Flashback.

YouTube Added: 08.06.2011

The man who trades freedom for security does not deserve nor will he ever receive either. – Benjamin Franklin

Flashback:

– The Coming Derivatives Crisis That Could Destroy The Entire Global Financial System (The Economic Collapse, Oct. 19th, 2011):

Most people have no idea that Wall Street has become a gigantic financial casino. The big Wall Street banks are making tens of billions of dollars a year in the derivatives market, and nobody in the financial community wants the party to end. The word “derivatives” sounds complicated and technical, but understanding them is really not that hard. A derivative is essentially a fancy way of saying that a bet has been made. Originally, these bets were designed to hedge risk, but today the derivatives market has mushroomed into a mountain of speculation unlike anything the world has ever seen before. Estimates of the notional value of the worldwide derivatives market go from $600 trillion all the way up to $1.5 quadrillion. Keep in mind that the GDP of the entire world is only somewhere in the neighborhood of $65 trillion. The danger to the global financial system posed by derivatives is so great that Warren Buffet once called them “financial weapons of mass destruction”. For now, the financial powers that be are trying to keep the casino rolling, but it is inevitable that at some point this entire mess is going to come crashing down. When it does, we are going to be facing a derivatives crisis that really could destroy the entire global financial system.

Most people don’t talk much about derivatives because they simply do not understand them.

Perhaps a couple of definitions would be helpful.

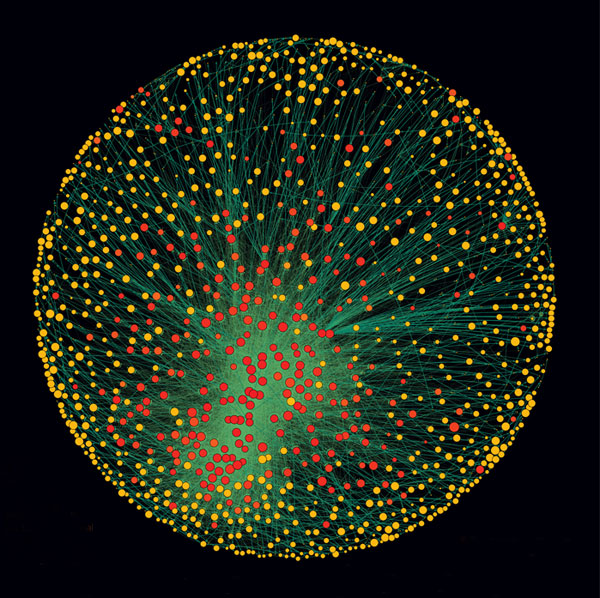

The 1318 transnational corporations that form the core of the economy. Superconnected companies are red, very connected companies are yellow. The size of the dot represents revenue (Image: PLoS One)

– Revealed – the capitalist network that runs the world (New Scientist, Oct. 19, 2011):

AS PROTESTS against financial power sweep the world this week, science may have confirmed the protesters’ worst fears. An analysis of the relationships between 43,000 transnational corporations has identified a relatively small group of companies, mainly banks, with disproportionate power over the global economy.

The study’s assumptions have attracted some criticism, but complex systems analysts contacted by New Scientist say it is a unique effort to untangle control in the global economy. Pushing the analysis further, they say, could help to identify ways of making global capitalism more stable.

The idea that a few bankers control a large chunk of the global economy might not seem like news to New York’s Occupy Wall Street movement and protesters elsewhere (see photo). But the study, by a trio of complex systems theorists at the Swiss Federal Institute of Technology in Zurich, is the first to go beyond ideology to empirically identify such a network of power. It combines the mathematics long used to model natural systems with comprehensive corporate data to map ownership among the world’s transnational corporations (TNCs).

“Reality is so complex, we must move away from dogma, whether it’s conspiracy theories or free-market,” says James Glattfelder. “Our analysis is reality-based.”

Insanity just hit RECORD HIGHS!

– HOLY BAILOUT – Federal Reserve Now Backstopping $75 Trillion Of Bank Of America’s Derivatives Trades (The Daily Bail, Oct 18, 2011):

This story from Bloomberg just hit the wires this morning. Bank of America is shifting derivatives in its Merrill investment banking unit to its depository arm, which has access to the Fed discount window and is protected by the FDIC.

