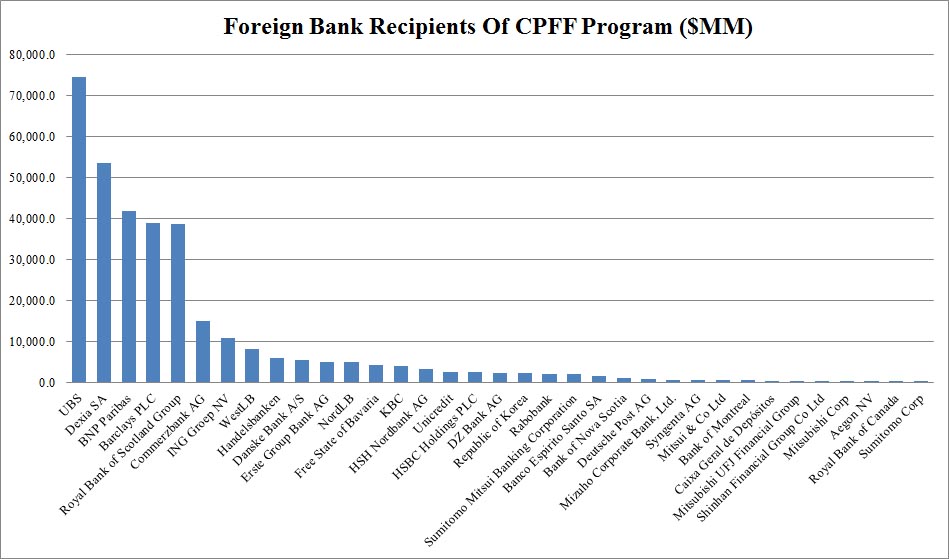

As we reported over the weekend in “By “Punishing” France, The US Just Accelerated The Demise Of The Dollar“, following the record $9 billion fine against French BNP, the outcry has been fast and furious, with virtually everyone in the local chain of command, from the CEO of Total to the head of the Bank of France (and ECB member) Christian Noyer, all saying that the US is now clearly abusing the reserve power of the dollar and it is time to move away from a dollar-based reserve currency (how that jives with concurrent French demands for a lower EUR is a different, incomprehensible matter entirely).

It appears that having pushed France forcefully into the Russia-China Eurasian, and anti-US camp, the US will now do the same with Germany. Because after infuriating the German population by first refusing to return their gold contained (the legend goes) at the New York Fed, and then with scandal after spying scandal, most recently involving the CIA directly soliciting a German double agent, now the time has come to “punish” Germany’s largest banks for the same kind of money laundering that BNP was engaged in. As the NYT and Reuters report, the time has come to shift away from the BNP scandal and focus on what will soon be the Commerzbank and Deutsche Bank fallout.

According to the NYT, the money laundering crackdown is “bound for another European financial center: Germany. State and federal authorities have begun settlement talks with Commerzbank, Germany’s second-largest lender, over the bank’s dealings with Iran and other countries blacklisted by the United States, according to people briefed on the matter. The bank, which is suspected of transferring money through its American operations on behalf of companies in Iran and Sudan, could strike a settlement deal with the state and federal authorities as soon as this summer, said the people briefed on the matter, who were not authorized to speak publicly.

The contours of a settlement, which the authorities have only begun to sketch out, are expected to include at least $500 million in penalties for Commerzbank, the people added. Although prosecutors were still weighing punishments, the people briefed on the matter said that the bank would most likely face a so-called deferred prosecution agreement, which would suspend criminal charges in exchange for the financial penalty and other concessions.

It’s not just Commerzbank – a settlement with the smaller bank will merely pave the way for the punishment of the biggest bank of all (in terms of groiss derivative notional held): Deutsche Bank.

A potential deal with Commerzbank — which is expected to pave the way for a separate settlement with Deutsche Bank, Germany’s largest bank — would pale in comparison to the case announced last week against France’s biggest bank, BNP Paribas. The French bank agreed to pay a record $8.9 billion penalty and plead guilty to criminal charges for processing transactions on behalf of Sudan and other countries that America has hit with sanctions, a rare criminal action against a financial giant.

As NYT adds, correctly, “The Commerzbank investigation features an added twist: The bank is 17 percent owned by the German government. It is unclear whether — as in the BNP case, which led French authorities to intervene on the bank’s behalf — the settlement talks could inflame diplomatic tensions between Washington and Berlin.”

Of course, since this is the ridiculous “scorched earth” diplomatic policy, if one may call it that, of the Obama administration, nobody is surprised any more that the US president is alienating one former ally after another.

As we first observed a few weeks ago when we revealed JPM’s involvement in all of this money laundering, “some critics have questioned why American authorities have set their eye on European banks. The answer, authorities say, is that American banks by and large avoided processing transactions for Iran and Sudan. But American banks are not immune from touching dirty money. Citigroup’s Banamex unit is under investigation for processing money linked to a drug cartel. And in January, JPMorgan Chase reached a roughly $2 billion deal with the authorities over ignoring signs of the Ponzi scheme orchestrated by Bernard L. Madoff, who held accounts at the bank for over two decades.”

Not only that but as we wrote over the weekend, the bank that was instrumental in facilitating BNP’s money laundering for nearly a decade was none other than JPM. One wonders if JPM also “unwittingly” was the bank that made German money laundering around the globe possible. Did we mention unwittingly?

Still, while one can debate the idiocy of US foreign policy, eager to push European allies into the willing hands of Russia and China at the worst possible moment, when regional and civil wars and conflicts are suddenly breaking out across all key geopolitical hotspots, one wonders: in the case of BNP, the “fine” was as a result of French unwillingness to halt the Russian amphibious warship deal despite US demands. So it would be curious just what the US blackmail against German banks is for: one really does wonder just what punishment Angela Merkel deserves behind the scenes in the eyes of John Kerry et clueless al, to punish her and Germany so blatantly for the entire world to see.

One thing is clear: if the US thinks that Germany will continue to consider America its BFF and make zero contingency plans for when the alliance with the US finally crashes and burns, it will be truly surprised when the Eurasian alliance of Russia and China finally announces its final, all-important, missing link member: the manufacturing and export powerhouse that is Germany itself.