For over 25 years my office, The Center for Holistic Medicine located in West Bloomfield, MI, has been effectively treating viral infections. The last few days I have seen the panic that is occurring: schools are closing, college students sent home, and all large events are being cancelled. Rather than a time to panic, this is a time to reflect on our health care system and how to ensure that your immune system is ready to fight COVID-19 (the present coronavirus infection).

Conventional medicine’s approach to COVID-19 is suboptimal. They can offer hand washing and quarantining. That is about it. Really, it is pathetic!!

At my office, we are not worried about COVID-19. As I mentioned above, we have been successfully treating coronavirus, influenza, rhinovirus and many other viral flu-like illnesses since 1993. That is a long history.

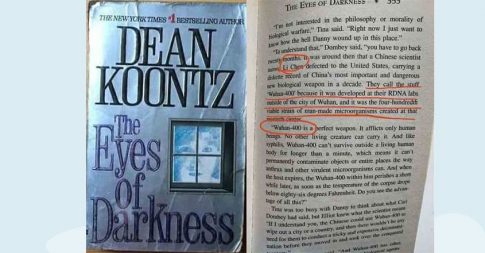

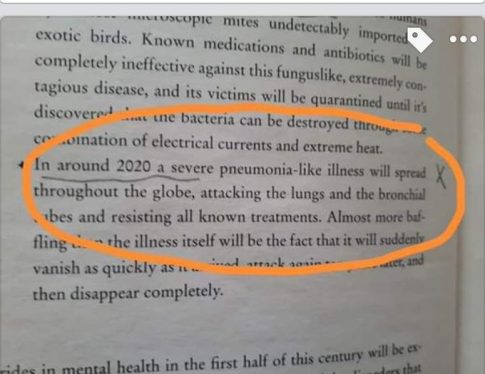

The media and the Powers-That-Be would have you believe that this is the first-time coronavirus has ever infected humankind. That is simply not true. In fact, about 20% of common colds are caused by…coronavirus. (1) It is important to know that coronaviruses have been around for hundreds of years. I know this strain is different, but all viruses change (mutate) on a yearly basis. In fact, the influenza virus changes during every flu season. As I previously stated, I have been treating these viral changes for over 25 years.

My partners (Dr. Nusbaum, Dr Ng, Taylor Eason, NP & Jenny Drummond, PA) have all found success using natural therapies to enhance the body’s immune system as well as to kill viruses including flu-like viruses. Today, I ordered intravenous hydrogen peroxide, vitamin C, ozone, and glutathione for my sick patients. I am confident these therapies will help them recover uneventfully. Keep in mind my partners and I have nearly 80 years of experience with these therapies! Not only do they work, they can be miraculous. Just ask our patients!

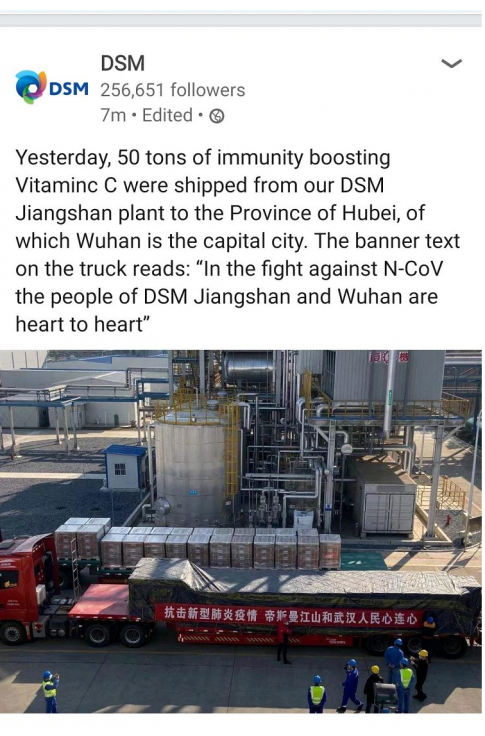

Intravenous nutrient therapies are wonderful treatments, but there are other oral natural therapies that are effective against viral infections including coronavirus. Vitamins A, C, and D along with iodine have proven benefit. At the first sign of any illness, I suggest my patients take 100,000 U of vitamin A (NOT beta-carotene), 50,000 U of vitamin D3 and 5-10,000 mg of vitamin C per day for four days. Pregnant women should not take high doses of vitamins A and D. Vitamin C can be increased to bowel tolerance.

Read moreVitamin C Saves Wuhan Family from COVID-19 – La vitamina C salva una famiglia di Wuhan dal COVID-19 – La vitamine C sauve une famille de Wuhan du COVID-19 – Dr. David Brownstein, M.D.: We are Not Worried About COVID-19