This means that the investment bank’s European derivatives exposure is now backstopped by U.S. taxpayers. Bank of America didn’t get regulatory approval to do this, they just did it at the request of frightened counterparties. Now the Fed and the FDIC are fighting as to whether this was sound. The Fed wants to “give relief” to the bank holding company, which is under heavy pressure.

This is a direct transfer of risk to the taxpayer done by the bank without approval by regulators and without public input. You will also read below that JP Morgan is apparently doing the same thing with $79 trillion of notional derivatives guaranteed by the FDIC and Federal Reserve.

What this means for you is that when Europe finally implodes and banks fail, U.S. taxpayers will hold the bag for trillions in CDS insurance contracts sold by Bank of America and JP Morgan. Even worse, the total exposure is unknown because Wall Street successfully lobbied during Dodd-Frank passage so that no central exchange would exist keeping track of net derivative exposure.

This is a recipe for Armageddon. Bernanke is absolutely insane. No wonder Geithner has been hopping all over Europe begging and cajoling leaders to put together a massive bailout of troubled banks. His worst nightmare is Eurozone bank defaults leading to the collapse of the large U.S. banks who have been happily selling default insurance on European banks since the crisis began.

– BofA Said to Split Regulators Over Moving Merrill Derivatives to Bank Unit (Bloomberg, Oct 18, 2011):

Bank of America Corp. (BAC), hit by a credit downgrade last month, has moved derivatives from its Merrill Lynch unit to a subsidiary flush with insured deposits, according to people with direct knowledge of the situation.

– The Megabanks are trying to prevent bank runs in the United States (Video) (Activist Post, October 15, 2011):

Megabanks around the world are reeling from their customers removing their capital and closing their accounts. People are standing up worldwide in a non-participational form of civil disobedience in order to do anything possible to bring down these corrupt megabanks.

There was an Italian bank run scare in at the beginning of August that really started the gears in motion for the possibilities of future bank runs.

Financial blogs predicted a run on the French banks during the economic turmoil in the EU and Eurozone countries.] Many corporations in France have moved their money out of French banks and into safer short term holdings for the time being.

Similar bank runs in August occurred in the United States, and the megabank Bank Of America had to employ the assistance of the St. Louis SWAT Team to prevent customers from closing their accounts and moving their money to smaller banks.

YouTube Added: 14.08.2011

The bank run issue even hit mainstream media in the United States, covered here by NPR.

Since the Occupy protests have started, big banks have been the prime target of disgruntled humans for their corrupt practices of taking peoples homes, robbing the elderly, and funding many illicit activities that normal Americans would face prison time over.

On September 30th, families and individual customers of Bank of America had a sit in protest to show civil disobedience against the megabank. 20+ of the protesters were arrested.

This was also covered on the local mainstream media news in Boston.

It would seem as if America is done with the megabanks, and for good reason. I came across this blog recently and information that there is a bank run being planned in the United States on December 7th.

Operation Bank Run 7th Of December:

YouTube Added: 09.10.2011

Many have already closed their accounts with the megabanks. I closed mine years ago, after the financial disaster in 2008 and the bank bailouts. Many are closing their accounts today.

In horrendous fashion, Citibank held more than twenty of their customers hostage and imprisoned them until police could come to arrest them all.

YouTube Added: 15.10.2011

The video above shows a well-dressed customer of Citibank outside talking with another customer about having been inside and having tried to close her account. A plain-clothers officer then starts yelling from behind her and drags her and her friend inside the bank to be arrested with the other Citibank customers. This is simply egregious activity by the officers in New York and the megacorporation Citigroup.

The end of the international banking cartel, their fiat currency that is imploding society by design, and the revival of sound money is at hand. But we must first be sure to force these too big to fail banks into oblivion. Let us keep the pressure up on them, and force their monopolies to come down. If the government and our ‘elected representatives’ won’t stand up for the rule of law, then we must come together to enforce it ourselves through direct democracy and non-participation.

– 11 Facts You Need To Know About The Nation’s Biggest Banks (Think Progress, Oct 7, 2011):

The Occupy Wall Street protests that began in New York City more than three weeks ago have now spread across the country. The choice of Wall Street as the focal point for the protests — as even Federal Reserve Chairman Ben Bernanke said — makes sense due to the big bank malfeasance that led to the Great Recession.

