Added: Jun 29, 2014

Description:

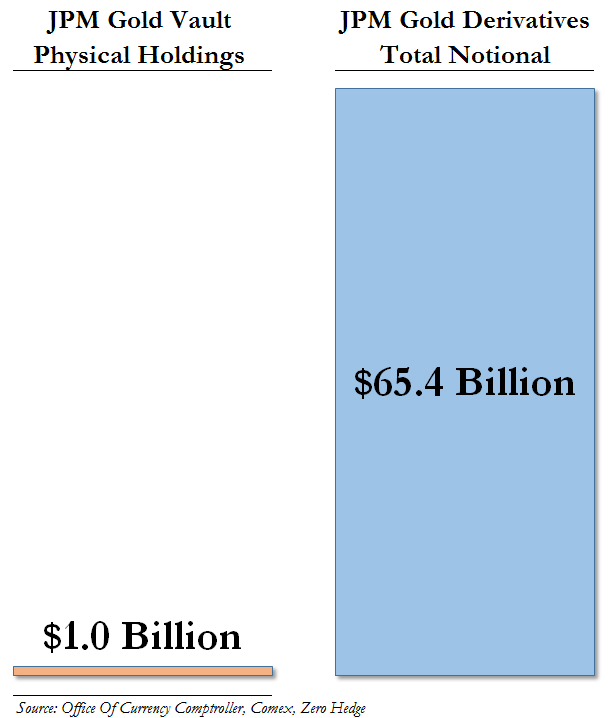

Chris Martenson, who holds a PhD in pathology and an MBA, contends 2008 was just a warm up to a much bigger calamity. Martenson says, “2008 was the shot across the bow, and that’s when our credit experiment broke, and we have been doing everything possible to paper over it since. . . . When you take real stuff out of the ground, you grow food, you take oil out of the ground, you process ore into steel, and you manufacture real things–that’s real wealth. The claims (such as stocks, bonds and currencies) have to be in proportion to the real wealth, and the claims have been growing and growing and growing for so long that they are way out of balance to the real stuff, and the real stuff isn’t growing like it used to. You can see that in the GDP numbers for the U.S. or the world at large. Growth is slowing, slowing, slowing, and the claims are getting larger and larger. This represents a huge and gigantic source of potential energy. There is a gap there and it’s going to get closed. Only one of two things are going to happen: (1) real stuff starts expanding like crazy, or (2) the claims get destroyed. That’s what we are talking about when we talk about a market crash. The claims get destroyed. People get wiped out. The people who don’t get ruined are people safely over in the real wealth already. If you own an unencumbered farm, if you own a productive asset, if you own gold or silver, or if you own your house outright, you are going to be vastly safer than . . . someone who is leveraged and hinged into this other system.”

Join Greg Hunter as he goes One-on-One with Chris Martenson co-founder of PeakProsperity.com.