Source

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

The man who trades freedom for security does not deserve nor will he ever receive either. – Benjamin Franklin

2020 Annual Wrap Up: The Going Direct Reset

Catherine Austin Fitts on The Corbett Report

John Titus on Central Bank Digital Currencies

Powell: A CBDC Would Make Cryptocurrencies Obsolete

The Global Landscape on Vaccine ID Passports and Where It’s Headed: Part 1

Episode 275 – Solutions: Boycotts and Buycotts

Coming Clean: Building a Wonderful World

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

https://youtu.be/C1-0XKYAZII

Gandalf (reading):

"They have taken the bridge and the second hall. We have barred the gates but cannot hold them for long. The ground shakes, drums… drums in the deep. We cannot get out. A shadow lurks in the dark. We can not get out… they are coming." pic.twitter.com/V0DV7dou14

— Infinite Unknown (@SecretNews) September 2, 2020

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

$21 Trillion dollars is missing from the US government. That is $65,000 per person…

…as much as the national debt!https://t.co/HTrr8GX7x7

— Infinite Unknown (@SecretNews) June 24, 2020

* * *

Please support I. U.

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

https://youtu.be/xI_JvEbEEHc

via the New York Times:

Bill Gates Met With Jeffrey Epstein Many Times, Despite His Past

Gandalf (reading):

“They have taken the bridge and the second hall. We have barred the gates but cannot hold them for long. The ground shakes, drums… drums in the deep. We cannot get out. A shadow lurks in the dark. We can not get out… they are coming.” pic.twitter.com/76GG9Ux7qo

— Infinite Unknown (@SecretNews) May 5, 2020

* * *

Please support I. U.

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

FYI.

Also exposing the Clintons…

DON’T MISS THIS VIDEO!

FYI.

Trump and Putin are both elite puppets, like Obama, Clinton, Bush, Reagan, Gorbachev, Merkel, Sarkozy, Blair, Macron, Brown, Cameron, May,…

… and they are all Freemasons.

And by the way both Bill Clinton AND Donald Trump are friends with Jeffrey Epstein AND Ghislaine Maxwell, who procured those young women for Epstein.

“Epstein likes to tell people that he’s a loner, a man who’s never touched alcohol or drugs, and one whose nightlife is far from energetic. And yet if you talk to Donald Trump, a different Epstein emerges. “I’ve known Jeff for fifteen years. Terrific guy,” Trump booms from a speakerphone. “He’s a lot of fun to be with. It is even said that he likes beautiful women as much as I do, and many of them are on the younger side. No doubt about it — Jeffrey enjoys his social life.” Source

https://www.youtube.com/watch?time_continue=9&v=0TkYa34hEpk

In an earlier interview with Catherine Austin Fitts, the discussion was brought up over where HUD money has been possibly siphoned off to. Catherine Austin Fitts suggested that private defense contractors (what has been referred to as a “parallel system of finance” controlled by the “deep state”) had taken over HUD and were running it. There was according to Catherine Austin Fitts, “$3.3 trillion missing From HUD (Housing and Urban Development) and the Department of Defense (DoD) in Fiscal Years 1998 thru 2000”.

Still need to wake up to Trump.

At least Dr. Paul Craig Roberts woke up.

H/t reader I.G.

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

https://www.youtube.com/watch?v=KVmpnVNmX9g

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

https://www.youtube.com/watch?v=feW-iDhkoiA

Jul 17, 2016

Description:

On the economy crashing this year, investment banker and former Assistant Secretary of Housing, Catherine Austin Fitts says, “Could we turn into a bear market? I think given the commitment to equity markets and given the willingness to debase the currency, I think the chances of that are relatively small this year. Next year, depending on what happens in the election, the gloves are going to come off globally about what’s been going on in the U.S. Anything could happen. That’s the danger if you are an investment advisor or an investor. The swings here is we could be up 30%, or we could be down 50%. A black swan could happen, so if you are an investor, you need to be prepared for very, very wide swings both up and down in prices in the equity markets. Here’s the important thing to remember. . . . We now have $12 trillion sitting in negative interest rates. Where’s all that money going to go? It can’t sit there getting nothing. It will have to go into real estate. It’s going to have to go into equity. It’s going to have to go to precious metals because it can’t sit there getting no or negative yields forever. . . . The debt game is over.”

On gold and silver, Fitts says, “Interest rates coming down makes gold and silver more attractive. I think the number one thing driving precious metals is you’ve still got growth going on in Asia, and they are buyers. People are afraid, and they are looking at what is going on with the leadership, and they are getting scared. They want to hedge their bets, and gold and silver is where you go when you don’t trust the system.”

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

H/t reader I.G.

MIT researcher interviewed in Vaxxed:

“At the current rate in 2032 1 out of every 2 children will be autistic.”

https://www.youtube.com/watch?v=IbNdUFAc1RA

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

FYI.

– Catherine Austin Fitts interviews the Saker for the Solari Report: A Unipolar vs. Multipolar World:

Dear friends,

Last month I have had, once again, the real pleasure to have a one hour long conversation with Catherine Austin Fitts, the president of Solari, Inc., the publisher of The Solari Report and managing member of Solari Investment Advisory Services. Normally, the Catherine’s interviews are for subscribers only, but she has kindly agreed to make it available for free to our community.

Here is the main page of the interview: https://solari.com/blog/the-saker-a-uni-polar-vs-multi-polar-world/

You can listen to the interview here: https://solari.com/audio/sr20160407_InterviewHQ.mp3

You can get the transcript in PDF format here: https://solari.com/00archive/web/solarireports/2016/sr20160407_1.pdf

I highly recommend that you check out the rest of the Solari Reports and the Solari Books.

Enjoy!

The Saker

* * *

PayPal: Donate in USD

PayPal: Donate in EUR

PayPal: Donate in GBP

H/t reader L.V.:

“Since I saw this Greg Hunter lash out relentlessly at Catherine Austin Fitts for her daring to criticize the Israeli government even a little bit, I shun any interview where this guy is visible or audible.

The part about Israel and Iran starts around : 12:50

An interesting part about ‘Who is in control?’ starts at 25:10″

It was hard to listen to what comes out of Greg Hunter’s mouth.

There is so much wrong with what he said.

Maybe Greg Hunter should remove the American flag and put the Zionist flag up there in background and replace “USAWatchdog” with “ZionistLapdog”.

Israel is a creation of the Rothschilds, which is why Baron Edmond Benjamin James de Rothschild is known as the “Father of the (Jewish) Settlement” (Avi ha-Yishuv).

They’ve created Israel and they have planned to destroy it in the not too distant future.

If you are living in Israel, leave while you still can.

The Rothschilds funded and controlled Hitler and also Stalin, Roosevelt and Churchill.

WW2 has been a staged event. The Illuminati (= Rothschilds and the 12 other elite families) have built up Germany to burn the world in the hell of war and profit greatly from it.

Hitler, Stalin, Roosevelt and Churchill were all Freemasons and Illuminati puppets and so are Putin and Obama, which is why … We Are On Our Own.

And now the Illuminati have planned the greatest financial collapse in world history, civil war and WW3 (More like a conventional war, without full nuclear exchange. It nevertheless will easily kill much more people than WW1 and WW2 combined.) for us.

That said, here is the interview …

Catherine Austin Fitts-Central Bank Warfare Model Wearing Thin

https://www.youtube.com/watch?v=eaJJClb_gXc

* * *

Greg Hunter in the comment section:

“It is an undisputed fact that Iran is the #1 state sponsor of terror according to the US State Department.”

* * *

– The Missing Islamic State Link: A Documented CIA Connection

– General Wesley Clark: ‘ISIS Got Started Through Funding From Our Friends & Allies’

– ISIS EXPOSED 100% AS CIA OPERATION: ‘The Next Osama Bin Laden is Here’ (Video)

– Secret Pentagon Report Reveals US “Created” ISIS As A “Tool” To Overthrow Syria’s President Assad

– Mentioning also who is behind ISIS: Former CIA Agent: ‘Every Single Terrorist Incident We Have Had In The U.S. Has Been A False Flag’ (Video)– General Wesley Clark: ‘ISIS Got Started Through Funding From Our Friends & Allies’

… and I’ve extensively posted much more articles on this subject.