While the Dodd-Frank financial reform law did a lot to ensure that a repeat of the 2008 financial crisis won’t occur — through regulation of derivatives, a new consumer protection agency, and new powers for the government to dismantle failing banks — the biggest banks still have a firm grip on the financial system, even more so than before the 2008 financial crisis. Here are eleven facts that you need to know about the nation’s biggest banks:

– Bank profits are highest since before the recession…: According to the Federal Deposit Insurance Corp., bank profits in the first quarter of this year were “the best for the industry since the $36.8 billion earned in the second quarter of 2007.” JP Morgan Chase is currently pulling in record profits.

– …even as the banks plan thousands of layoffs: Banks, including Bank of America, Barclays, Goldman Sachs, and Credit Suisse, are planning to lay off tens of thousands of workers.

– Banks make nearly one-third of total corporate profits: The financial sector accounts for about 30 percent of total corporate profits, which is actually down from before the financial crisis, when they made closer to 40 percent.

– Since 2008, the biggest banks have gotten bigger: Due to the failure of small competitors and mergers facilitated during the 2008 crisis, the nation’s biggest banks — including Bank of America, JP Morgan Chase, and Wells Fargo — are now bigger than they were pre-recession. Pre-crisis, the four biggest banks held 32 percent of total deposits; now they hold nearly 40 percent.

– The four biggest banks issue 50 percent of mortgages and 66 percent of credit cards: Bank of America, JP Morgan Chase, Wells Fargo and Citigroup issue one out of every two mortgages and nearly two out of every three credit cards in America.

– The 10 biggest banks hold 60 percent of bank assets: In the 1980s, the 10 biggest banks controlled 22 percent of total bank assets. Today, they control 60 percent.

– The six biggest banks hold assets equal to 63 percent of the country’s GDP: In 1995, the six biggest banks in the country held assets equal to about 17 percent of the country’s Gross Domestic Product. Now their assets equal 63 percent of GDP.

– The five biggest banks hold 95 percent of derivatives: Nearly the entire market in derivatives — the credit instruments that helped blow up some of the nation’s biggest banks as well as mega-insurer AIG — is dominated by just five firms: JP Morgan Chase, Goldman Sachs, Bank of America, Citibank, and Wells Fargo.

– Banks cost households nearly $20 trillion in wealth: Almost $20 trillion in wealth was destroyed by the Great Recession, and total family wealth is still down “$12.8 trillion (in 2011 dollars) from June 2007 — its last peak.”

Read more11 Facts You Need To Know About The Nation’s Biggest Banks

– Five Banks Account For 96% Of The $250 Trillion In Outstanding US Derivative Exposure; Is Morgan Stanley Sitting On An FX Derivative Time Bomb? (ZeroHedge, Sep. 24, 2011):

The latest quarterly report from the Office Of the Currency Comptroller is out and as usual it presents in a crisp, clear and very much glaring format the fact that the top 4 banks in the US now account for a massively disproportionate amount of the derivative risk in the financial system. Specifically, of the $250 trillion in gross notional amount of derivative contracts outstanding (consisting of Interest Rate, FX, Equity Contracts, Commodity and CDS) among the Top 25 commercial banks (a number that swells to $333 trillion when looking at the Top 25 Bank Holding Companies), a mere 5 banks (and really 4) account for 95.9% of all derivative exposure (HSBC replaced Wells as the Top 5th bank, which at $3.9 trillion in derivative exposure is a distant place from #4 Goldman with $47.7 trillion). The top 4 banks: JPM with $78.1 trillion in exposure, Citi with $56 trillion, Bank of America with $53 trillion and Goldman with $48 trillion, account for 94.4% of total exposure. As historically has been the case, the bulk of consolidated exposure is in Interest Rate swaps ($204.6 trillion), followed by FX ($26.5TR), CDS ($15.2 trillion), and Equity and Commodity with $1.6 and $1.4 trillion, respectively. And that’s your definition of Too Big To Fail right there: the biggest banks are not only getting bigger, but their risk exposure is now at a new all time high and up $5.3 trillion from Q1 as they have to risk ever more in the derivatives market to generate that incremental penny of return.

– Rash of bank downgrades signals return to ‘danger zone:’ IMF (The Globe And Mail, Sep. 21, 2011):

Europe’s big financial institutions are under pressure to quickly secure tens of billions of euros of new capital, as the continent’s spreading debt crisis increasingly engulfs the banking system.

