Last August, Anthony Ward’s Amajaro fund tried, and failed, to corner the cocoa market. He may have been half a year early, as the country may soon let cocoa speculators (at least those on the long side) finally enjoy their day in the sun. After an ongoing political crisis has left the country with two presidents, neither of which is willing to abdicate power peacefully, and technically bankrupt the latest development is the logical: a countrywide bank run.

The Globe and Mail reports that the world’s largest exporter of cocoa, which has now effectively been isolated by the global banking system, following its technical default on $2.3 billion in bonds, is seeing bank after bank shut down as residents are scrambling to withdraw whatever money is available in the financial system.

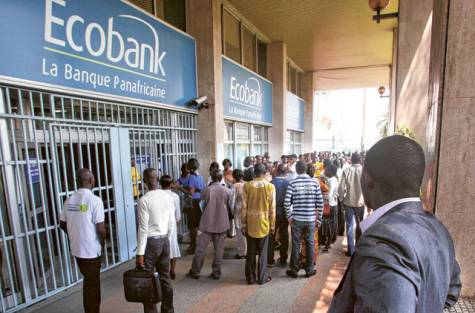

“A third bank shut its doors Wednesday amid a political crisis in Ivory Coast, as residents in the commercial hub lined up at banks to try to withdraw their savings amid rumours of a cash shortage. British bank Standard Chartered confirmed in an e-mail Wednesday that it had suspended its operations in Ivory Coast, joining two other banks, BICICI and Citibank, and the regional stock exchange.

Hundreds of people marched from one bank to the next in downtown Abidjan Wednesday afternoon, trying to find a working bank machine.” Well, not really a bank run. More like a bank march. However, unlike Egypt, we don’t anticipate the government (one of the two), to start flying in hundreds of millions in currency to placate the mob.

From Globe and Mail:

“They say all the banks are going to close,” said high school guidance counsellor Albert Kramo. “I’ve been to three banks today to try and get out some money before it’s too late.”

Read moreBank Run In Ivory Coast