Al-Qaeda has been created by the U.S. (with Al-Nusra belonging to Al-Qaeda):

Just one month after this article has been published in the Guardian Robin Cook DIED:

– Al Qaeda Doesn’t Exist or How The US Created Al Qaeda (Documentary)

– BBC: Al-Qaeda Does Not Exist (Documentary)

* * *

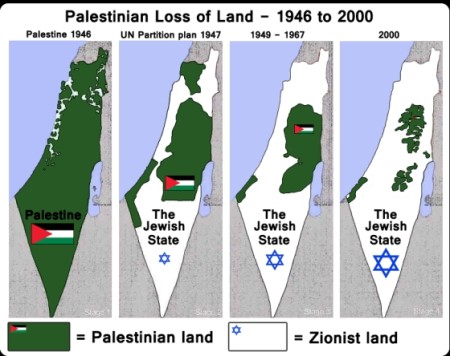

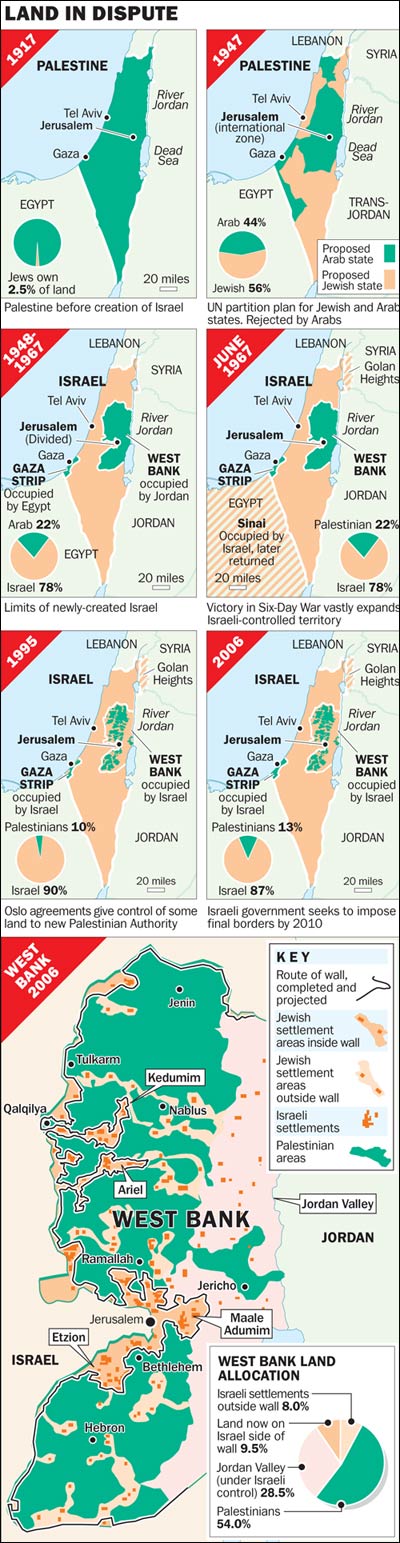

Wonder why Palestinians hate Israel?

Israel stealing Palestine:

– Real Danger Is Violence and War-Catherine Austin Fitts:

Financial expert Catherine Austin Fitts has long said before there is another big financial crash, there will be a big war. Fitts explains, “If you look at how fragile the geopolitics are, the danger, as I have always said, is that we go to violence, and then things really come unhinged. So, I’m worried about violence and war and kind of situation getting out of hand. That’s when you get the really dangerous scenarios.”

Read moreReal Danger Is Violence and War – Catherine Austin Fitts (Video)

FYI.

Added: Mar 20, 2014

“By failing to prepare, you are preparing to fail.”

– Benjamin Franklin

– Old System Struggling and Dying-Catherine Austin Fitts (USAWatchdog, July 31, 2013):

Money manager Catherine Austin Fitts says, “You are seeing a tug of war between the new system that’s coming up and the old system that’s struggling and dying.” Fitts explains it by saying, “Let’s pretend we have a company called USA, and we create a new company called Breakaway Civilization. We move all of our assets out of USA and put them in Breakaway Civilization. We leave union obligations and pension funds . . . in the old USA economy.” Fitts warns, “I think bail-ins are coming . . . the big question is not will we be able to get out insured deposits. I think the big question is how violent will things get?” Fitts biggest worry is not financial collapse. Fitts contends, “I don’t think the people who run the U.S. military or run the United States government are going to say we’re happy to collapse rather than go to war. They are going to go to war. They’re going to shake somebody down.” Fitts goes on to add, “I think gold is the greatest form of insurance you can have during this transition period.” Join Greg Hunter as he goes One-on-One with Catherine Austin Fitts of Solari.com.

