Source: The White House

– Sen. Paul Opposes Senate Debt Deal (Rand Paul, Oct 16, 2013):

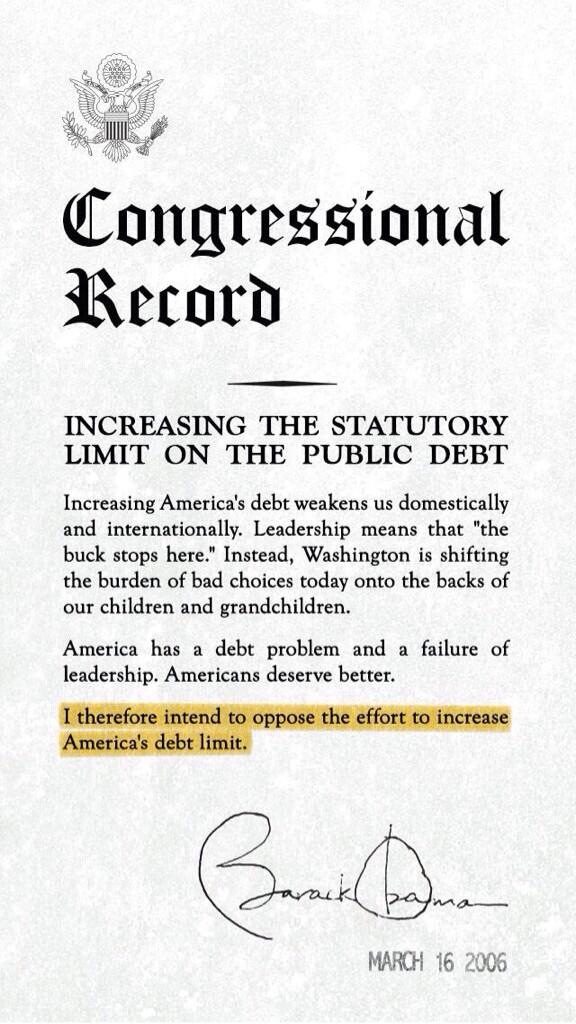

Oct 16, 2013WASHINGTON, D.C. – Sen. Rand Paul today voted no on H.R. 2775, as amended, that will suspend the debt ceiling until February 7, 2014 and fund the government to January 15, 2014.

“Tonight, a deal was struck to re-open the government and avoid the debt ceiling deadline. That is a good thing,” Sen. Paul said. “However, our country faces a problem bigger than any deadline: a $17 trillion debt. I am disappointed that Democrats would not compromise to avoid the looming debt debacle.”

From the article:

“Last night, after more than two weeks of utterly embarrassing theater, the government in the Land of the Free inked a deal to kick the can down the road a few more months. And in doing so, they set a very dangerous precedent.

As part of the bargain codified in HR 2775 (which President Obama signed into law), the Treasury Department is authorized to SUSPEND the debt ceiling. In other words, for all intents and purposes, there is now NO LIMIT government borrowing.

This limitless borrowing authority will expire on February 7, 2014. But it sets the precedent that dismissing the debt ceiling is a perfectly viable course of action.

Congress has effectively removed their handcuffs… so you can almost assuredly bet down the road that this provision will be extended, and ultimately become permanent.”

– Slowly at first, then all at once (Sovereign Man, Oct 17, 2013):

“How did you go bankrupt?” Bill asked.

“Two ways,” Mike said. “Gradually and then suddenly.”

The dialogue above is from Ernest Hemingway’s 1926 novel, The Sun Also Rises.

It’s often attributed to Mark Twain or F. Scott Fitzgerald, or misquoted as something like “At first you go bankrupt slowly, then all at once.” But the theme is the same.

Nations go bankrupt in the same way. Banking collapses occur in the same way. Currency crises strike in the same way. They all happen gradually… and then suddenly. Sometimes overnight.