The International Monetary Fund warned the global financial system is more vulnerable now than at any point since the financial crisis of three years ago, as Europe’s debt crisis risks trigger a treacherous slide back into the widespread instability that prevailed during the darkest days of 2008.

“We are back in the danger zone,” IMF director José Vinals said on the eve of a key meeting of global finance ministers and central bankers in Washington.

Read moreIMF Director José Vinals: ‘We are back in the danger zone’ – Run On European Banks Begins

Flashback:

– Welcome to the Recovery (New York Times, by Timothy Geithner, August 2, 2010)

‘Recovery’ is the ‘Greatest Depression’.

– Bank of America cutting 30,000 jobs (CNNMoney, Sep. 12, 2011):

Bank of America said Monday that it plans to eliminate 30,000 jobs as part of a plan to save $5 billion.

The announcement came after Chief Executive Brian Moynihan outlined the bank’s strategy at an investor conference in New York.

Read moreBank of America Cutting 30,000 Jobs – ‘Welcome to the Recovery’

Recommended ‘extensive roundup’ here:

– Full-Blown Civil War Erupts On Wall Street: As Reality Finally Hits The Financial Elite, They Start Turning On Each Other (AmpedStatus, Sep 3, 2011):

Finally, after trillions in fraudulent activity, trillions in bailouts, trillions in printed money, billions in political bribing and billions in bonuses, the criminal cartel members on Wall Street are beginning to get what they deserve. As the Eurozone is coming apart at the seams and as the US economy grinds to a halt, the financial elite are starting to turn on each other. The lawsuits are piling up fast. Here’s an extensive roundup:

…

– Bank of America ‘called grieving widow 48 times a day to remind her of husband’s debt’ (Daily Mail, Sep 3, 2011):

Bank of America bombarded a grieving widow with calls up to 48 times a day to remind her that her recently deceased husband had missed a mortgage payment, it is claimed.

Deborah Crabtree, from Honolulu, Hawaii, is suing the bank after she said she was called by debt collectors as often as every 15 minutes including during the wake for her husband.

According to papers filed in Hawaii, Mrs Crabtree told the bank that she would pay the debt as soon as she received her husband’s life insurance pay out, but the bank continued to threaten to foreclose on her home.

The bank told the widow that it was unable to stop the calls until the debt was paid as they were computer generated.

Read moreBank of America ‘Called Grieving Widow 48 Times A Day To Remind Her Of Husband’s Debt’

– Here’s The Bomb That Might Blow A Hole In Bank Of America… (Business Insider, Aug. 31, 2011):

After watching its stock tank 50% this year while denying that it needed capital, Bank of America’s management has begun to acknowledge reality.

The bank raised $5 billion by selling preferred stock and options to Warren Buffett—diluting common shareholders in the process. And now, as previously promised, it has sold half its stake in China Construction Bank for $8 billion.

These moves are good news for the bank’s employees and shareholders, as well as for the U.S. taxpayer, which will be on the hook if Bank of America’s management flies the company into a mountain.

But many analysts believe that Bank of America will need to raise a lot more capital before it gets back on sound footing.

Read moreHere’s The Bomb That Might Blow A Hole In Bank Of America …

– In Case You Thought Bank Of America’s Troubles Were Over… (Business Insider, Aug. 26, 2011):

A few random thoughts on the BofA – Buffett deal.

This deal is $5b. A fair bit of change. But it is also small beer for a bank with $2.2 Trillion of assets.

The stories that went around re BAC were related to the following issues:

Litigation riskSecond lien mortgagesCommercial Real EstateGood will on the balance sheet that is in questionDirect sovereign debt exposure and indirect risk from CDSBusiness Insider summed up the various concerns. The number came to as high as $200b.

it looks as though we could easily come up with, say, $100-$200 billion in write-offs and exposures to “clean up” Bank of America’s balance sheet.

I don’t know what BAC has on its books, so I won’t hazard a guess on these numbers. I can’t believe there is no smoke with all this fire. Buffet’s 5 bill will cover 3-5% of the nut. Not much of a margin if there is, in fact, some big ticket issues.

– Bank Of Berkshire America: Buffett To Buy $5 Billion In Preferred Stock In Bank Of America (ZeroHedge, Aug 25, 2011):

Goldman bailout part 2 is here. And so the Octogenarian of Omaha doubles down on another taxpayer bailout. At least we can put aside all the lies that Bank of America did not need capital. It needed capital: $5 billion of it. It also confirmed it was completely locked out of both debt and equity public capital markets – the bank’s only recourse was a private raise with a crony capitalist who is once again doubling down on the global ponzi.

