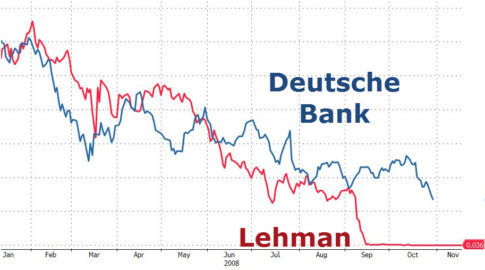

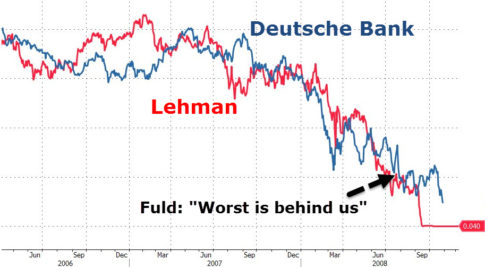

It is not solvency, or the lack of capital – a vague, synthetic, and usually quite arbitrary concept, determined by regulators – that kills a bank; it is – as Dick Fuld will tell anyone who bothers to listen – the loss of (access to) liquidity: cold, hard, fungible (something Jon Corzine knew all too well when he commingled and was caught) cash, that pushes a bank into its grave, usually quite rapidly: recall that it took Lehman just a few days for its stock to plunge from the high double digits to zero.

It is also liquidity, or rather concerns about it, that sent Deutsche Bank stock crashing to new all time lows earlier today: after all, the investing world already knew for nearly two weeks that its capitalization is insufficient. As we reported earlier this week, it was a report by Citigroup, among many other, that found how badly undercapitalized the German lender is, noting that DB’s “leverage ratio, at 3.4%, looks even worse relative to the 4.5% company target by 2018” and calculated that while he only models €2.9bn in litigation charges over 2H16-2017 – far less than the $14 billion settlement figure proposed by the DOJ – and includes a successful disposal of a 70% stake in Postbank at end-2017 for 0.4x book he still only reaches a CET 1 ratio of 11.6% by end-2018, meaning the bank would have a Tier 1 capital €3bn shortfall to the company target of 12.5%, and a leverage ratio of 3.9%, resulting in an €8bn shortfall to the target of 4.5%.

Read moreThis Is How Much Liquidity Deutsche Bank Has At This Moment, And What Happens Next