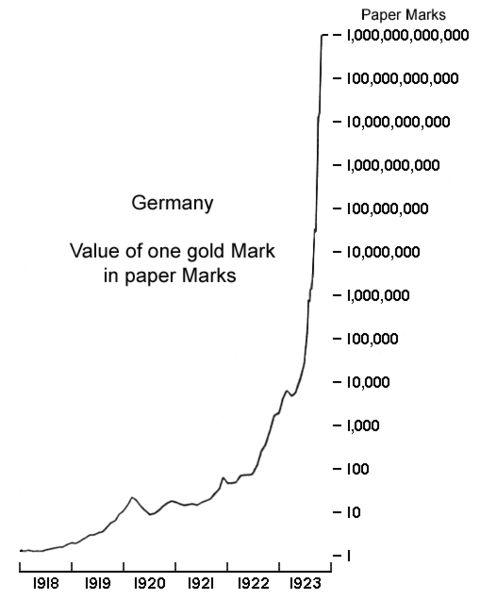

Turkey Hit By Bank Runs, Currency Panic As Locals Sell Their Cars And Houses To Buy Gold While Lira Implodes

"I think it is the best investment right now so I converted my dollars to buy gold."https://t.co/KqioaPjbOt

— Infinite Unknown (@SecretNews) August 16, 2020

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP