– Moody’s: Greek sovereign credit rating remains at C (Reuters, Mar 9, 2012):

March 9 – Moody’s Investors Service says that it considers Greece to have defaulted per Moody’s default definitions further to the conclusion of an exchange of EUR177 billion of Greece’s debt that is governed by Greek law for bonds issued by the Greek government, GDP-linked securities, European Financial Stability Facility (EFSF) notes. Foreign-law bonds are eligible for the same offer, and Moody’s expects a similar debt exchange to proceed with these bondholders, as well as the holders of state-owned enterprise debt that has been guaranteed by the state, in the coming weeks. The respective securities will enter our default statistics at the tender expiration date, which is was Thursday 8 March for the Greek law bonds and is currently expected to be 23 March for foreign law bonds. Greece’s government bond rating remains unchanged at C, the lowest rating on Moody’s rating scale.

Moody’s understands that 85.8% of debtholders holding Greek-law bonds issued by the sovereign have agreed to the exchange, with the vast majority of remaining bondholders likely to be drawn in following the exercise of Collective Action Clauses that will be inserted pursuant to a recent Act by the Greek parliament. The terms of the exchange entail a discount – a loss to creditors – of at least 70% on the net present value of existing debt. According to Moody’s definitions, this exchange represents a `distressed exchange’, and therefore a debt default. This is because (i) the exchange amounts to a diminished financial obligation relative to the original obligation, and (ii) the exchange has the effect of allowing Greece to avoid payment default in the future.

– Greece averts immediate default, markets sceptical (Reuters, Mar 9, 2012):

Greece averted the immediate threat of an uncontrolled default on Friday, winning strong acceptance from its private creditors for a bond swap deal which will eat into its mountainous public debt and clear the way for a new bailout.

With euro zone ministers set to approve the 130 billion euro (109 billion pounds) rescue, French President Nicolas Sarkozy declared the Greek problem had been settled – just as Germany said that any impression the crisis was over “would be a big mistake.”

Markets sharply marked down the value of new Greek bonds to be issued to the creditors, reflecting the risk of paralysis after elections expected this spring and doubts about whether Athens can bring its debt to a more manageable level by 2020.

Sarkozy, who is trailing his socialist challenger for the presidency before France’s own elections in April and May, pronounced the Greek deal a major success.

“Today the problem is solved,” he said in the southern French city of Nice. “A page in the financial crisis is turning.”

Euro zone finance ministers held a teleconference call and were expected to declare Athens had met the tough terms of the bailout, its second since 2010, and to authorise the release of funds which the country needs to meet heavy debt repayments later this month and avoid bankruptcy.

On the streets of Athens, some Greeks denounced the deal as a sham that would impose more crippling austerity on a people already enduring pay and pension cuts and soaring unemployment.

German Finance Minister Wolfgang Schaeuble was also in a more sombre mood than Sarkozy, issuing a warning to Athens which has a record of failing to meet its promises of reform and austerity made to international lenders.

“Greece has today got a clear opportunity to recover. But the precondition is that Greece uses this opportunity,” he told a news conference. “It would be a big mistake to give the impression that the crisis has been resolved. They have an opportunity to solve it and they must use it.”

Under the biggest sovereign debt restructuring in history, Greece’s private creditors will swap their old bonds for new ones with a much lower face value, lower interest rates and longer maturities, meaning they will lose about 74 percent on the value of their investments.

“A VERY GOOD DAY”

Data published on Friday underlined the depth of Greece’s problems. It showed the economy shrank 7.5 percent in 2011, marking the fourth successive year of recession.

That was worse even than 1974, when Greece’s military dictatorship collapsed following a confrontation with Turkey over Cyprus and as a leap in oil prices hit economies around the world. That year the Greek economy shrank 6.4 percent.

Nevertheless, Greek Finance Minister Evangelos Venizelos hailed the bond swap, which the European Union and IMF had demanded in return for the new bailout, as marking a long-awaited success for all Greeks enduring a painful recession.

“I hope everyone will realise, sooner or later, that this is the only way to keep the country on its feet and give it the second historic chance that it needs,” Venizelos, who led often ill-tempered negotiations with the EU and IMF, told parliament.

He said the bond deal had cut its debt by 105 billion euros.