Flashback:

– The Perfect Pope (Solari, Feb 15, 2013):

The other day, I imagined members of the Knights of Malta and Opus Dei (the money guys) gathering in a quiet sanctuary to discuss the current financial meltdown in the Catholic Church and the perfect Pope to help evolve their business model and lead them into a new and wealth building period.

Who would be the ideal candidate? What would the profile be?

Read moreFormer Assistant Secretary Of Housing Catherine Austin Fitts: The Perfect Pope

FYI.

YouTube Added: 04.09.2012

Description:

Catherine Austin Fitts of The Solari report says our leaders are “. . . doing a number of things that are going to depopulate or bankrupt the rest of us.” Why are people so ill-informed? Fitts says it’s because, “Corporate media is lying to you and wasting your time.” She also says, “Were going through a period of great change, and the pace is going to accelerate.” And, “Gold will be at the center of a new currency that will emerge.” Join Greg Hunter of USAWatchdog.com as he goes One-on-One with Catherine Austin Fitts.

– It’s Time to Bring Our Mortgages Home – Your Municipality and Community Venture Fund is the Ideal Investor for Fannie, Freddie & FHA Defaulted Mortgages (Solari, August 29, 2011):

By Catherine Austin Fitts (in the first person) and Carolyn Betts

The Administration is now proposing the transfer of significant defaulted mortgages and foreclosed properties held by Fannie Mae, Freddie Mac and the Federal Housing Administration (“FHA”) to large national institutional investors.

A Huge Housing Bargain — but Not for You

The Street (18 Aug 11)White House Seeks Ideas to Shrink Foreclosure Glut

Catherine, News & Commentary (11 Aug 11)Enterprise/FHA REO Asset Disposition (PDF)

RFIFinal (10 Aug 11)Such a transfer is not economic — other than for the large investors and to serve a wider agenda of social control and engineering, including gentrification of numerous areas whose former residents were fraudulently induced and evicted with the use of these mortgages.

I served as FHA Commissioner (See: Austin Fitts Better be Good With Hammer and Nails) during the first Bush Administration and then, several years later, my company, Hamilton Securities Group, served as the lead financial advisor to FHA, providing portfolio strategy advice with respect to $400 billion of financial liabilities and assets, including over 50,000 of foreclosed properties held by the government as the result of mortgage insurance claims for defaulted FHA-insured mortgages.

Don’t miss:

– BullionVault.com Runs Out Of Silver In Germany

Added: 13. Januar 2011

See also:

– Catherine Austin Fitts: The Looting Of America:

Former Assistant Secretary of Housing under George H.W. Bush Catherine Austin Fitts blows the whistle on how the financial terrorists have deliberately imploded the US economy and transferred gargantuan amounts of wealth offshore as a means of sacrificing the American middle class. Fitts documents how trillions of dollars went missing from government coffers in the 90?s and how she was personally targeted for exposing the fraud.

Related information:

– The Ultimate Cost of 0% Money

– These Central Banks Are Printing Money – Prepare Yourself

Gold:

– George Soros’ and John Paulson’s Biggest Holding Is GOLD

– China, Russia, Iran are Dumping the Dollar, Buy Gold And Silver

– Gold and Gold Mining Shares As a Percentage of Global Assets or ‘The Once In a Lifetime Ride’

Silver:

– Silver: Shortage This Decade, Will Be Worth More Than Gold

– Silver Derivatives – China and JP Morgan

– Max Keiser: Want JP Morgan to Crash? Buy Silver!

– Max Keiser: Crash JP Morgan – Buy Silver!

– JPMorgan Silver Manipulation Explained (Must-See!)

And don’t forget to do this (!!!):

– James G. Rickards of Omnis Inc.: Get Your Gold Out Of The Banking System