From the press release:

YouTube Added: 22.08.2011

– Wall Street Aristocracy Got $1.2 Trillion in Fed’s Secret Loans (Bloomberg, Aug 22, 2011):

Citigroup Inc. (C) and Bank of America Corp. (BAC) were the reigning champions of finance in 2006 as home prices peaked, leading the 10 biggest U.S. banks and brokerage firms to their best year ever with $104 billion of profits.

By 2008, the housing market’s collapse forced those companies to take more than six times as much, $669 billion, in emergency loans from the U.S. Federal Reserve. The loans dwarfed the $160 billion in public bailouts the top 10 got from the U.S. Treasury, yet until now the full amounts have remained secret.

Fed Chairman Ben S. Bernanke’s unprecedented effort to keep the economy from plunging into depression included lending banks and other companies as much as $1.2 trillion of public money, about the same amount U.S. homeowners currently owe on 6.5 million delinquent and foreclosed mortgages. The largest borrower, Morgan Stanley (MS), got as much as $107.3 billion, while Citigroup took $99.5 billion and Bank of America $91.4 billion, according to a Bloomberg News compilation of data obtained through Freedom of Information Act requests, months of litigation and an act of Congress.

– Welcome to the Recovery (New York Times, by Timothy Geithner, August 2, 2010)

– Reports: Bank of America to ax 10,000 or more jobs (AP, Aug 19, 2011):

Bank of America Corp. is cutting 3,500 employees this quarter and working on restructuring plans that will ax several thousand more jobs, The Wall Street Journal and The New York Times reported citing people familiar with the situation.

The reports Friday said that the job cuts at the biggest U.S. bank by assets might exceed 10,000 or about 3.5 percent of its current work force.

The retrenchments are part of CEO Brian Moynihan’s efforts to engineer a recovery at BoA, which was hit hard by the bursting of the housing bubble. Its share price has fallen nearly 50 percent so far this year.

Read more‘Welcome To The Recovery’: Bank Of America To Ax 10,000 Or More Jobs

Flashback:

– Former Assistant Secretary of Housing: The U.S. is the Global Leader in Illegal Money Laundering

See also:

– Matt Taibbi On RT: ‘Nothing Stops Big Banks From Ripping Off People AGAIN’

– Matt Taibbi: The People vs. Goldman Sachs (Rolling Stone)

– S.E.C. Files Were Illegally Destroyed, Lawyer Says (New York Times, August 17, 2011):

WASHINGTON — An enforcement lawyer at the Securities and Exchange Commission says that the agency illegally destroyed files and documents related to thousands of early-stage investigations over the last 20 years, according to information released Wednesday by Congressional investigators.

The destroyed files comprise records of at least 9,000 preliminary inquiries into matters involving notorious individuals like Bernard L. Madoff, as well as several major Wall Street firms that later were the subject of scrutiny after the 2008 financial crisis, including Goldman Sachs, Lehman Brothers, Citigroup and Bank of America.

The S.E.C. is the very agency that is charged with making sure that Wall Street firms retain records of their own activities, and has brought numerous enforcement cases against firms for failing to do so.

Flashback:

– Former Assistant Secretary of Housing: The U.S. is the Global Leader in Illegal Money Laundering

See also:

– Matt Taibbi On RT: ‘Nothing Stops Big Banks From Ripping Off People AGAIN’

– Matt Taibbi: The People vs. Goldman Sachs (Rolling Stone)

– Is the SEC Covering Up Wall Street Crimes? (Rolling Stone, August 17, 2011):

A whistleblower claims that over the past two decades, the agency has destroyed records of thousands of investigations, whitewashing the files of some of the nation’s worst financial criminals.

Imagine a world in which a man who is repeatedly investigated for a string of serious crimes, but never prosecuted, has his slate wiped clean every time the cops fail to make a case. No more Lifetime channel specials where the murderer is unveiled after police stumble upon past intrigues in some old file – “Hey, chief, didja know this guy had two wives die falling down the stairs?” No more burglary sprees cracked when some sharp cop sees the same name pop up in one too many witness statements. This is a different world, one far friendlier to lawbreakers, where even the suspicion of wrongdoing gets wiped from the record.

