The Australian founder of the whistleblower website Wikileaks had his passport confiscated by police when he arrived in Melbourne last week.

Julian Assange, who does not have an official home base and travels every six weeks, told the Australian current affairs program Dateline that immigration officials had said his passport was going to be cancelled because it was looking worn.

However he then received a letter from the Australian Communication Minister Steven Conroy’s office stating that the recent disclosure on Wikileaks of a blacklist of websites the Australian government is preparing to ban had been referred to the Australian Federal Police (AFP).

Last year Wikileaks published a confidential list of websites that the Australian government is preparing to ban under a proposed internet filter – which in turn caused the whistleblower site to be placed on that list.

Mr Assange, 37, told The Age newspaper that half an hour after his passport was returned to him an AFP officer searched one of his bags and questioned him about a previous criminal record for computer hacking offences when he was a teenager.

Read moreWikileaks founder Julian Assange has passport confiscated in Australia

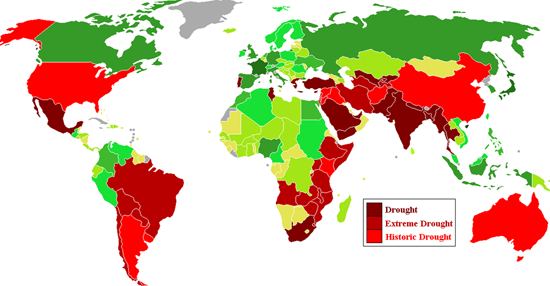

Australia is facing its worst drought in a century

Australia is facing its worst drought in a century