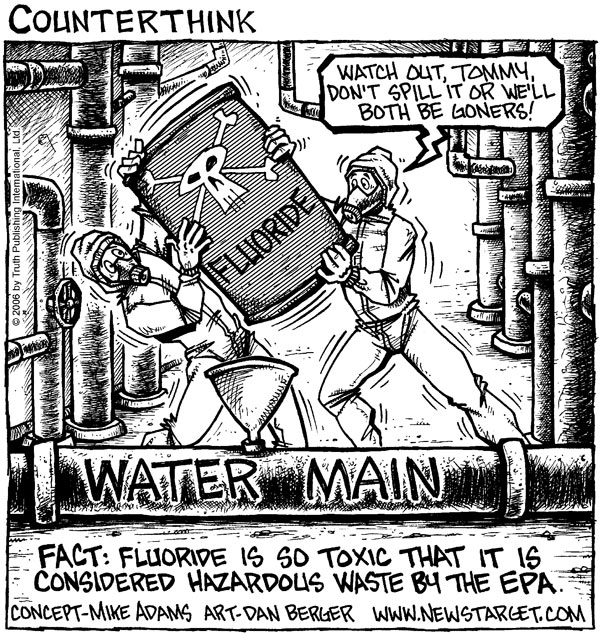

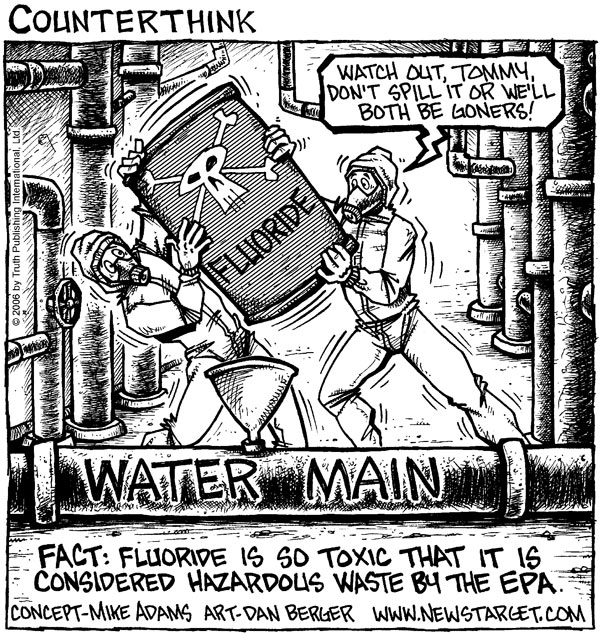

Fluoride is a poison, yet we add it to our water and toothpaste and even call it a supplement, although it has no nutritional value. Its medicinal value – the prevention of tooth decay – is the official explanation for adding the toxic mineral to the water supply. But that value is far outweighed by its toxic side effects – amply documented by Paul Connett in his Statement of Concern.

Recent European Union legislation on food supplements lists fluoride as an essential element to offer for supplementation. This is somewhat ironic when contrasted with the European legislators’ feigned concern over the putative toxicity of vitamins and their efforts to limit dosages of these vital nutrients in order to “protect public health”.

We also use fluoride in many household items, such as non-stick frying pans, high-tech water repellent fabrics and others. Recently, at least some timid attempts to start assessing the disease burden caused by fluoride are under way. The Journal of Water Health carries an article on this research. Meanwhile in the US, the FDA has decided that fluoride should be allowed in bottled water, perhaps in deference to WalMart’s offerings.

The use of fluoride for “health” reasons is one of the great insanities of our times. Could it be just by chance that the Germans and Russians both used fluoride to make prisoners stupid and docile or that the US government faced legal action over the toxic effects in the environment of this nuclear waste by-product?

Perhaps the push for ‘enriching’ our water and our foods with fluoride has some ulterior motive that has little to do with health. Be that as it may, the campaign for fluoridation is stil in full swing and health authorities are pushing the poison as if their monthly paychecks depended on it.

Jennifer Luke’s PhD thesis on fluoride and its accumulation in the pineal gland – Paul Connett says that research might just be the scientific straw that breaks the camel’s back:

– – –

Fluoride & the Pineal Gland: Study Published in Caries Research

The wheels of science grind very slowly. Finally, the first half of the work that was the subject of Jennifer Luke’s Ph.D. thesis; presentation in Bellingham, Washington (ISFR conference) in 1998 and a videotaped interview I had with her (see www.fluoridealert.org/videos.htm), has been published in Caries Research.

In my view this work is of enormous importance and could be (or should be) the scientific straw that breaks the camel’s back of fluoridation.

When Luke found out that the pineal gland – a little gland in the center of the brain, responsible for a very large range of regulating activities (it produces serotonin and melatonin) – was also a calcifying tissue, like the teeth and the bones, she hypothesized it would concentrate fluoride to very high levels. The gland is not protected by the blood brain barrier and has a very high perfusion rate of blood, second only to the kidney.

Luke had 11 cadavers analyzed in the UK. As she predicted she found astronomically high levels of fluoride in the calcium hydroxy apatite crystals produced by the gland. The average was 9000 ppm and went as high as 21,000 in one case. These levels are at, or higher, than fluoride levels in the bones of people suffering from skeletal fluorosis. It is these findings which have just been published.

Read moreFluoride: A Toxic Poison That Accumulates In The Pineal Gland