That, it now appears, is exactly how the Securities and Exchange Commission has been treating the Wall Street criminals who cratered the global economy a few years back. For the past two decades, according to a whistle-blower at the SEC who recently came forward to Congress, the agency has been systematically destroying records of its preliminary investigations once they are closed. By whitewashing the files of some of the nation’s worst financial criminals, the SEC has kept an entire generation of federal investigators in the dark about past inquiries into insider trading, fraud and market manipulation against companies like Goldman Sachs, Deutsche Bank and AIG. With a few strokes of the keyboard, the evidence gathered during thousands of investigations – “18,000 … including Madoff,” as one high-ranking SEC official put it during a panicked meeting about the destruction – has apparently disappeared forever into the wormhole of history.

– $9.1 billion loss is BofA’s biggest (Charlotte Observer, July 20, 2011):

Bank of America reported the worst quarterly results in its history Tuesday, but chief executive Brian Moynihan continued to insist his bank doesn’t need to raise more capital.

The Charlotte bank’s capital base was a hot topic for analysts after the bank reported a second-quarter loss of $9.1 billion, including preferred dividend payments. The loss was in line with estimates the bank gave last month when it disclosed plans to take more than $20 billion in mortgage-related charges.

The river of red ink, compared to a $2.8 billion gain a year earlier, again showed the nation’s biggest bank is laboring to bury mortgage-related troubles inherited from its 2008 Countrywide Financial purchase. A big chunk of the losses stem from an $8.5 billion settlement announced last month over investor claims related to Countrywide loans sold off during the housing boom.

Read moreBank of America Reports Worst Quarterly Results In Its History: $9.1 Billion Loss!

The national debt system of The New World Order

– Two Examples of Fascism Run by Banks (Activist Post, July 18, 2011):

The United States and other countries of the world are becoming more fascist as New World Order globalists rush to complete their fascist world government by late 2012. According to Italy’s former fascist dictator and MI5 asset, Benito Mussolini, “fascism should rightly be called corporatism, as it is the merger of corporate and government power.” The following examples demonstrate fascism/corporatism within the banking structure of the United States.

JP Morgan and Bank of America

JP Morgan and Bank of America obtain profits by issuing government funded food stamps/subsidies.JP Morgan is the largest processor of food stamp benefits in the United States. JP Morgan has contracted to provide food stamp debit cards in 26 U.S. states and the District of Columbia. JP Morgan is paid for each case that it handles, so that means that the more Americans that go on food stamps, the more profits JP Morgan makes.Currently, approximately 44.2 million Americans (1 in 7) are receiving food stamps, which means JP Morgan will continue to reap great profits in addition to their regular derivatives and fractional reserve banking scams.

Not to be left out, Bank of America and Visa struck a deal with the State of California:“The Employment Development Department (EDD) Debit CardSM from Bank of America is the new and more efficient way of delivering California State Disability Insurance (Disability Insurance [DI], Paid Family Leave [PFL]), and beginning July 8, 2011 Unemployment Insurance (UI) benefit payments…The EDD Debit CardSM can be used everywhere Visa® debit cards are accepted.”Of course, using the fascist debit card is subject to bank fees. Therefore, rather than issuing checks directly to recipients, California chose a debit card system that will guarantee fees and profits paid to B of A and Visa.

– Too Big To Fail?: 10 Banks Own 77 Percent Of All U.S. Banking Assets (The Economic Collapse, July 18th, 2011):

Back during the financial crisis of 2008, the American people were told that the largest banks in the United States were “too big to fail” and that was why it was necessary for the federal government to step in and bail them out. The idea was that if several of our biggest banks collapsed at the same time the financial system would not be strong enough to keep things going and economic activity all across America would simply come to a standstill. Congress was told that if the “too big to fail” banks did not receive bailouts that there would be chaos in the streets and this country would plunge into another Great Depression. Since that time, however, essentially no efforts have been made to decentralize the U.S. banking system. Instead, the “too big to fail” banks just keep getting larger and larger and larger. Back in 2002, the top 10 banks controlled 55 percent of all U.S. banking assets. Today, the top 10 banks control 77 percent of all U.S. banking assets. Unfortunately, these giant banks are also colossal mountains of risk, debt and leverage. They are incredibly unstable and they could start coming apart again at any time. None of the major problems that caused the crash of 2008 have been fixed. In fact, the U.S. banking system is more centralized and more vulnerable today than it ever has been before.

It really is difficult for ordinary Americans to get a handle on just how large these financial institutions are. For example, the “big six” U.S. banks (Goldman Sachs, Morgan Stanley, JPMorgan Chase, Citigroup, Bank of America, and Wells Fargo) now possess assets equivalent to approximately 60 percent of America’s gross national product.

– The Bank Of America Non-Settlement “Settlement” (ZeroHedge, June 29, 2011):

Some curious language in the BAC settlement: “…In addition, because the settlement is with the Trustee on behalf of the Covered Trusts and releases rights under the governing agreements for the Covered Trusts, the settlement does not release investors’ securities law or fraud claims based upon disclosures made in connection with their decision to purchase, sell, or hold securities issued by the trusts. To date, various investors, including certain members of the Investor Group, are pursuing securities law or fraud claims related to one or more of the Covered Trusts. The Corporation is not able to determine whether any additional securities law or fraud claims will be made by investors in the Covered Trusts and, if made, to reasonably estimate the amount of losses, if any, with respect to such asserted or potential claims…” Uh, just how is that a settlement.

Also, did Bank of America just admit its securitization trusts violated IRS laws:

“the settlement is conditioned on receipt of private letter rulings from the IRS as well as receipt of legal opinions under California and New York state tax laws and regulations.”

We can’t wait to hear for the cash strapped IRS’ response on this matter.

– Bank Of America To Pay $8.5 Billion To Settle Mortgage (Mis)Representation Suit With BlackRock, Pimco, New York Fed Et Al. (ZeroHedge, June 28, 2011):

Bank of America may be about to part with more money than it has earned since 2008 in what will soon be the biggest financial settlement in the industry to date According to the WSJ, the Charlotte, NC-based bank is preparing to pay $8.5 billion to settle mortgage (mis)representation claims (aka the Mortgage putback issue) brought on by such high profile figures as BlackRock, Pimco, MetLife and, of course, the Federal Reserve, previously discussed on Zero Hedge. “A deal would end a nine-month fight with a group of 22 investors that hold more than $56 billion in mortgage-backed securities at the center of the dispute, including giant money manager BlackRock Inc., insurer MetLife Inc. and the Federal Reserve Bank of New York.” Keep in mind that this is actually not good news for the bank, contrary to what the company’s stock is doing after hours, as this still keeps the company exposed to a multitude of other rep and warranty litigation (which will now be largely underreserved), not to mention fraudclosure issues, which are totally unrelated, and which will plague the bank for years and years. Lastly, BAC is largley underreserved (see below) for a settlement of this size which means its Tier 1 capital ratio will likely be impacted due to a major outflow of cash.

From the WSJ:

The deal could embolden mutual-fund managers, insurance companies and investment partnerships to go after similar settlements with other major U.S. banks, arguing that billions in loans scooped up before the U.S. housing collapse didn’t meet sellers’ promises or were improperly managed. Most vulnerable would be Wells Fargo & Co and J.P. Morgan Chase & Co., which along with Bank of America collect loan payments on about half of all outstanding U.S. mortgages.

Added: 04.06.2011

Starting June 25 of this year, Bank of America will start charging more and more of their credit card customers an APR of almost 30%. According to a letter that came in the mail today, that new rate would apply “indefinitely.” If you make a single late payment, B of A may raise your interest rate to as much as 29.99%. The new rate would only apply to new purchases, not existing balances (that’s one of the few good things about the CARD act), but according to recent surveys over 15% of customers have made at least one late payment in the last 12 months. (I know we’ve done it once or twice.)

From a free market perspective, the new late payment policy isn’t terrible, but in practice it still stinks. That’s because, like most fees and penalties charged by banks and credit card companies, it will be more onerous for the poorest and most vulnerable. Think about it, if you have good credit and a good job, who cares if you make a late payment? If your credit card company assesses a penalty rate of 30% on new purchases, you can just switch to a different card. But if your Bank of America card is your only source of revolving credit, then you’re pretty much stuck with the new interest rate. And over time, more and more customers will end up with the new penalty rate because of a late payment. Moreover, it will end up being those customers who can least afford it who end up paying the new rate because B of A will most likely refrain from instituting high penalty rates on customers they know can simply walk away.

Read moreBank Of America To Start Charging 30 Percent On Credit Cards