– Greece Has Defaulted: Here Is Where We Stand (ZeroHedge, Mar 9, 2012):

After reading this, everyone should have a fairly good grasp of what happened not only today, but ever since the great (and quite endless) European financial crisis took center stage, and what to look forward to next…

From Chindit13

In a nutshell—okay, a coconut shell—this seems to be where we are:

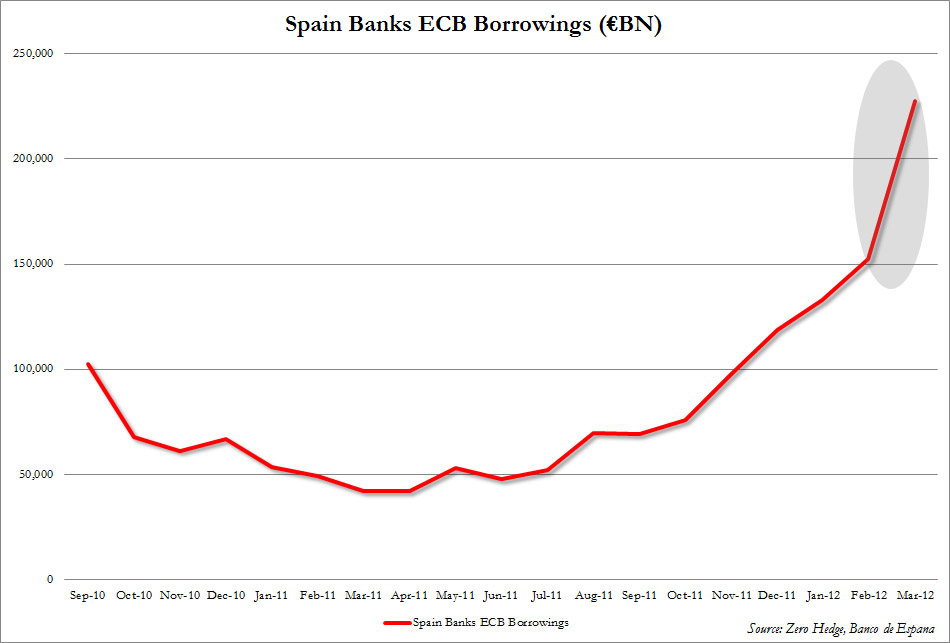

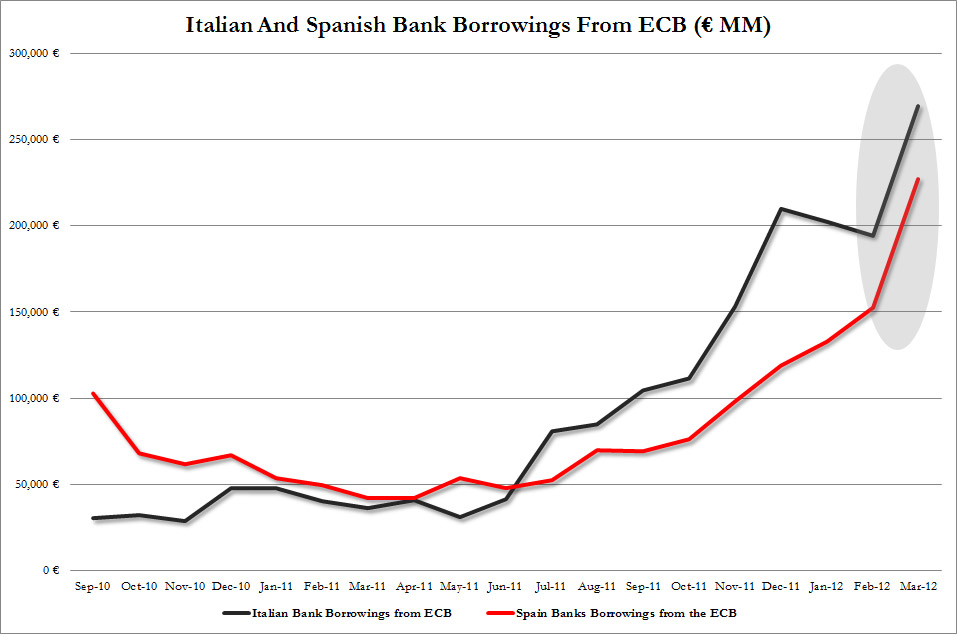

1) Greece was able to write off 100 billion euros worth of debt in exchange for a 130 billion rescue package of new debt, of which Greece itself will receive 19%, or about 25 billion, so that it can continue to operate as an ongoing concern. Somehow Greece is in a better position than before, with more debt and less sovereignty and still—by virtue of sharing a common currency—trying to compete toe-to-toe with the likes of Germany and the Netherlands, kind of like being the Yemeni National Basketball team in an Olympic bracket that includes the US, Spain and Germany. At least a “within the euro” default prevented bank runs in Portugal, Spain, Italy et al.

2) As a result of the bond haircuts, Greece has many pension plans that can no longer even pretend to be viable, at least according to the original contracted scheme, but pensionholders still working can take heart in the fact that their current wages will be cut, too.

Read moreMoody’s: GREECE HAS DEFAULTED: Creditors To Lose Over 70% On The Value Of Their Investment – Here Is Where We Stand