Paul Craig Roberts was Assistant Secretary of the Treasury during President Reagan’s first term. He was Associate Editor of the Wall Street Journal. He has held numerous academic appointments, including the William E. Simon Chair, Center for Strategic and International Studies, Georgetown University, and Senior Research Fellow, Hoover Institution, Stanford University.

Dr. Paul Craig Roberts

– The Fiscal Cliff Is A Diversion: The Derivatives Tsunami and the Dollar Bubble (Paul Craig Roberts, Dec 17, 2012):

The “fiscal cliff” is another hoax designed to shift the attention of policymakers, the media, and the attentive public, if any, from huge problems to small ones.

The fiscal cliff is automatic spending cuts and tax increases in order to reduce the deficit by an insignificant amount over ten years if Congress takes no action itself to cut spending and to raise taxes. In other words, the “fiscal cliff” is going to happen either way.

The problem from the standpoint of conventional economics with the fiscal cliff is that it amounts to a double-barrel dose of austerity delivered to a faltering and recessionary economy. Ever since John Maynard Keynes, most economists have understood that austerity is not the answer to recession or depression.

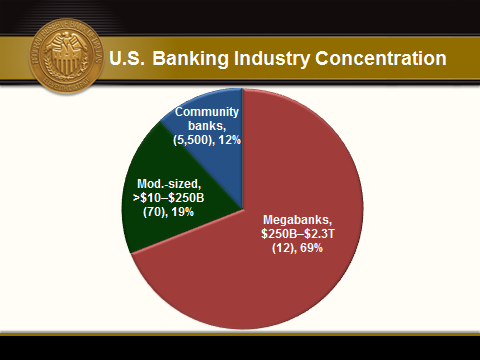

Regardless, the fiscal cliff is about small numbers compared to the Derivatives Tsunami or to bond market and dollar market bubbles.

Read moreThe Fiscal Cliff Is A Diversion: The Derivatives Tsunami And The Dollar Bubble