– Mark-To-Market Manipulation Hides $90 Billion Losses For UK Banks (ZeroHedge, March 12, 2013):

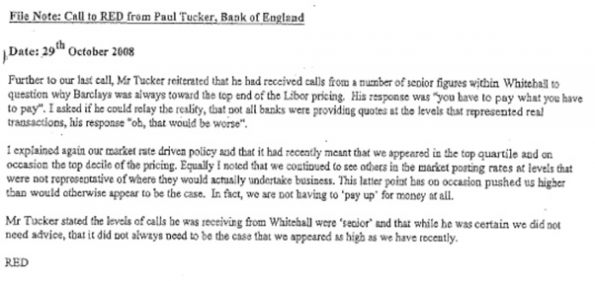

Some have attributed the resurrection of the financial markets (or more appropriately the banks) from the March 2009 lows to the IASB/FASB changes to factual to fantasy accounting. The Telegraph reports today that from PIRC’s and the Bank of England’s Financial Policy Committee that while banker bonuses continue to rise (for now), ‘hidden’ losses among UK banks could total GBP60 Billion (USD 90 Billion). HSBC topped the list with GBP10.4 Billion in bad debts that have yet to be written off and while the ‘accounting’ bodies are suggesting they will address criticism of this farce, as one analyst notes, they “can still make unprofitable lending appear profitable.” Regulators expect to hear plans from lenders on how they intend to fill these holes before the end of the month to coincide either with the FPC’s meeting on March 19 or a statement scheduled for March 27. While outright recaps are unlikely, banks are expected to

restructure and set out plans to raise their capital levels over the next

couple of years. More fantasy…PIRC has calculated the amount of bad debts the banks may have to write off in coming years but have yet to subtract from profits, together with other items such as deferred bonuses not booked.

HSBC, which is the biggest bank by assets, was shown to have £10.4bn of hidden losses, the Royal Bank of Scotland has £9.4bn, and Barclays has £7.3bn. Lloyds Banking Group has £2.5bn and Standard Chartered £2.2bn. Together the undeclared losses total £31.8bn.

Read moreMark-To-Market Manipulation Hides $90 BILLION Losses For UK Banks