– In Unprecedented Move, China Plans To Pay For Oil Imports With Yuan Instead Of Dollars:

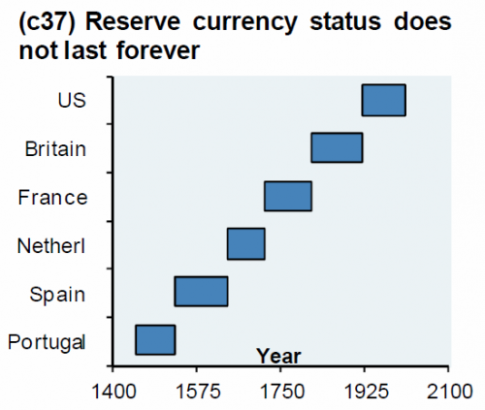

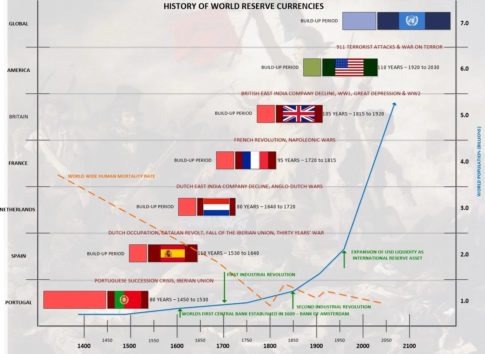

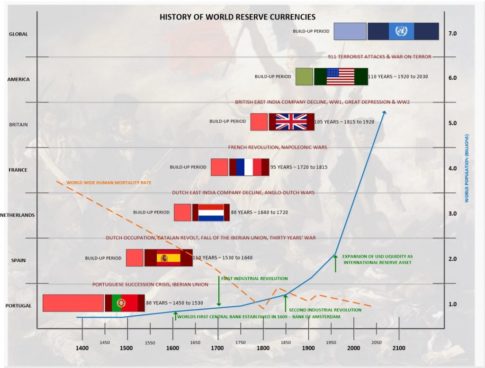

A change in the default crude oil transactional currency – which for decades has been the “Petrodollar”, blessing the US with global reserve currency status – would have monumental consequences for capital allocations and trade flows.

…

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP