– The Denials Begin: Interactive Brokers Is First To Claim It Has Not Engaged In Commingling Rehypothecation (ZeroHedge, Dec. 10, 2011):

Now that the rehypothecation bogeyman has been let loose, and the question of just how many paper (and apparently physical) assets have been double, triple, and n-counted (where n can be a number up to “infinity”) by the infinitely daisy-chained modern global financial system in which one’s liability is someone else’s asset….apparently up to infinity times, the next logical step was for the firms named in the original Reuters article (‘MF Global and the great Wall St re-hypothecation scandal’) to step up and begin denials they had anything to do with anything. Sure enough, below is the first (of many) such response, by Interactive Brokers, claiming it has been greatly misunderstood and unlike MF Global, it has done nothing wrong at all. Of note is that IB was simply one of many brokers mentioned in the Reuters piece, where we read that

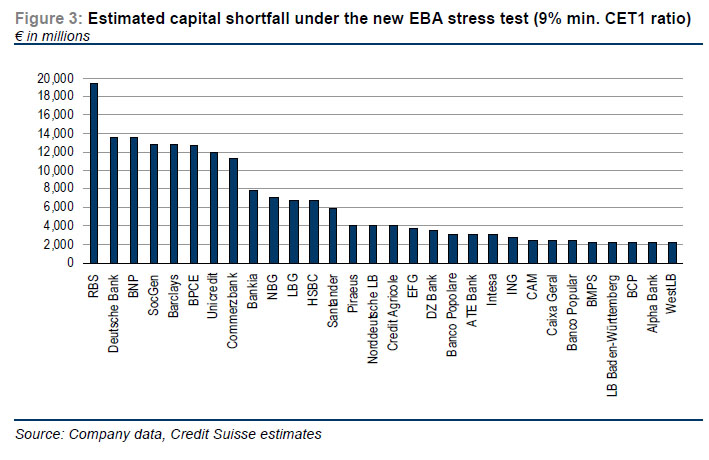

“Engaging in hyper-hypothecation have been Goldman Sachs ($28.17 billion re-hypothecated in 2011), Canadian Imperial Bank of Commerce (re-pledged $72 billion in client assets), Royal Bank of Canada (re-pledged $53.8 billion of $126.7 billion available for re-pledging), Oppenheimer Holdings ($15.3 million), Credit Suisse (CHF 332 billion), Knight Capital Group ($1.17 billion),Interactive Brokers ($14.5 billion), Wells Fargo ($19.6 billion), JP Morgan($546.2 billion) and Morgan Stanley ($410 billion).“

Sure enough, we predicted a firm would have to promptly step up and “deny all charges.” To wit: “Oh Jefferies, Jefferies, Jefferies. Barely did you manage to escape the gauntlet of accusation of untenable gross (if not net) sovereign exposure, that you will soon, potentially as early as tomorrow, have to defend your zany rehypothecation practices.” As it turns out Jefferies, and all the other mentioned banks tried to avoid this festering can of worms by completely ignoring the topic… until Interactive Brokers’ response now demands that every single named bank has to do the same and come out with an outright explanation of why it has billions in hyper-hypothecation, or else not journalists and bloggers, but the market itself will suddenly start asking questions. Something tells us it will not be nearly as easy enough for the others to deny all charges… Incidentally, if this indeed becomes “the next big thing”, what the potential collapse of (re) hypothection means is that PBs will be unable to lend out shares anymore, in effect collapsing stock shorting as there is one giant short stock recall/forced buy in. Ironicaly the unwind of the biggest market fraud could result in the entire market pulling one last “Volkswagen“style hurrah, before all hell breaks loose.

From Interactive Brokers